| Line 21: | Line 21: | ||

==Setup Margin Scheme Database== | ==Setup Margin Scheme Database== | ||

Last Customisation Update : ''' | Last Customisation Update : '''08 Mar 2016''' | ||

:1. Get the NEW database structure for Margin Scheme (in backup format) from this link [http://www.sql.com.my/document/NEW%20COMPANY%20(For%20Margin%20Scheme)%20-%20%5BGST-MS.20.02.2016%5D%20-%202016-02-20%20-%20sqlacc.zip GST Margin New Database] | :1. Get the NEW database structure for Margin Scheme (in backup format) from this link [http://www.sql.com.my/document/NEW%20COMPANY%20(For%20Margin%20Scheme)%20-%20%5BGST-MS.20.02.2016%5D%20-%202016-02-20%20-%20sqlacc.zip GST Margin New Database] | ||

| Line 39: | Line 39: | ||

::3. Click '''Execute'''. | ::3. Click '''Execute'''. | ||

::4. Repeat step 2 - 3 and apply with another patch filename '''Patch-MarginScheme-02-20160220'''. | ::4. Repeat step 2 - 3 and apply with another patch filename '''Patch-MarginScheme-02-20160220'''. | ||

<br /> | |||

Last Customisation Update : '''08 Mar 2016''' | |||

* Tax amount not equal to zero. Will prompt message "Cost will be tax excluded for GST Margin purpose" after save the purchase invoice. | |||

* Run the '''SQL Accounting Diagnosis - DB Patch''' and apply the patch files can be download from [http://www.sql.com.my/downloadfile/Fairy/Patch-MarginScheme-20160308.zip Patch-Margin Scheme-20160308.zip] | |||

::1. Select the database file (eg.ACC-XXXXX.FDB). | |||

::2. Drag the patch filename '''DELETE_PHPI_OnAfterSave_08.03.2016'''. | |||

::3. Click '''Execute'''. | |||

::4. Repeat step 2 - 3 and apply with another patch filename '''UPDATE_PHPI_OnAfterSave_08.03.2016'''. | |||

