| (32 intermediate revisions by the same user not shown) | |||

| Line 3: | Line 3: | ||

==Introduction== | ==Introduction== | ||

A taxable person may claim bad debt relief subject to the requirements and conditions set forth under sec.58 of the GSTA 2014 and the person has not received any payment or part of the payment in respect of the taxable supply from the debtor after the sixth month from the date of supply.<br /> | :A taxable person may claim bad debt relief subject to the requirements and conditions set forth under sec.58 of the GSTA 2014 and the person has not received any payment or part of the payment in respect of the taxable supply from the debtor after the sixth month from the date of supply.<br /> | ||

The bad debt relief may be claimed if - <br /> | :The bad debt relief may be claimed if - (amended on 28 Oct 2015 from DG Decision) <br /> | ||

(a) requirements under s.58 GSTA and Part X of GST Regulations 2014 are fulfilled; and <br /> | :(a) requirements under s.58 GSTA and Part X of GST Regulations 2014 are fulfilled; and <br /> | ||

(b) the supply is made by a GST registered person to another GST registered person <br /> | :(b) the supply is made by a GST registered person to another GST registered person <br /> | ||

<br /> | <br /> | ||

The bad debt relief shall be claimed immediately in the taxable period after the expiry of the sixth month from the date of supply. If the bad debt relief is not claimed by the supplier in the immediate taxable period immediately after the expiry of the sixth month, then the taxable person has to notify the Director General (DG) within 30 days after the expiry of the sixth month on his intention to claim at a later date. <br /> | :The bad debt relief shall be claimed immediately in the taxable period after the expiry of the sixth month from the date of supply. If the bad debt relief is not claimed by the supplier in the immediate taxable period immediately after the expiry of the sixth month, then the taxable person has to notify the Director General (DG) within 30 days after the expiry of the sixth month on his intention to claim at a later date. <br /> | ||

<br /> | <br /> | ||

A GST registered person who has made the input tax claim but fails to pay his supplier within six months from the date of supply shall account for output tax | :A GST registered person who has made the input tax claim but fails to pay his supplier within six months from the date of supply shall account for output tax immediately after the expiry of the sixth month (s.38(9) GSTA). <br /> | ||

immediately after the expiry of the sixth month (s.38(9) GSTA). <br /> | |||

<br /> | <br /> | ||

The word ‘month’ in sec.58 refers to calendar month or complete month – <br /> | :The word ‘month’ in sec.58 refers to calendar month or complete month – <br /> | ||

Example: Invoice issued at 15 th January 2017. For monthly taxable period, the sixth month expires at the end of June and the bad debt relief shall be claimed in | :Example: Invoice issued at 15 th January 2017. For monthly taxable period, the sixth month expires at the end of June and the bad debt relief shall be claimed in July taxable period.<br /> | ||

July taxable period.<br /> | |||

<br /> | <br /> | ||

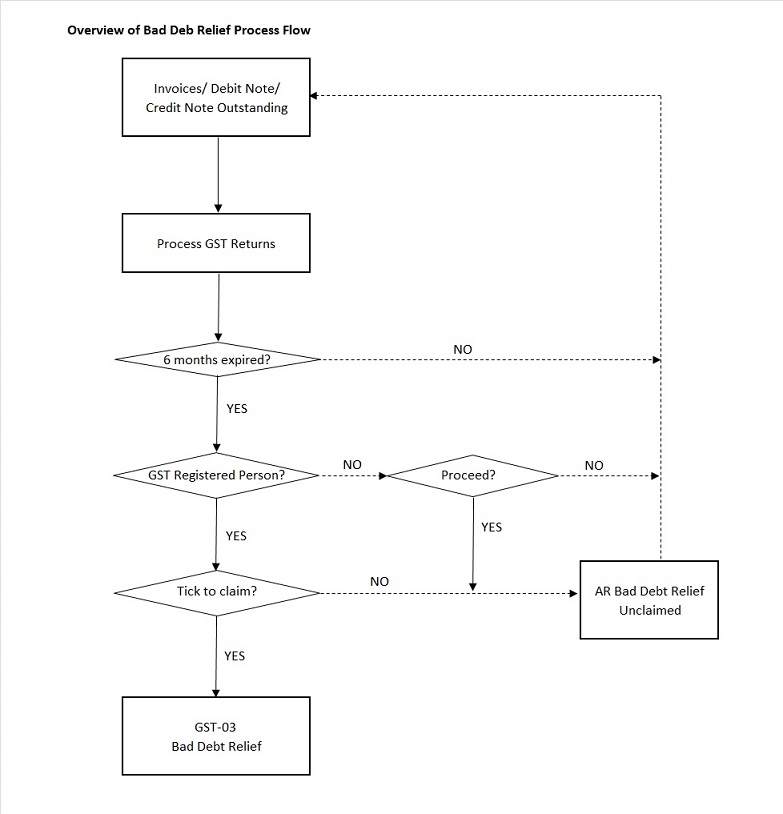

See below the overview of GST Bad Debt Relief system flow: | :See below the overview of GST Bad Debt Relief system flow: | ||

::[[File:01 GST Bad Debt Relief-FlowChart.jpg | 30PX]] | ::[[File:01 GST Bad Debt Relief-FlowChart.jpg | 30PX]] | ||

| Line 27: | Line 25: | ||

''[GST | Maintain Tax...]'' | ''[GST | Maintain Tax...]'' | ||

Below tax code will be AUTO used for Bad Debt Relief matter when process GST Return: <br /> | :Below tax code will be AUTO used for Bad Debt Relief matter when process GST Return: <br /> | ||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

