| (6 intermediate revisions by one other user not shown) | |||

| Line 61: | Line 61: | ||

==Extra== | ==Extra== | ||

===AR Bad Debt Relief=== | ===AR & AP Bad Debt Relief=== | ||

:1. Bad Debt Relief screen will be prompted (see the screenshot below) if the system found there are outstanding Tax Invoices has expired at 6 months. <br /> | |||

:2. Sales documents from the company with empty GST No will be unticked. You can tick the documents if you think this company is a GST Registered person. <br /> | |||

::[[File:03 GST BDR-GST Return1.jpg | 30PX]] | |||

<br /> | |||

'''Tips:''' | |||

[[File:Template.Warning-01.jpg|80px]] To avoid to tick the documents manually for GST Registered company, please go to update the GST no at Maintain Customer.<br /> | |||

:3. Press OK if get a "confirm" message prompted (see the screenshot below), it means there are some company do not have GST No. <br /> | |||

:4. If you has confirmed that the company is '''Non-GST Registered person''' then you can press YES to proceed. <br /> | |||

:5. Otherwise press NO, you have to update the GST No at Maintain Customer to confirm the company is a '''GST Registered person''' before process the GST Return. <br /> | |||

::[[File:03 GST BDR-GST Return2.jpg | 30PX]] | |||

<br /> | |||

===Capital Goods Acquired=== | ===Capital Goods Acquired=== | ||

| Line 69: | Line 79: | ||

::[[File: GST-New GST Return-07.jpg| 30PX]] | ::[[File: GST-New GST Return-07.jpg| 30PX]] | ||

<br /> | <br /> | ||

:2. Tick on the transactions line to take in the credit adjustment (eg. Rm15,000.00). See the screenshot below. | :2. Tick on the transactions line to take in the credit adjustment (eg. Rm15,000.00). Otherwise, it will capture the value Rm60,000.00 in GST-03 item 16. See the screenshot below. | ||

::[[File: GST-New GST Return-07b.jpg| 30PX]] | ::[[File: GST-New GST Return-07b.jpg| 30PX]] | ||

<br /> | <br /> | ||

Latest revision as of 08:53, 24 November 2017

Introduction

- To process and close the GST Returns period. You can generate the GST-03 and GAF.

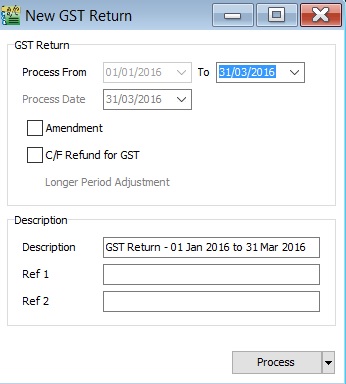

New GST Return

[GST | New GST Return...]

Field Name Field Type Explanation Process From to Date GST Taxable Period,eg. either monthly or quarterly. Process Date Date Date to process the GST Return. Amendment Boolean Ticked. In GST-03, the "Amendment" checkbox will be marked X. C/F Refund for GST Boolean Ticked. In GST-03, the Item 9 Do you choose to carry forward refund for GST? will be marked X in Yes checkbox. Longer Period Adjustment (LPA) Boolean Auto ticked according to the first tax year adjustment. Description String GST Return - Process From Date to Date (by default). Ref 1 String Key-in any reference no. Ref 2 String Key-in any reference no.

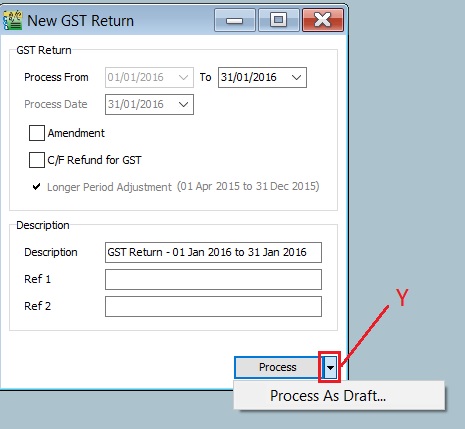

Draft-GST Return

[GST | New GST Return...]

- You are able to draft the GST-03 before the final GST-03 submission by process as draft.

- 1. Click on the arrow key down at the Process button (Y).

- 2. See below screenshot.

Note: You still can amend the documents where the DRAFT GST return has generated. You can draft as many before FINAL process the GST Returns for the period.

