| (6 intermediate revisions by the same user not shown) | |||

| Line 3: | Line 3: | ||

==Introduction== | ==Introduction== | ||

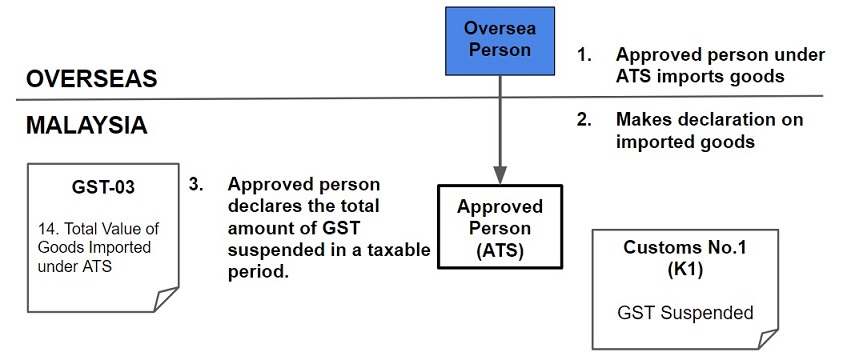

:'''Approved Trader Scheme (ATS)''' is a special schemes are introduced to | :'''Approved Trader Scheme (ATS)''' is a special schemes are introduced to relieve GST payment on importation of goods. | ||

: | :Section 71 under ATS, | ||

:# ATS participants are allowed to suspend GST on the importation of goods. | :# ATS participants are allowed to suspend GST on the importation of goods. | ||

:# Goods imported is used in the course or furtherance of business. | :# Goods imported is used in the course or furtherance of business. | ||

:# The amount of GST suspended needs to be declared in the GST return (for the taxable period to which the suspension relates). | :# The amount of GST suspended needs to be declared in the GST return (for the taxable period to which the suspension relates). | ||

::[[File:GST-ATS-PI-00A.jpg | 200PX]] | |||

:Persons eligible for ATS | :Persons eligible for ATS | ||

| Line 29: | Line 31: | ||

! Tax Code !! Description !! Tax Rate % | ! Tax Code !! Description !! Tax Rate % | ||

|- | |- | ||

| IS || Imports under special scheme with no GST incurred. | | IS || Imports under special scheme with no GST incurred.<br /> | ||

This refers to goods imported under the Approved Trader Scheme (ATS) and Approved Toll Manufacturer Scheme (ATMS), where GST is suspended when the trader imports the non-dutiable goods into Malaysia. These two schemes are designed to ease the cash flow of Trader Scheme (ATS) and Approved Toll Manufacturer Scheme (ATMS), who has significant imports. || 0% | This refers to goods imported under the Approved Trader Scheme (ATS) and Approved Toll Manufacturer Scheme (ATMS), where GST is suspended when the trader imports the non-dutiable goods into Malaysia. These two schemes are designed to ease the cash flow of Trader Scheme (ATS) and Approved Toll Manufacturer Scheme (ATMS), who has significant imports. | ||

|| 0% | |||

|}<br /> | |}<br /> | ||

Latest revision as of 04:44, 20 January 2018

Import Goods (IM)

Introduction

- Approved Trader Scheme (ATS) is a special schemes are introduced to relieve GST payment on importation of goods.

- Section 71 under ATS,

- ATS participants are allowed to suspend GST on the importation of goods.

- Goods imported is used in the course or furtherance of business.

- The amount of GST suspended needs to be declared in the GST return (for the taxable period to which the suspension relates).

- Persons eligible for ATS

- Companies located within Free Industries Zone (FIZ)

- Licensed Manufacturing Warehouse (LMW)

- International Procurement Centre (IPC)

- Regional Distribution Centre (RDC)

- Toll manufacturers under ATMS

- Jewellery manufacturers under AJS

- Companies with turnover above RM25 million and at least 80% of their supplies made are zero-rated; or

- Any other person approved by the Minister.

ATS

Tax Code

[GST | Maintain Tax...]

- You can found the following tax code available in SQL Financial Accounting.

Tax Code Description Tax Rate % IS Imports under special scheme with no GST incurred.

This refers to goods imported under the Approved Trader Scheme (ATS) and Approved Toll Manufacturer Scheme (ATMS), where GST is suspended when the trader imports the non-dutiable goods into Malaysia. These two schemes are designed to ease the cash flow of Trader Scheme (ATS) and Approved Toll Manufacturer Scheme (ATMS), who has significant imports.

