| (4 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

:''Available from version 781.731 and above'' | :''Available from version 781.731 and above'' | ||

| Line 5: | Line 4: | ||

:For those company who might asked and self report to RMCD for the GST-03 amendment. It could be because of applying wrong tax code or others reasons. | :For those company who might asked and self report to RMCD for the GST-03 amendment. It could be because of applying wrong tax code or others reasons. | ||

:Therefore, this guide will explain the features to perform amendment on the particular GST-03 and re-submit via TAP website. | :Therefore, this guide will explain the features to perform amendment on the particular GST-03 and re-submit via TAP website. | ||

<br /> | |||

<big>'''NOTIFICATION ON GST 03 RETURN AMENDMENT'''</big> | |||

:In accordance with '''Regulation 69 of the GST Regulation 2014''', with '''effect from 23 August 2016''', rules on return amendments are follows: | |||

::1. There is '''no limit''' on return amendments until due date of submission of return. | |||

::2. Amendment are allowed once within 30 days '''(for monthly taxable period)''' or 90 days '''(for quarterly taxable period)''' after last day of submission of return. Subsequent amendment are subject to approval by GST Officer. | |||

::3. Amendment after the period stated in PARA 2 above are subject to approval by GST Officer. | |||

::4. Amendment can be made through TAP but are subject to approval by GST Officer. | |||

::5. Return amendments which are not approved by GST Officer is considered invalid and previous return made before the amendment will be accepted. | |||

