| Line 18: | Line 18: | ||

| Code || | | Code || | ||

* Enter the tax code to be shown in report | * Enter the tax code to be shown in report | ||

|- | |||

| Active || | |||

* Checked : Active & able to select from the Tax List in data entry | |||

* UnChecked : InActive & unable to select from the Tax List in data entry | |||

|- | |- | ||

| Description || | | Description || | ||

| Line 37: | Line 41: | ||

|- | |- | ||

| Tax Inclusive || | | Tax Inclusive || | ||

* | * Checked : Default is Tax Inclusive | ||

* | * UnChecked : Default is Tax Exclusive | ||

|} | |} | ||

<br /> | <br /> | ||

Revision as of 02:18, 23 October 2015

Menu: Tools | Maintain Tax... or

Menu: GST | Maintain Tax...

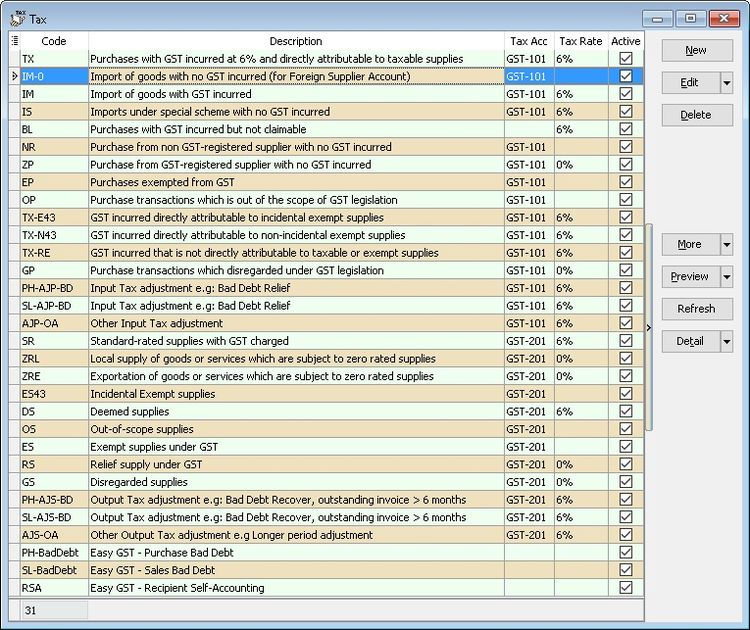

Introduction

- This to Maintain all the available tax given by Government or user can self add or modified

Create New Tax

- Screenshot below is the Maintain Tax entry form.

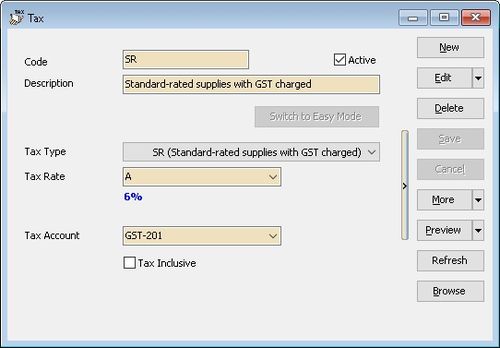

Field Name Explanation & Properties Code - Enter the tax code to be shown in report

Active - Checked : Active & able to select from the Tax List in data entry

- UnChecked : InActive & unable to select from the Tax List in data entry

Description - Enter the tax description.

Tax Type - Select the Tax Type for the Tax Code to be created

Tax Rate User can self determine the rate or set Auto

- A : Auto Tax Rate. System will auto change to new rate if there is update in GST Rate (Must update SQL Accounting)

- E : Mean to be excluded from IRR calculation (useful for OS Tax Code & Mixed Supplies Industry)

- EA : Combine of A & E

- 6% : User self determine by fixed rate (eg here is 6%)

- E6% : User self determine fixed rate for be excluding from IRR calculation

Tax Account - Select an appropriate GL Account from Maintain Account.

Tax Inclusive - Checked : Default is Tax Inclusive

- UnChecked : Default is Tax Exclusive

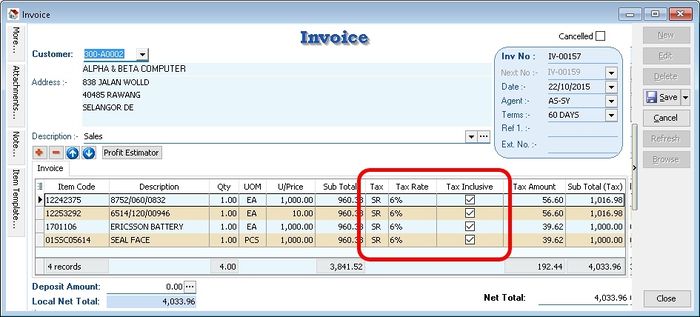

Use of Tax

- You can set the tax as default to an item. See below screenshot.

- Therefore, item inserted will be automatically calculate the tax amount based on the subtotal. See below screenshot.