| Line 46: | Line 46: | ||

==Field Mapping - Detail== | ==Field Mapping - Detail== | ||

{| class="wikitable" style="margin: 1em auto 1em auto;" | |||

! scope="col" style="width: 200px;" | For Sales Invoice | |||

! scope="col" style="width: 200px;" | For Sales Credit Note | |||

|- style="vertical-align: top;" | |||

| | |||

:{| class="wikitable" | |||

|- | |||

! FnN Field !! Field Position !! Field Size !! SQL Accounting Field | |||

|- | |||

| Item_ID || style="text-align: center;" | 14 || style="text-align: center;" | 10 || Itemcode or <br> Maintain Item Code Note | |||

|- | |||

| Unit or <br> SubUnits || style="text-align: center;" | 74 or <br>84 || style="text-align: center;" | 10 || Qty | |||

|- | |||

| Unit_Price || style="text-align: center;" | 94 || style="text-align: center;" | 10 || UnitPrice | |||

|- | |||

| Discount || style="text-align: center;" | 104 || style="text-align: center;" | 10 || Disc | |||

|- | |||

| Tax_Code || style="text-align: center;" | 139 || style="text-align: center;" | 5 || Tax | |||

|- | |||

| SubTotal_Net_Amount || style="text-align: center;" | 189 || style="text-align: center;" | 10 || Amount | |||

|- | |||

| SubTotal_Tax_Amount || style="text-align: center;" | 149 || style="text-align: center;" | 10 || TaxAmt | |||

|} | |||

|| | |||

:{| class="wikitable" | |||

|- | |||

! FnN Field !! Field Position !! Field Size !! SQL Accounting Field | |||

|- | |||

| Item_ID || style="text-align: center;" | 14 || style="text-align: center;" | 10 || Itemcode or <br> Maintain Item Code Note | |||

|- | |||

| Unit or <br> SubUnits || style="text-align: center;" | 74 or <br>84 || style="text-align: center;" | 10 || Qty | |||

|- | |||

| Unit_Price || style="text-align: center;" | 94 || style="text-align: center;" | 10 || UnitPrice | |||

|- | |||

| Discount || style="text-align: center;" | 104 || style="text-align: center;" | 10 || Disc | |||

|- | |||

| Tax_Code || style="text-align: center;" | 139 || style="text-align: center;" | 5 || Tax | |||

|- | |||

| SubTotal_Net_Amount || style="text-align: center;" | 259 || style="text-align: center;" | 10 || Amount | |||

|- | |||

| SubTotal_Tax_Amount || style="text-align: center;" | 149 || style="text-align: center;" | 10 || TaxAmt | |||

|} | |||

==Setting== | ==Setting== | ||

Revision as of 01:35, 29 June 2016

Introduction

Is External Shareware Program which to import F&N Text file to

- Sales Invoice

- Sales Credit Note

Limitation

- TaxCode with DS will not import.

F & N Specification

Import Program

- Version (2.1.0.9) - 26 Jun 2015

- http://www.estream.com.my/downloadfile/Fairy/SQLAccFNImp-setup.exe

- MD5 : B33D2565876D2E61DA90D682DA50B1E2

History New/Updates/Changes

--Build 9--

- Fix unable to import docamt is 0 even is no DS Code.

- Fix Status no dropdown list.

- Fix Detail not Verify.

--Build 8--

- Fix Get File Error when record is without tax code.

--Build 7--

- Fix CN Get File Error.

Todo

- OutletID=Maintain Customer Code

Field Mapping - Header

| FnN Field | Field Position | Field Size | SQL Accounting Field |

|---|---|---|---|

| Invoice_Date | 1 | 10 | DocDate |

| Outlet_ID | 71 | 10 | Maintain Customer Remark |

| Invoice_ID | 11 | 10 | DocNo |

| Gross Amount | 41 | 10 | DocAmt |

Field Mapping - Detail

| For Sales Invoice | For Sales Credit Note | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

SettingIn SQL AccountingMake sure this option is Tick under Tools | Options | Customer

In F&N ImportThis can be see under Tools | Options

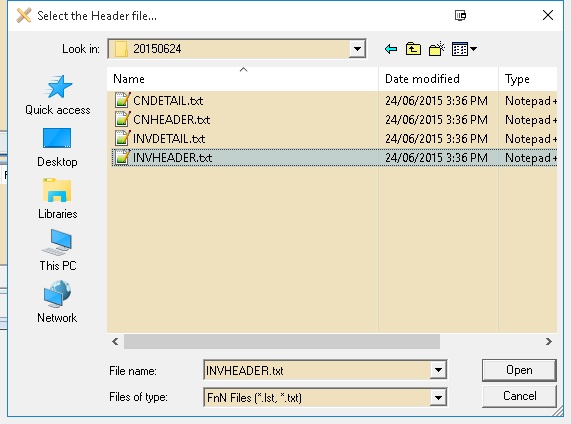

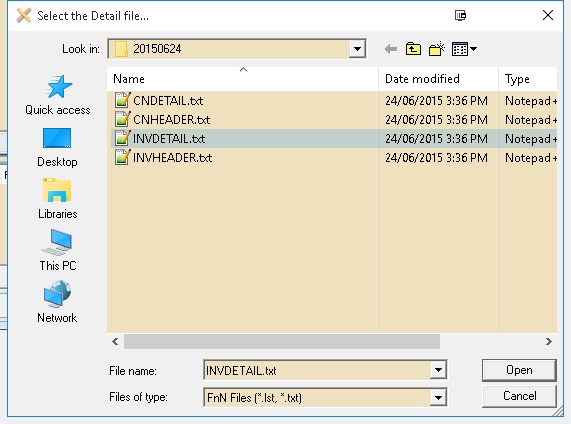

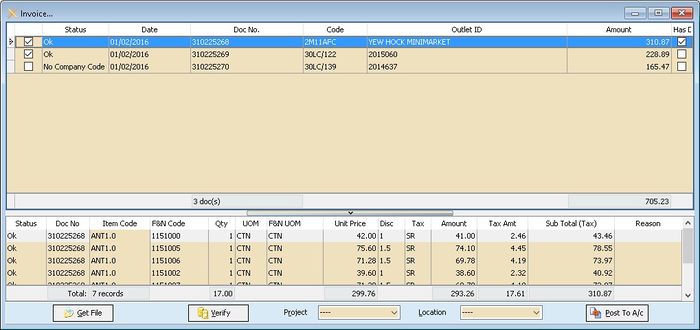

StepsBelow steps is example to import Sales Invoice 3. Select the F&N Invoice Text Header File 4. Select the F&N Invoice Text Detail File 5. Click Verify button to check the data with SQL Accounting Data

FAQMay refer to FAQ See also

|