<br /> | <br /> | ||

| Line 79: | Line 88: | ||

<br /> | <br /> | ||

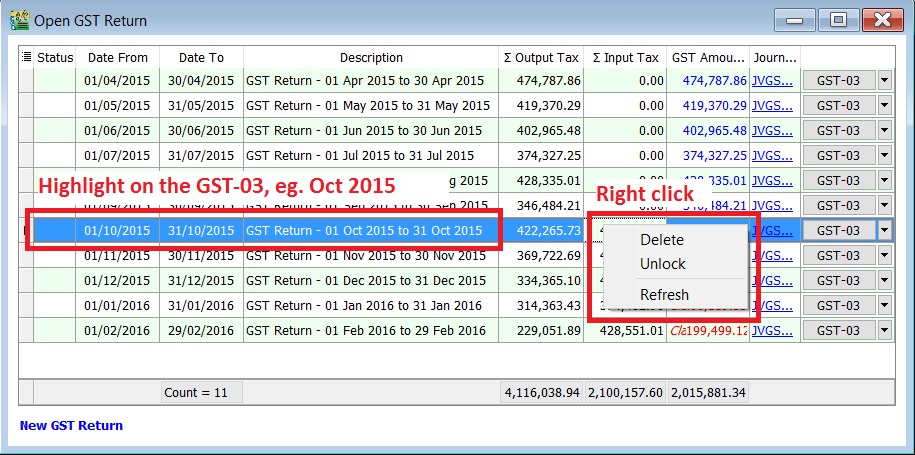

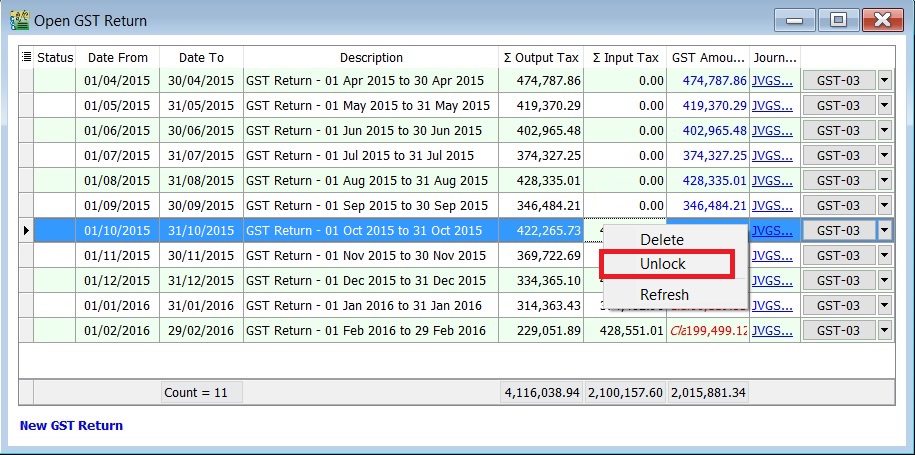

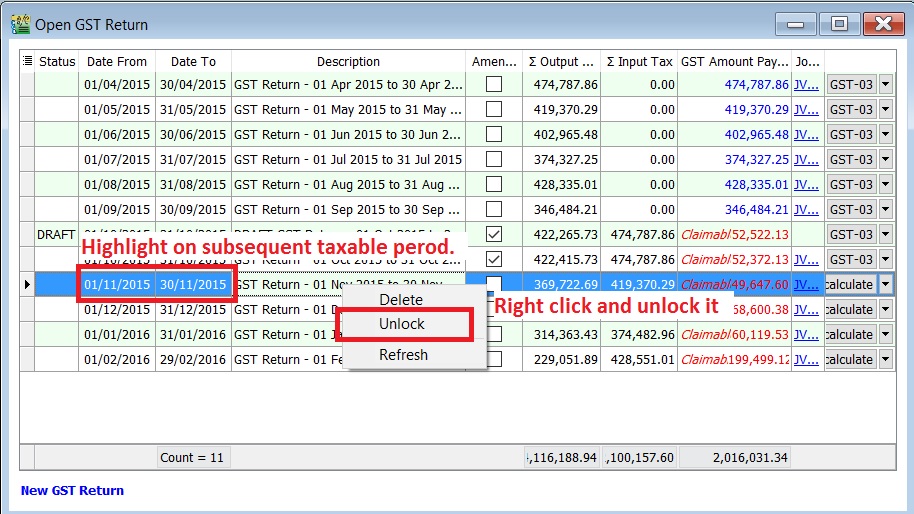

==How to unlock the subsequent | ==How to unlock the subsequent GST-03 for amendment?== | ||

:1. Highlight on the subsequent GST-03, eg. for subsequent taxable period is 01 Nov - 30 Nov 2015. | :1. Highlight on the subsequent GST-03, eg. for subsequent taxable period is 01 Nov - 30 Nov 2015. | ||

:2. Right and '''unlock''' it. | :2. Right and '''unlock''' it. | ||

Latest revision as of 04:42, 22 September 2016

- Available from version 781.731 and above

Introduction

- For those company who might asked and self report to RMCD for the GST-03 amendment. It could be because of applying wrong tax code or others reasons.

- Therefore, this guide will explain the features to perform amendment on the particular GST-03 and re-submit via TAP website.

NOTIFICATION ON GST 03 RETURN AMENDMENT

- In accordance with Regulation 69 of the GST Regulation 2014, with effect from 23 August 2016, rules on return amendments are follows:

- 1. There is no limit on return amendments until due date of submission of return.

- 2. Amendment are allowed once within 30 days (for monthly taxable period) or 90 days (for quarterly taxable period) after last day of submission of return. Subsequent amendment are subject to approval by GST Officer.

- 3. Amendment after the period stated in PARA 2 above are subject to approval by GST Officer.

- 4. Amendment can be made through TAP but are subject to approval by GST Officer.

- 5. Return amendments which are not approved by GST Officer is considered invalid and previous return made before the amendment will be accepted.

