No edit summary |

|||

| Line 8: | Line 8: | ||

:1. Select the process date range. | :1. Select the process date range. | ||

Tips: | Tips: | ||

Process date range allows to select '''more than 1 month or 1 year''' to process the depreciation. | 1. Process date range allows to select '''more than 1 month or 1 year''' to process the depreciation. | ||

2. Allow to process before system conversation date (No update to Maintain Opening Balance). | |||

<br /> | <br /> | ||

Revision as of 09:19, 20 October 2022

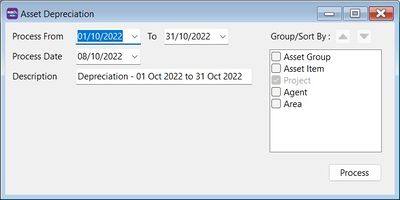

Menu: Asset | Process Depreciation...

Asset Depreciation

- 1. Select the process date range.

Tips: 1. Process date range allows to select more than 1 month or 1 year to process the depreciation. 2. Allow to process before system conversation date (No update to Maintain Opening Balance).

- 3. Description will be captured in the Journal Voucher description.

- 4. Click Process.

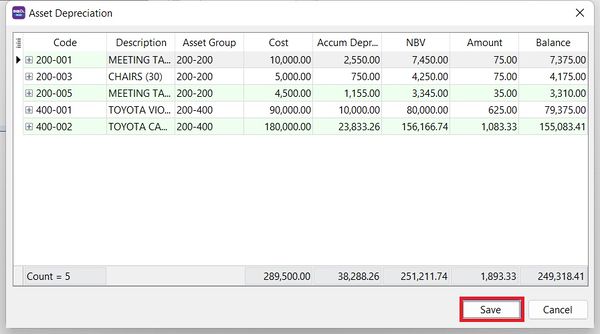

- 5. Preview the assets depreciation value and Net Book Value (NBV) before post to Journal Voucher. Click Save to post it.