<br /> | <br /> | ||

Revision as of 07:03, 8 March 2016

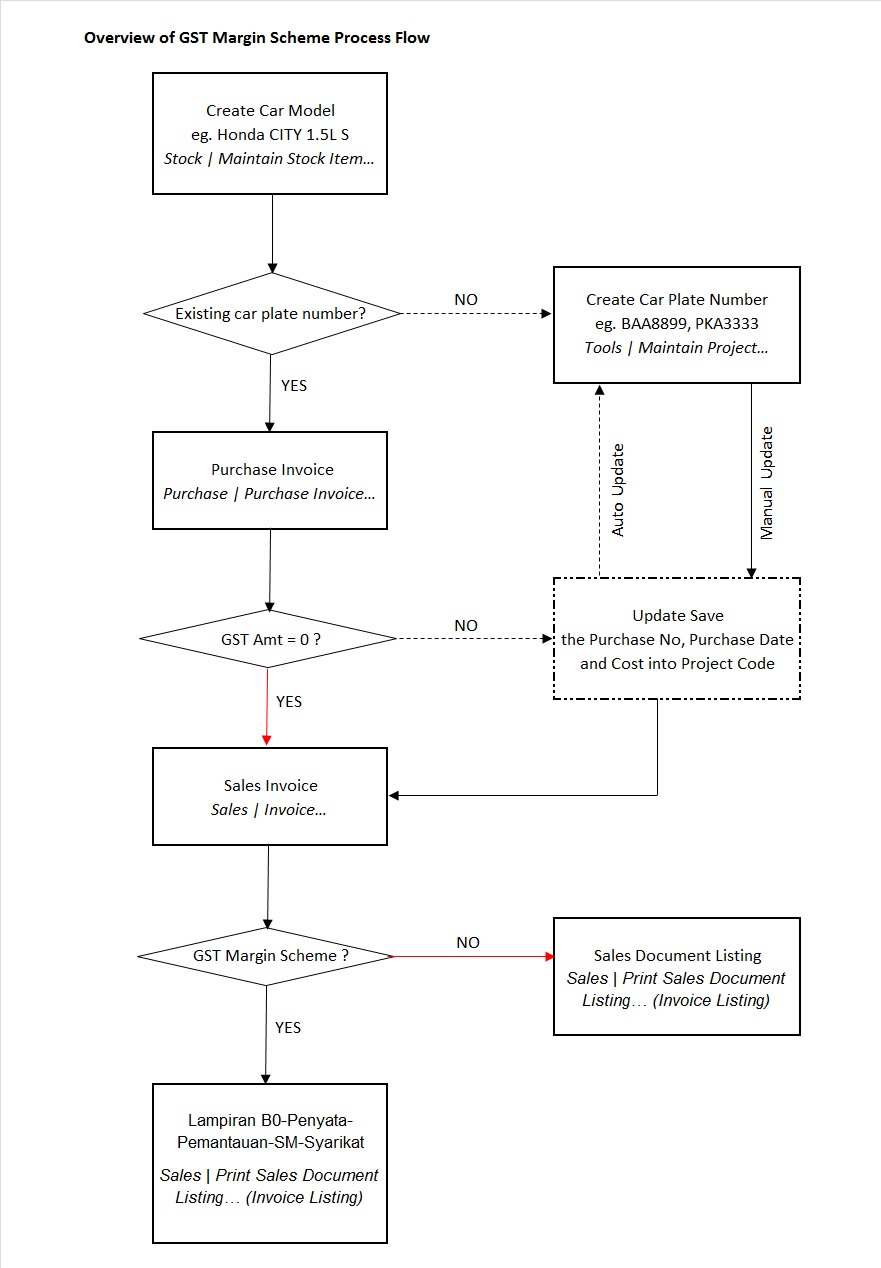

How To Start the New Margin Scheme with Special Database?

Introduction

- GST is normally due on the full value of goods sold. The margin scheme allows a GST Margin Scheme registered person (GST MS registered person) who meets all the conditions to calculate and charge GST on the margin i.e. the difference between the price at which the goods were obtained and the selling price. If no margin is made (because the purchase price exceeds the selling price) then no GST is charged and payable.

- For the purpose of GST, margin under this scheme means the difference between selling price and purchase price. If there is any value being added to the eligible goods such as cost for repairing, this cost is part of the margin other than profit. In other words, the value added must be included in the selling price and not the purchase price.

- Therefore, we have designed a database structure specially for business which has margin scheme involvement.

Modules Require

- SQL Accounting Basic (GST compliance)

- DIY field

- DIY script

- Project (use to record Car Plate number)

Setup Margin Scheme Database

Last Customisation Update : 08 Mar 2016

- 1. Get the NEW database structure for Margin Scheme (in backup format) from this link GST Margin New Database

- 2. Restore this backup.

- 3. Enter the user ID and password with “ADMIN” to login.

History New/Updates/Changes

Last Customisation Update : 27 Nov 2015

- Move Cars Information to Maintain Project

- Auto Capture Initial Cost on Select Project

Last Customisation Update : 20 Feb 2016

- Empty item code (eg. repairs) will not update the Project - Purchase Details.

- Run the SQL Accounting Diagnosis - DB Patch and apply the patch files can be download from Patch-Margin Scheme-20160220.zip

- 1. Select the database file (eg.ACC-XXXXX.FDB).

- 2. Drag the patch filename Patch-MarginScheme1.

- 3. Click Execute.

- 4. Repeat step 2 - 3 and apply with another patch filename Patch-MarginScheme-02-20160220.

Last Customisation Update : 08 Mar 2016

- Tax amount not equal to zero. Will prompt message "Cost will be tax excluded for GST Margin purpose" after save the purchase invoice.

- Run the SQL Accounting Diagnosis - DB Patch and apply the patch files can be download from Patch-Margin Scheme-20160308.zip

- 1. Select the database file (eg.ACC-XXXXX.FDB).

- 2. Drag the patch filename DELETE_PHPI_OnAfterSave_08.03.2016.

- 3. Click Execute.

- 4. Repeat step 2 - 3 and apply with another patch filename UPDATE_PHPI_OnAfterSave_08.03.2016.

