Special-GST Treatment: Non-deductible Expenditure: Difference between revisions

| Line 11: | Line 11: | ||

::3. Input tax claims from RMCD after company is liable to register.<br /> | ::3. Input tax claims from RMCD after company is liable to register.<br /> | ||

::4. Company is not registered even though it is liable to register with RMCD<br /> | ::4. Company is not registered even though it is liable to register with RMCD<br /> | ||

Revision as of 02:44, 1 December 2015

How to enter and to retrieve the non-deductible expenditure?

Introduction

This guide will teach you the way to key-in the data entry to analyse the non-deductible expenditure for company income tax purposes.

Income Tax Act 1967 (ITA)

- Section 39 Deductions not allowed:

- 1. Registered taxpayer and claims input tax from RMCD. For example, the company purchase RM64,000 worth of stock, and was charged an input tax of Rm3,840. The input tax claimed from RMCD is not part ::of the cost for the stock and is not an allowable expenditure under paragraph 39(1)(o) ITA.

- 2. Registered taxpayer and does not claim input tax from RMCD even thought it is claimable. If the company does not claim input tax from RMCD. Input tax not claimed from RMCD is not part of the cost ::for the stock and is not an allowable expenditure under paragraph 39(1)(o) ITA

- 3. Input tax claims from RMCD after company is liable to register.

- 4. Company is not registered even though it is liable to register with RMCD

Subject to GST:

FIZ Local sell to FIZ Local → SR

FIZ local sell to LMW Local → SR

FIZ/LMW local sell to non-FIZ/LMW → SR

FIZ/LMW Local sell to Oversea → ZR

For example,

Item Item Description Qty Unit Price

(RM)Value(RM) Import Duty

(RM)1. Shirts 300 pcs 25.00 7,500.00 1,500.00 2. Paints 100 pcs 30.00 3,000.00 600.00 Total 10,500 2,100.00

Assuming 20% import duty (RM10,500 x 20% = 2,100.00)

GST on value + Import Duty are subject to GST (SR) = (10,500.00 + 2,100.00) x 6% = 756.00

Therefore, the Tax Invoice will be presented as per below:

Item Item Description Qty Unit Price

(RM)Value

(RM)1. Shirt 300 pcs 25.00 7,500.00 2. Paints 100 pcs 30.00 3,000.00 GST (SR-6%) 756.00 Total Amount Payable 11,256.00

How to enter the Tax Invoice if there is a FIZ/LMW transactions to another party?

[Sales | Invoice...]

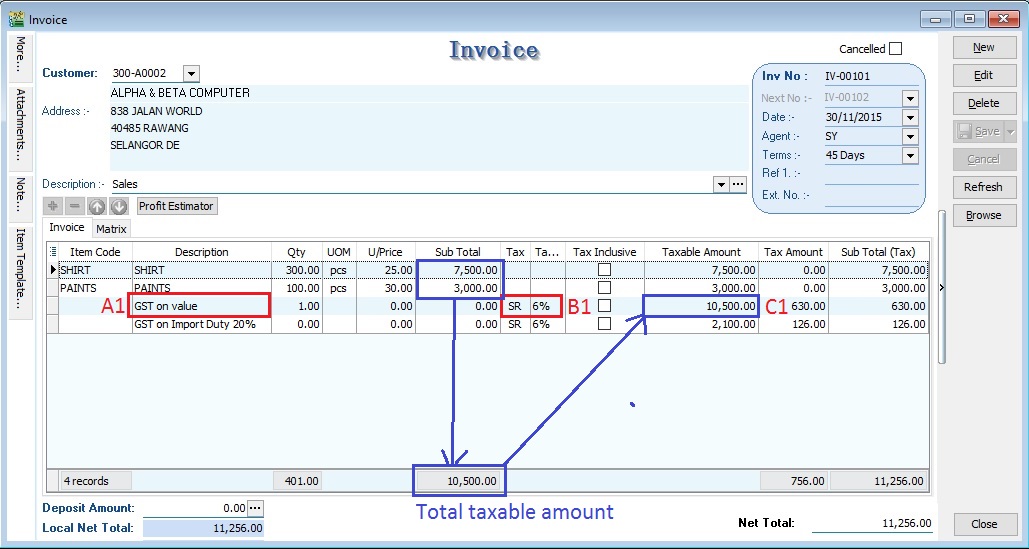

According to the example mentioned in above.

1. Insert and select the stock items sold with empty tax code. Because the stock items are under FIZ/LMW control.

Item Code Description Qty Unit Price Subtotal Tax Code Tax Amount SubTotal(Tax) SHIRT SHIRTS 300 pcs 25.00 7,500.00 <BLANK> 0.00 7,500.00 PAINTS PAINTS 100 pcs 30.00 3,000.00 <BLANK> 0.00 3,000.00

2. Inser new row and enter the GST on total supply value (Rm7500 + Rm3000 = Rm10,500) direct into Taxable Amount column (C1)

Description Taxable Amount Tax Code Tax Amount SubTotal(Tax) GST on value Rm10,500.00 10,500.00 SR 630.00 630.00

NOTE :

A1 : Key-in "GST on value" into description.