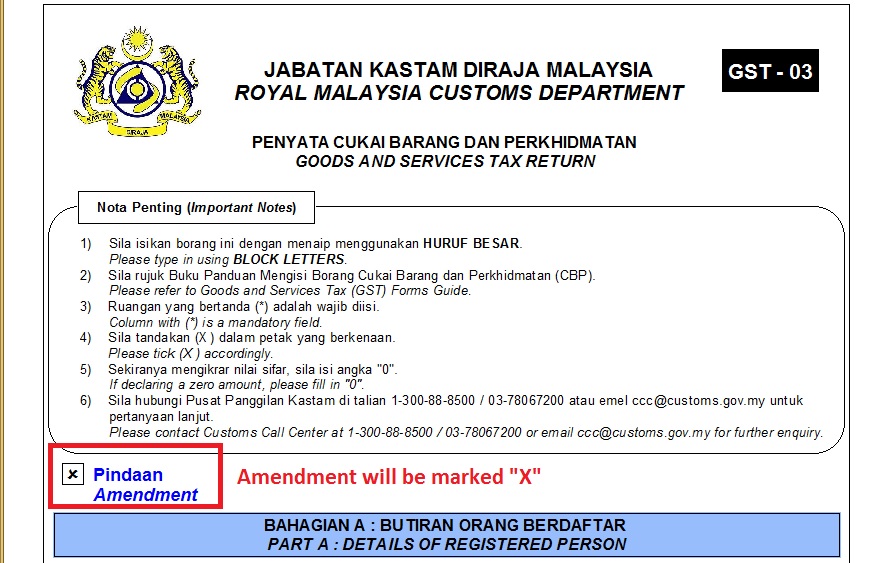

GST-03 Amendment

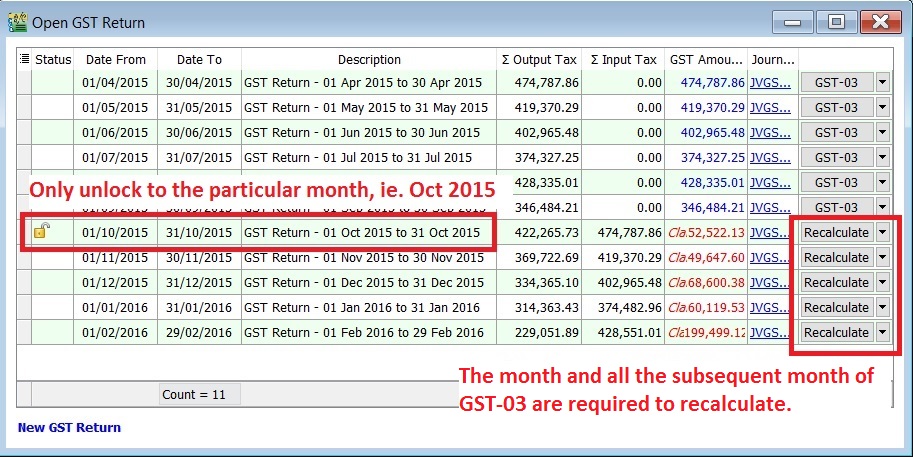

Menu: GST | Open GST Return...

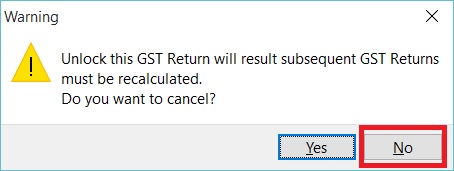

Important: Read the message before take further actions.

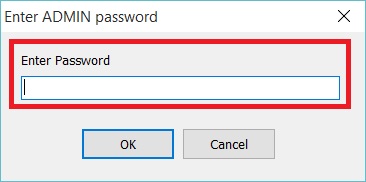

NOTE: ADMIN password only

- 5. Status will added Unlock icon. It means users are allow to amend the documents for the month unlock, eg. the documents are able to amend in Oct 2015 only.

NOTE: 1. The month and all the subsequent month of GST-03 will converted to "Recalculate" action. It is depends on the amendment which might trigger the bad debt relief result changed. 2. All the subsequent month of GST-03 are not allow to amend the documents (eg. invoice, credit note, supplied invoice, etc), unless you have Unlock it.