Setup Master Data

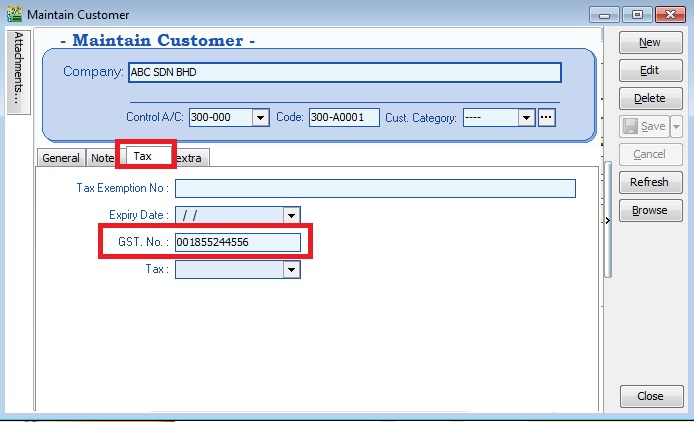

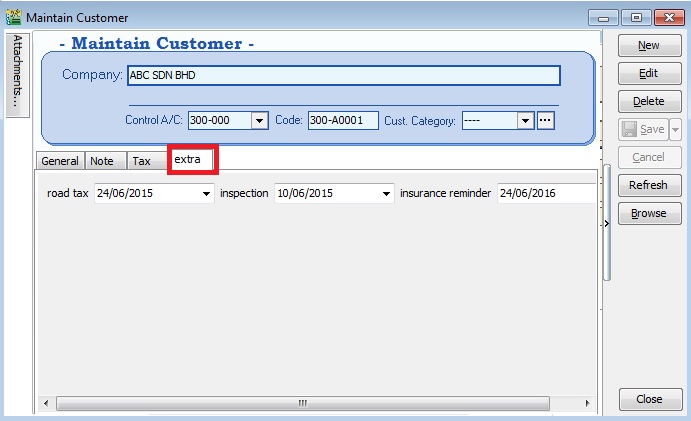

Maintain Customer

[Customer | Maintain Customer…]

- 1. Create new buyer name (eg. company name or person name).

- 2. Click on Tax tab to input the GST No (if applicable).

- 3. Click on extra tab. You can enter the road tax, inspection and insurance reminder date for reference.

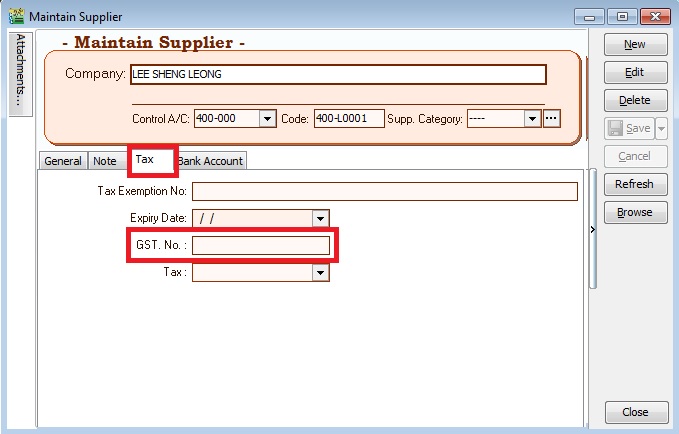

Maintain Supplier

[Supplier | Maintain Supplier…]

- 1. Create new seller name (eg. company name or person name).

- 2. Click on Tax tab to input the GST No (if applicable).