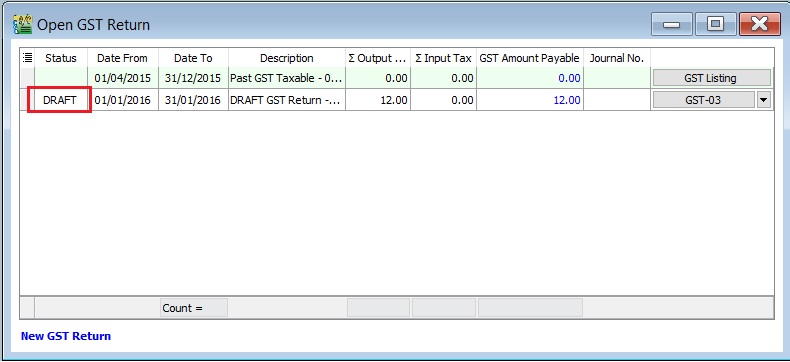

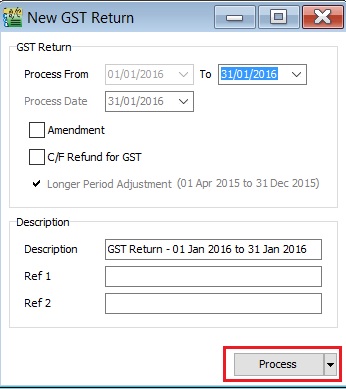

Final GST Return

[GST | New GST Return...]

Note: You cannot amend the documents anymore where the FINAL GST return has generated.

Extra

AR & AP Bad Debt Relief

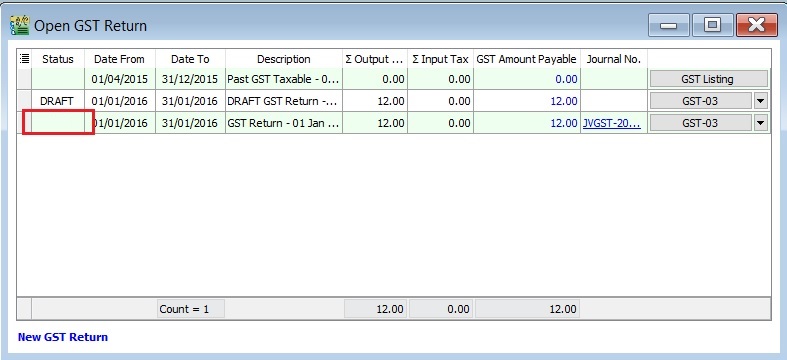

- 1. Bad Debt Relief screen will be prompted (see the screenshot below) if the system found there are outstanding Tax Invoices has expired at 6 months.

- 2. Sales documents from the company with empty GST No will be unticked. You can tick the documents if you think this company is a GST Registered person.

Tips:To avoid to tick the documents manually for GST Registered company, please go to update the GST no at Maintain Customer.

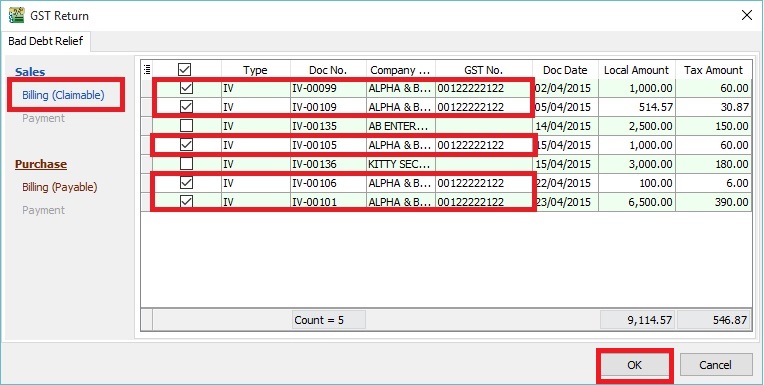

- 3. Press OK if get a "confirm" message prompted (see the screenshot below), it means there are some company do not have GST No.

- 4. If you has confirmed that the company is Non-GST Registered person then you can press YES to proceed.

- 5. Otherwise press NO, you have to update the GST No at Maintain Customer to confirm the company is a GST Registered person before process the GST Return.