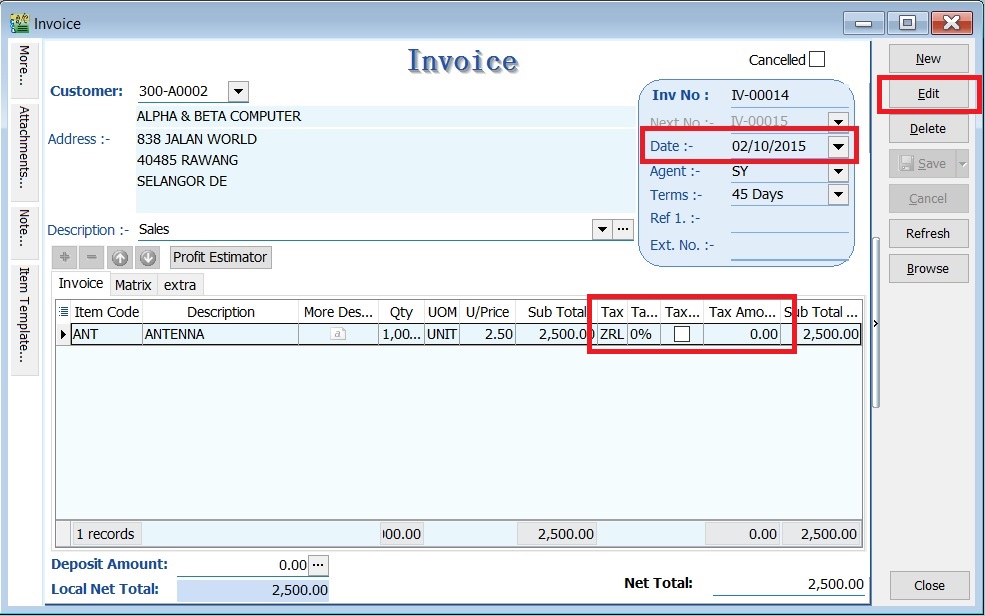

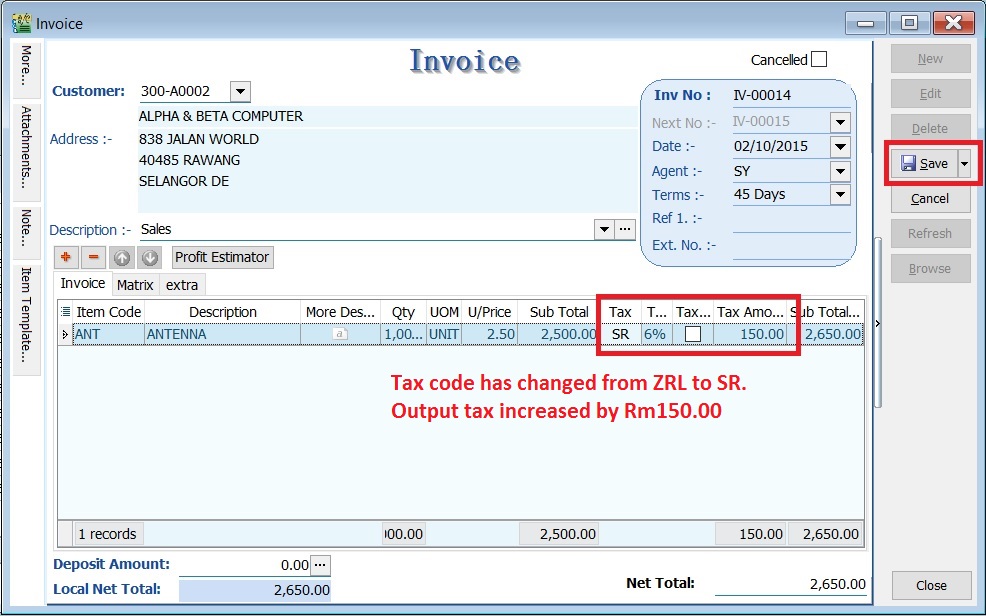

- 6.For example, to correct the tax code from ZRL to SR for the invoice amount Rm2,500.00.

NOTE: Unlock GST-03 is allow you to edit the documents only.

- 9. Press ok to proceed.

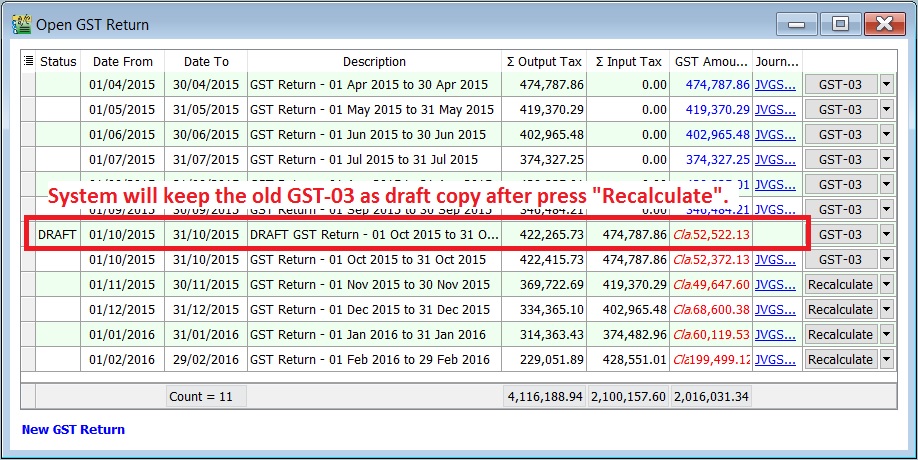

- 10. A draft copy of GST-03 for Oct 2015 will create automatically. A previous GST-03 before perform any amendment to the taxable period will converted as DRAFT status.