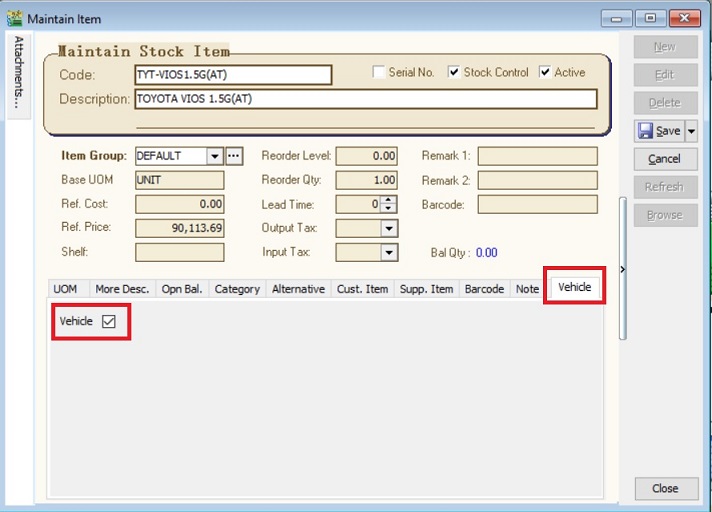

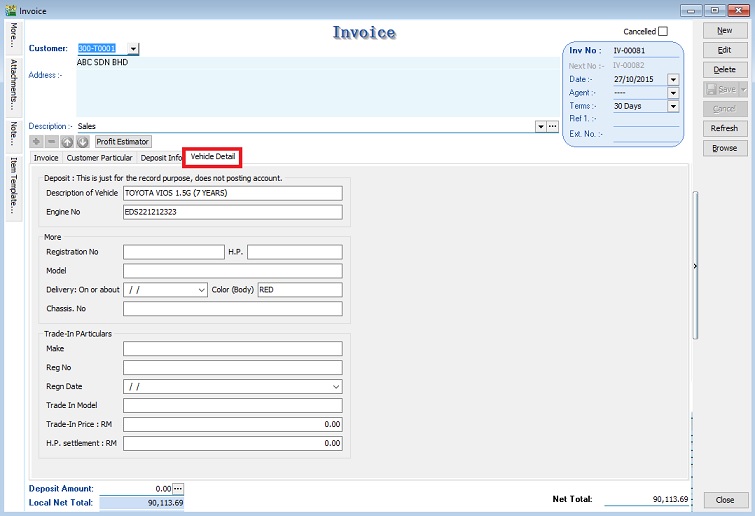

Maintain Stock Item

[Stock | Maintain Stock Item…]

- 1. Create the car model at Maintain Stock Item. For example, TOYOTA VIOS 1.5G(AT)

- 2. Click on Vehicle tab to define this item is a "Vehicle".

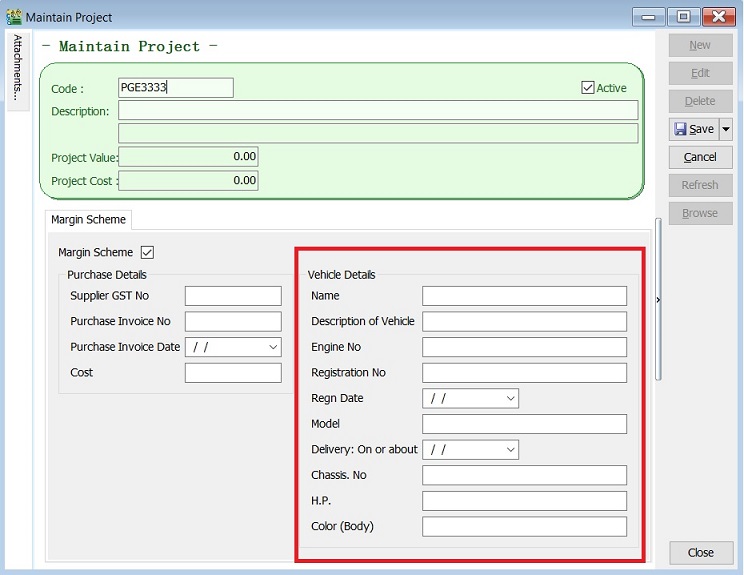

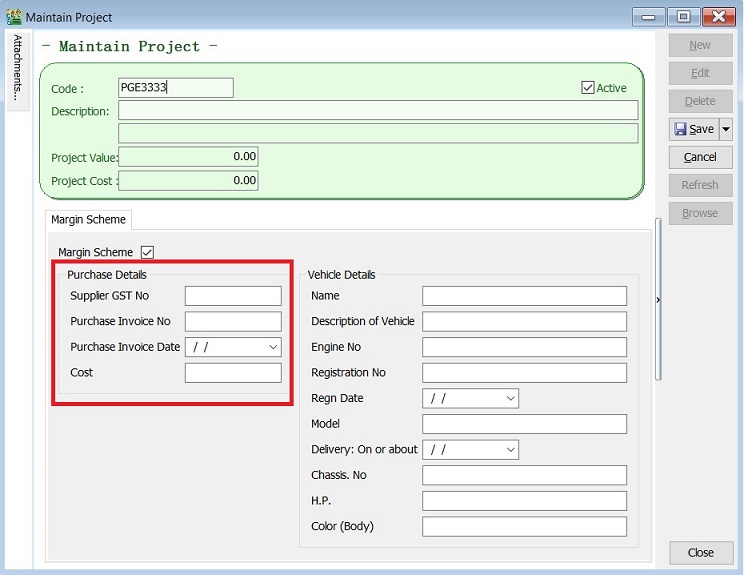

Maintain Project

[Tools | Maintain Project…]

- 3. Leave BLANK to Purchase Invoice Date, Purchase Invoice No and Cost. It will auto update when you are select the project code and save at the Purchase Invoice.