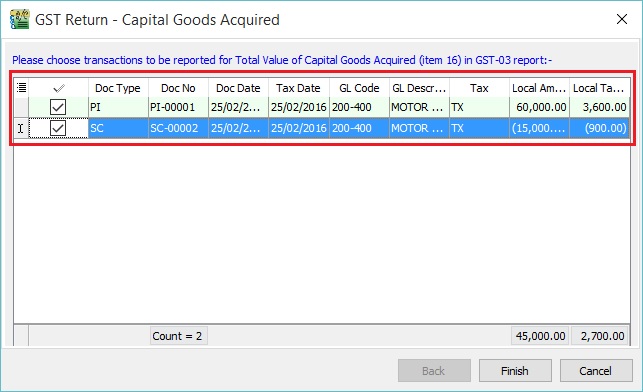

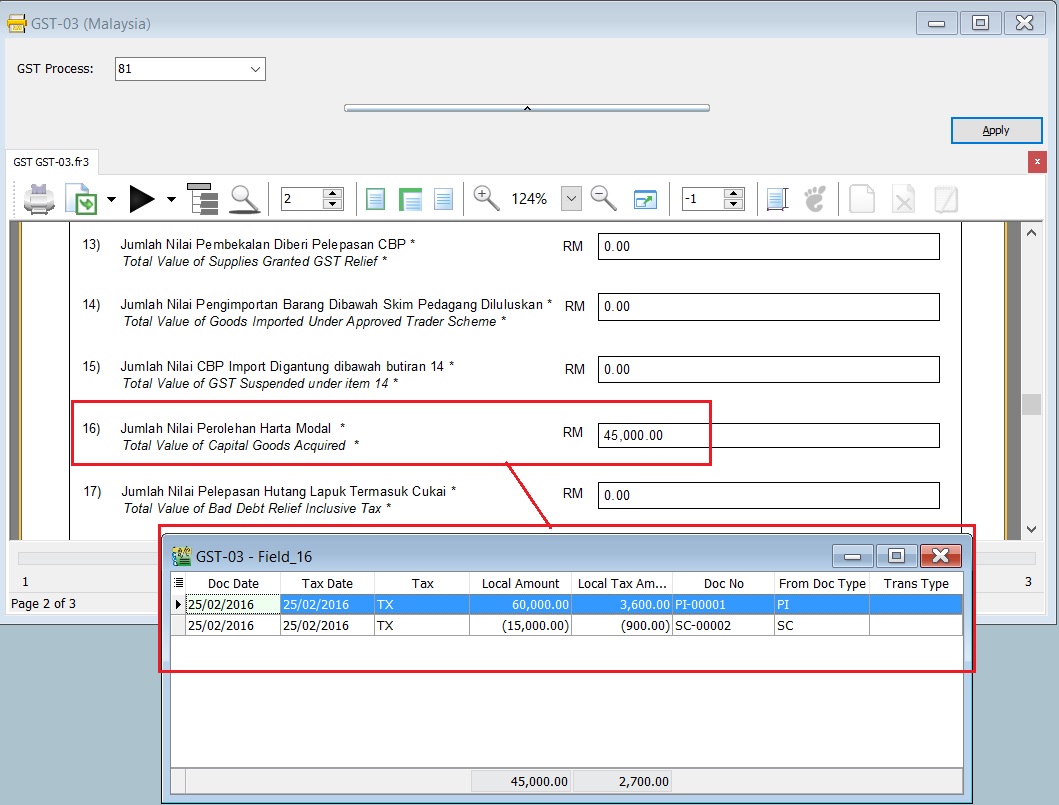

Capital Goods Acquired

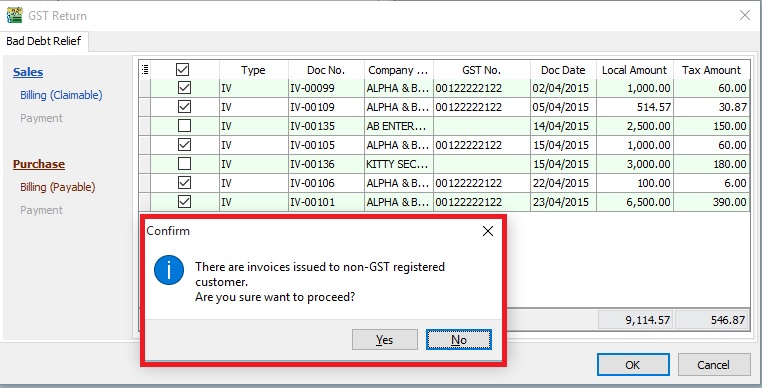

- 1. If you have get a prompt for the GST Return - Capital Goods Acquired, then it means there have some credit adjustment transactions for Fixed Asset Account. See below screenshot.

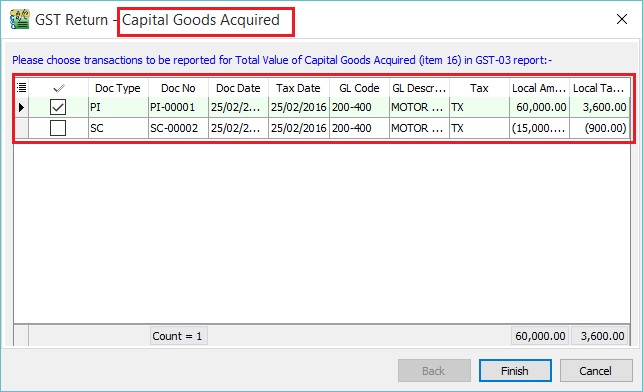

- 2. Tick on the transactions line to take in the credit adjustment (eg. Rm15,000.00). Otherwise, it will capture the value Rm60,000.00 in GST-03 item 16. See the screenshot below.