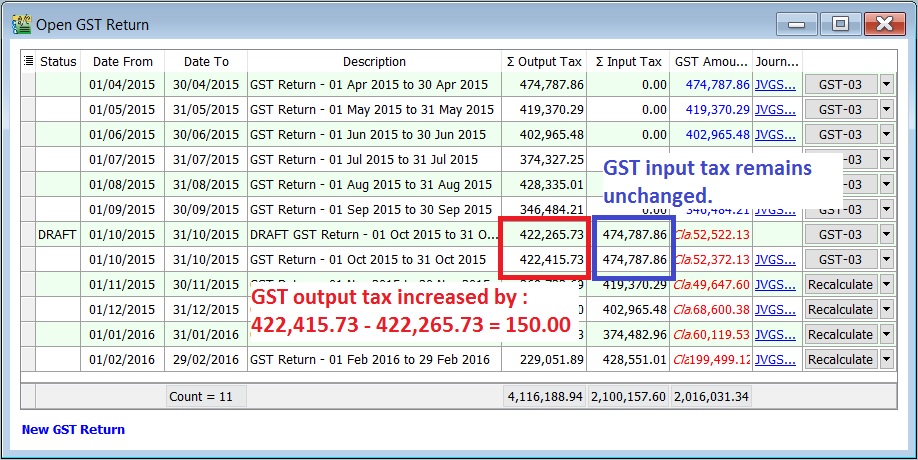

- 11. You can see the comparison in between the draft (from Recalculate) and the Final GST-03 for the amendment taxable period.

Status Taxable Period Total Output Tax Total Input Tax 01 Oct - 31 Oct 2015 422,415.73 474,787.86 DRAFT 01 Oct - 31 Oct 2015 422,265.73 474,787.86 Increase/Descrese (-) 150.00 0.00

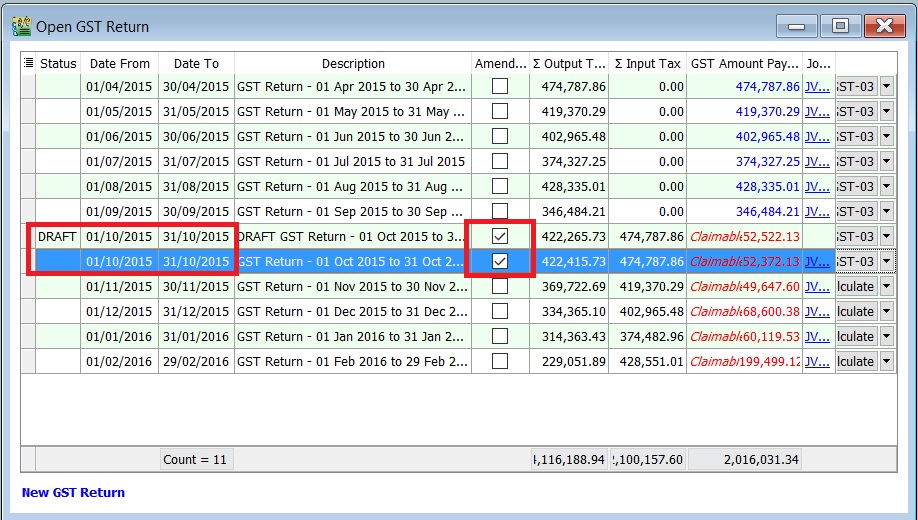

How to know the GST-03 has performed amendment?

- 2. At the GST Returns, insert a grid column Amendment. Usually, you will found the ticked on the amendment column for both DRAFT and final GST-03.

How to unlock the subsequent GST-03 for amendment?

- 1. Highlight on the subsequent GST-03, eg. for subsequent taxable period is 01 Nov - 30 Nov 2015.

- 2. Right and unlock it.