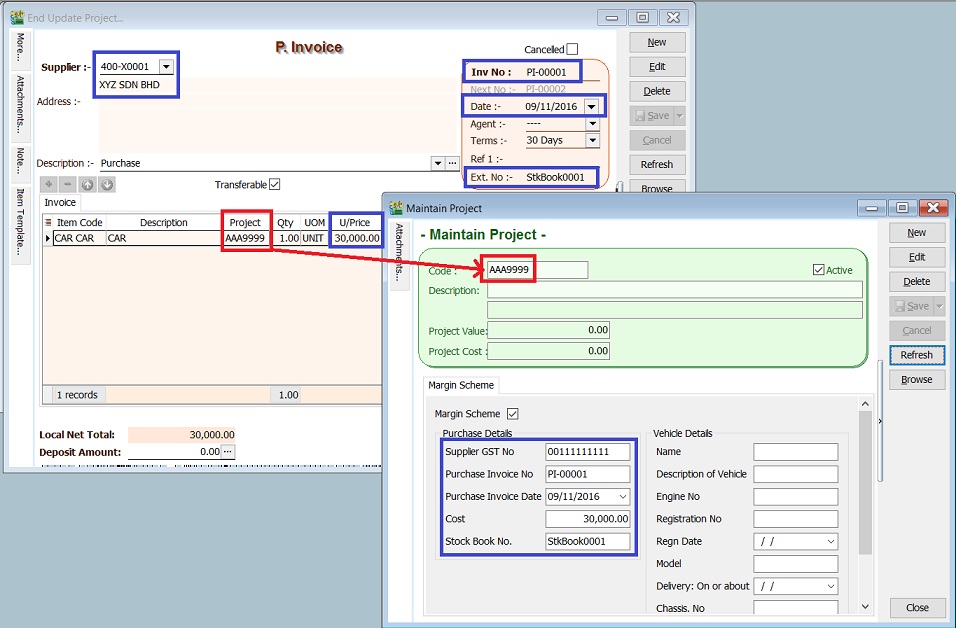

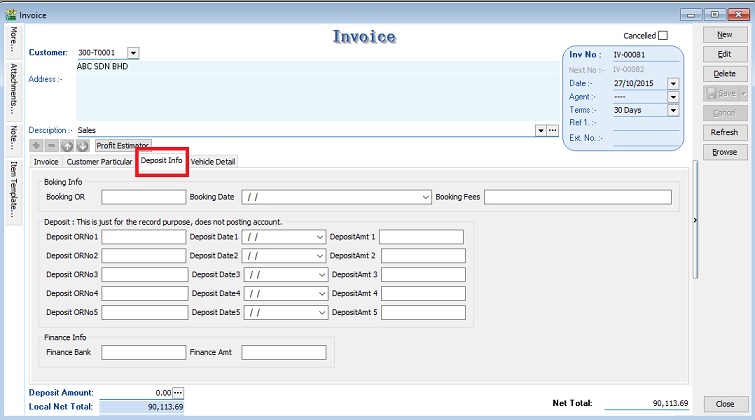

Record Purchase of Second Hand Car Value

[Purchase | Purchase Invoice…]

- 1. Enter the purchase value of second car at Purchase Invoice. (eg. RM30,000 )

- 2. You must select the correct car plate number from Project. (eg. PGE3333)

- 3. Supplier GST No, Purchase invoice number, date and cost will be update automatically after you have save the purchase invoice.

Purchase Detail Update from Supplier GST No Maintain Supplier Purchase Invoice No Purchase Invoice Purchase Invoice Date Purchase Invoice Cost Purchase Invoice

NOTE :

1. This information is required to show in Lampiran 07 -Monthly Report for Relief for Secondhand Goods or Margin Scheme (MS).

