| Line 3: | Line 3: | ||

===Create Withholding Tax Code=== | ===Create Withholding Tax Code=== | ||

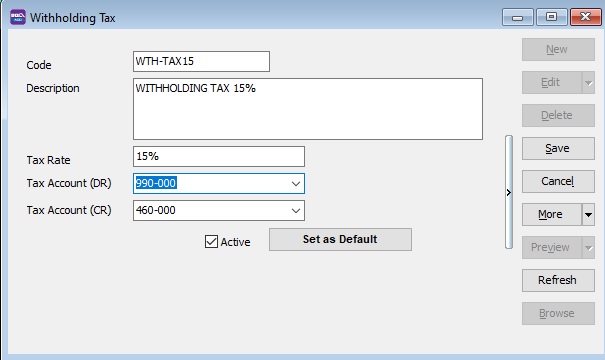

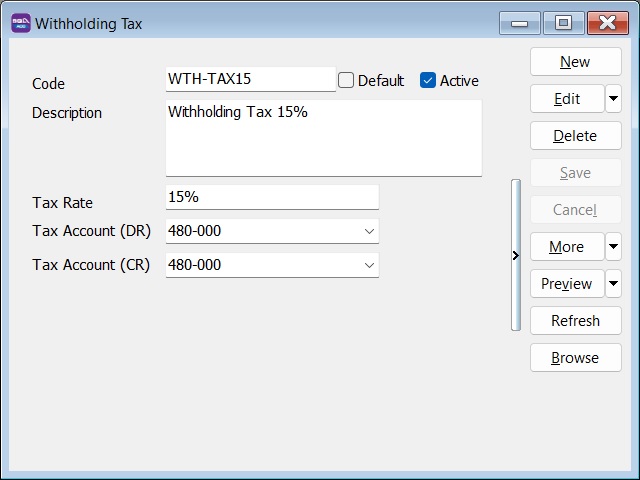

:1. Click New. | :1. Click '''New'''. | ||

:2. Input the following data: | :2. Input the following data: | ||

::{| class="wikitable" | ::{| class="wikitable" | ||

| Line 21: | Line 21: | ||

::[[File: WHT-001.jpg| 500PX]] | ::[[File: WHT-001.jpg| 500PX]] | ||

<br /> | <br /> | ||

:3. Click on Save. | :3. Click on '''Save'''. | ||

===Withholding Document Number Set=== | ===Withholding Document Number Set=== | ||

Revision as of 03:02, 6 June 2020

Menu : Tools | Maintain Withholding Tax...

Create Withholding Tax Code

- 1. Click New.

- 2. Input the following data:

Field Name Explanation Remark Code Set a code WTH-TAX15 Description Describe the meaning/usage of this code Withholding Tax 15% Tax Rate Withholding Tax Rate 15% Tax Account (DR) Set to Withholding Tax Exepense account At GL\Maintain Account, create the Withholding Tax Expense account under Expenses Tax Account (CR) Set to Withholding Tax Payable account At GL\Maintain Account, create the Withholding Tax Payable account under Current Liabilities

- 3. Click on Save.

Withholding Document Number Set

[Tools | Maintain Document Number...]

Descripion Document Type Format WITHHOLDING TAX Payment Voucher WTHPV-%.5d

- 2. Next, Go to Tools | Maintain Payment Method...

- 3. Edit the WITHHOLDING TAX.

- 4. Set the PV number Set to WITHHOLDING TAX. Click Save.