B1 : Must select tax code.

C1 : Key-in the Total Supply Value into Taxable Amount.

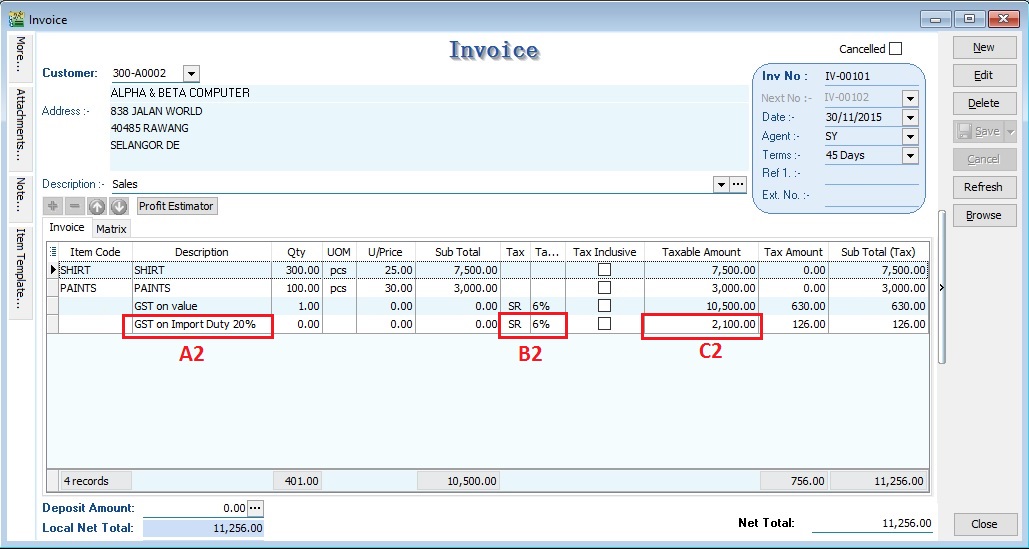

3. Insert new row and enter the GST on total Import Duty (Rm1,500 + Rm600.00 = Rm2,100) direct into Taxable Amount column (C2)

Description Taxable Amount Tax Code Tax Amount SubTotal(Tax) GST on Import Duty 20% 2,100.00 SR 126.00 126.00

NOTE :

A2 : Key-in "GST on Import Duty" into description.

B2 : Must select tax code.

C2 : Key-in the Total Import Duty value into Taxable Amount.

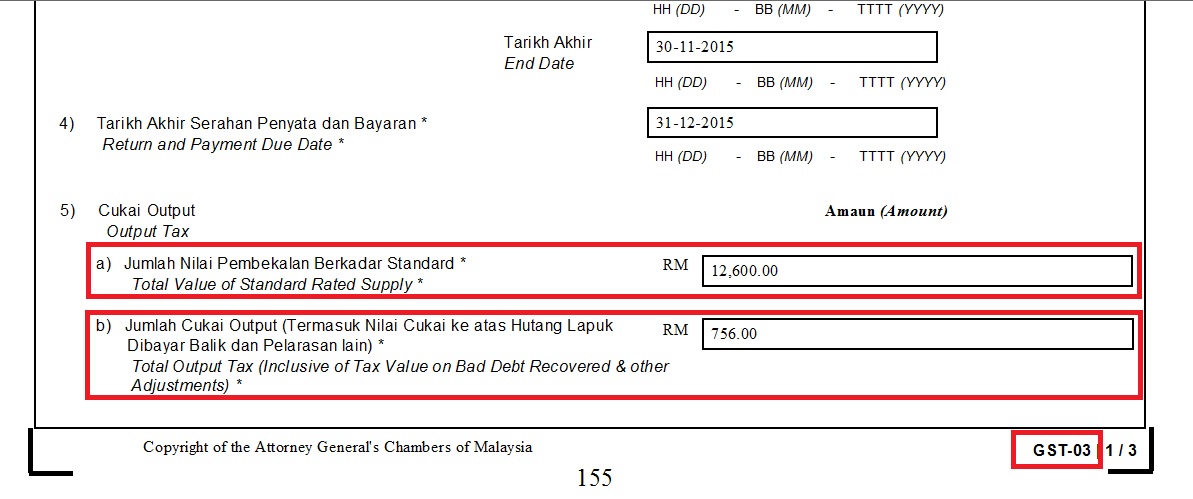

GST Return

[ GST | New GST Return...]

1. Process GST Return for the month

2. Click on print GST-03

RESULTS :

5a Total value of supplies = 12,600.00

5b total output tax = 756.00