2. Auto update to project purchase detail (Purchase No, Purchase Date and Cost) if tax amount is zero.

Record Sale of Second Hand Car Value

[Sales | Invoice…]

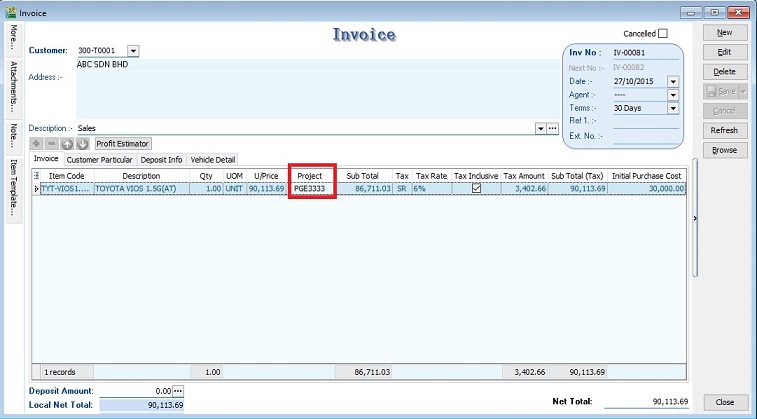

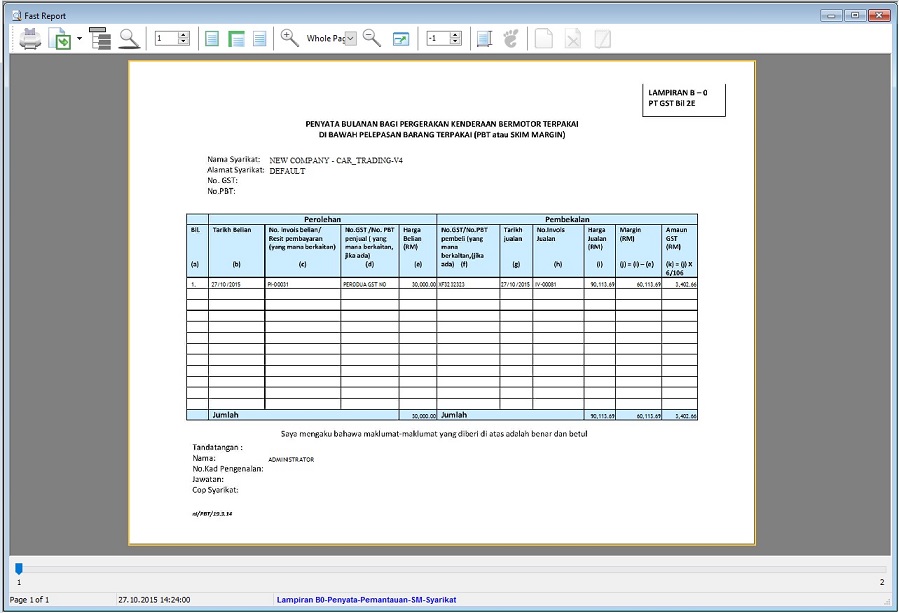

Margin Scheme Input

- 1. Enter the sale value of second car at Invoice. (eg.RM90,113.69)

- 2. You must select the correct car plate number from Project.(eg.PGE3333)

- 3. Initial Purchase Cost will auto upadate after select the project (car plate number).

- 4. Tax amount will be calculated based on Margin Scheme method.(See screenshot below)

- a. Sellng Price = 90,113.69

- b. Purchase Cost = 30,000.00

- c. Margin = 90,113.69 – 30,000.00 = 60,113.69

- d. Tax amount = 60,113.69 x 6/106 = 3,402.66

- a. Sellng Price = 90,113.69

- 6. Invoice no, invoice date, selling price, margin, and margin tax amount will be shown in Lampiran 07 -Monthly Report for Relief for Secondhand Goods or Margin Scheme (MS)

Other Information

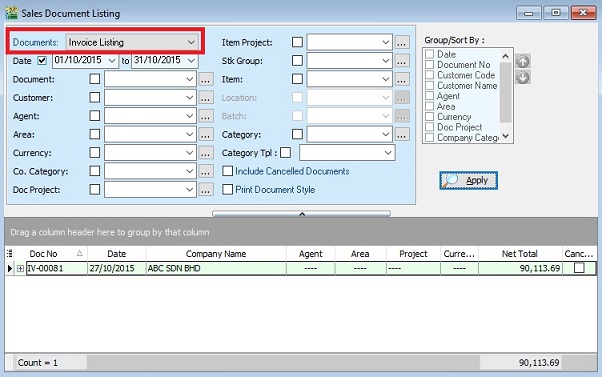

Print for GST Lampiran 07 (Lampiran B0-Penyata-Pemantauan-SM-Syarikat)

[Sales | Print Sales Document Listing…]

See also

- Others Customisation