0%

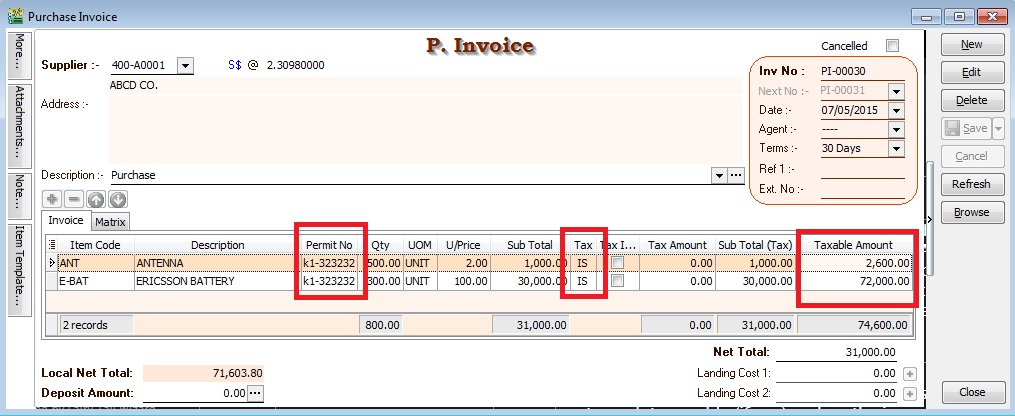

Purchase Invoice For ATS

[Purchase | Purchase Invoice...]

- 1. Create the oversea supplier invoice at Purchase Invoice.

- 2. You are required to key-in the Import Declaration No. (eg. K1 or K9) into Permit No column. This import declaration no will be appear in GAF file.

- 3. Select the tax code = IS. Tax amount = 0.00

- 4. Taxable Amount (local value) should entered as:

GST Value = Customs Value (CIF) + any customs duty paid + any excise duty paid

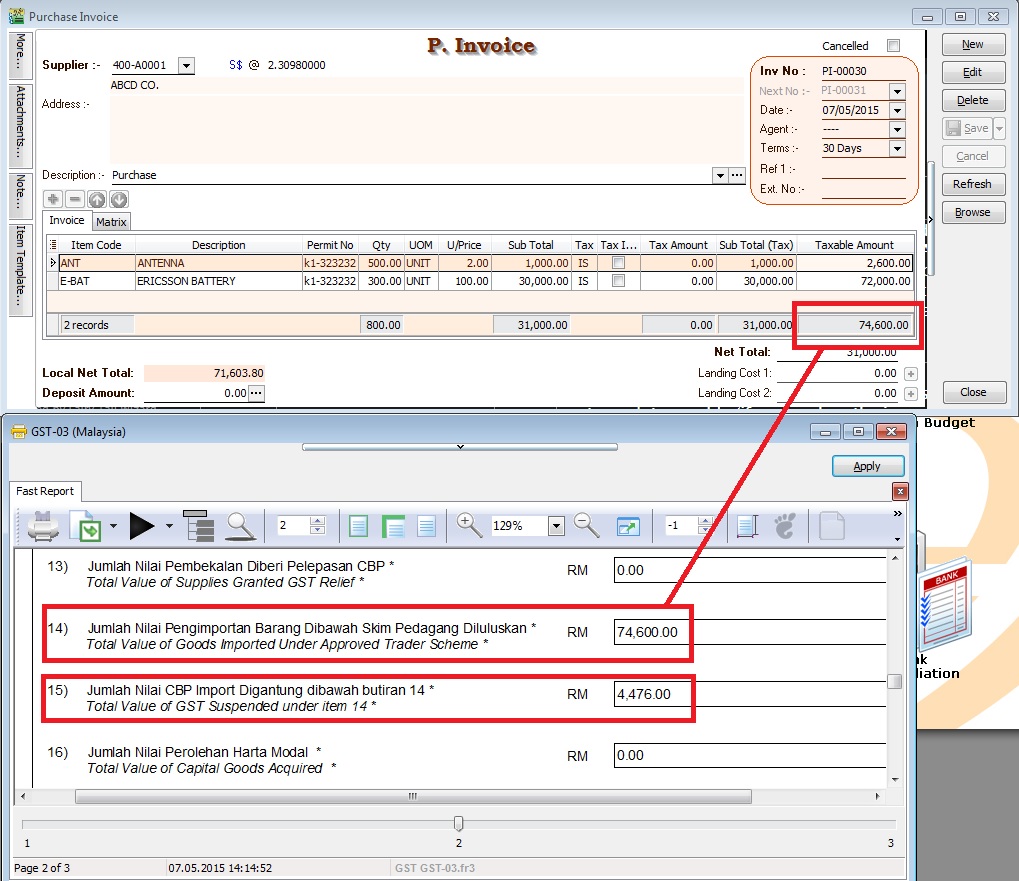

GST Return Process

[ GST | New GST Return...]

- 1. Process the month GST Return.

- 2. GST03 item no 14 will be fill-up with the Taxable Amount from the purchase invoice item with tax code “IS”.

- 3. GST03 Item no 15 = Taxable Amount (local value) x 6%

- 4. For example, below screenshot:-

GST03 Item no 15 = 74,600.00 x 6% = 4,476.00

Highlight Changes

| Date | Initiated by | Remarks |

|---|---|---|

| 07 May 2015 | Loo | Initial document. |