! Tax Code !! Description !! Tax Acc Entry !! Explanation | ! Tax Code !! Description !! Tax Acc Entry !! Explanation | ||

|- | |- | ||

| | | SL-AJP-BD || Input Tax adjustment e.g: Bad Debt Relief || DR GST-Claimable <br /> CR GST-Sales Deferred Tax || For customer bad debt relief claim | ||

|- | |- | ||

| SL- | | SL-AJS-BD || Output Tax adjustment e.g: Bad Debt Recover, outstanding invoice > 6 months || DR Sales Deferred Tax <br /> CR GST-Payable || For customer bad debt relief recovered | ||

|- | |- | ||

| PH- | | PH-AJP-BD || Input Tax adjustment e.g: Bad Debt Relief || DR GST-Claimable <br /> CR GST-Purchase Deferred Tax || For supplier bad debt relief recovered | ||

|- | |- | ||

| | | PH-AJS-BD || Output Tax adjustment e.g: Bad Debt Recover, outstanding invoice > 6 months || DR GST-Purchase Deferred Tax <br /> CR GST-Payable || For supplier bad debt relief payable | ||

|} | |} | ||

<br /> | <br /> | ||

| Line 45: | Line 43: | ||

''[Customer | Maintain Customer...]'' | ''[Customer | Maintain Customer...]'' | ||

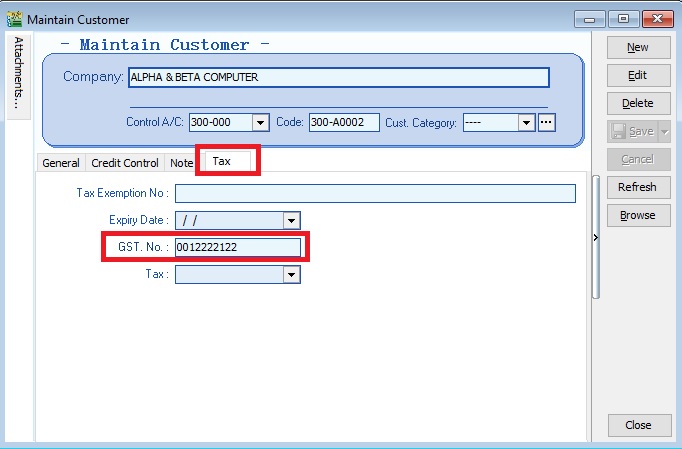

1. There is one condition to determine the bad debt relief can be claimed if - <br /> | :1. There is one condition to determine the bad debt relief can be claimed if - <br /> | ||

::(a) requirements under s.58 GSTA and Part X of GST Regulations 2014 arefulfilled; and <br /> | ::(a) requirements under s.58 GSTA and Part X of GST Regulations 2014 arefulfilled; and <br /> | ||

::'''(b) the supply is made by a GST registered person to another GST registered person''' <br /> | ::'''(b) the supply is made by a GST registered person to another GST registered person''' <br /> | ||

<br /> | <br /> | ||

2. Therefore, you need to update the GST No for your customer who is GST registered person. See the screenshot below.<br /> | :2. Therefore, you need to update the GST No for your customer who is GST registered person. See the screenshot below.<br /> | ||

3. Under the Tax tab in Maintain Customer,<br /> | :3. Under the Tax tab in Maintain Customer,<br /> | ||

::[[File:02 GST BDR-Maintain Customer.jpg| 30PX]] | ::[[File:02 GST BDR-Maintain Customer.jpg| 30PX]] | ||

<br /> | <br /> | ||

| Line 58: | Line 56: | ||

''[GST | New GST Return...]'' | ''[GST | New GST Return...]'' | ||

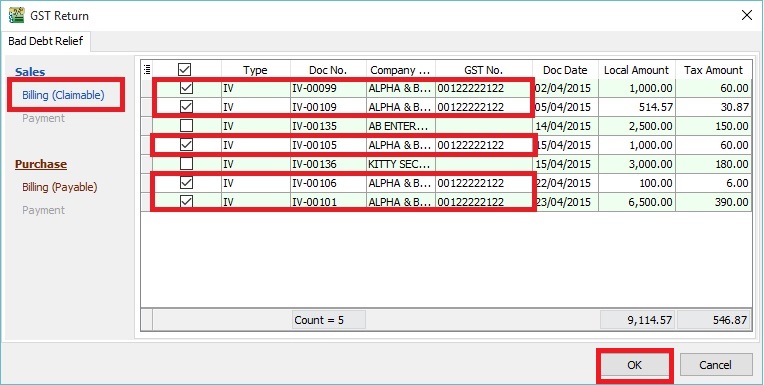

1. Process GST Return. For example, process from 01/10/2015 to 31/10/2015.<br /> | :1. Process GST Return. For example, process from 01/10/2015 to 31/10/2015.<br /> | ||

2. Bad Debt Relief screen will be prompted (see the screenshot below) if the system found there are outstanding Tax Invoices has expired at 6 months. <br /> | :2. Bad Debt Relief screen will be prompted (see the screenshot below) if the system found there are outstanding Tax Invoices has expired at 6 months. <br /> | ||

3. Sales documents from the company has empty GST No will be unticked. You can tick the documents if you think this company is a GST Registered person. <br /> | :3. Sales documents from the company has empty GST No will be unticked. You can tick the documents if you think this company is a GST Registered person. <br /> | ||

::[[File:03 GST BDR-GST Return1.jpg | 30PX]] | ::[[File:03 GST BDR-GST Return1.jpg | 30PX]] | ||

<br /> | <br /> | ||

| Line 67: | Line 65: | ||

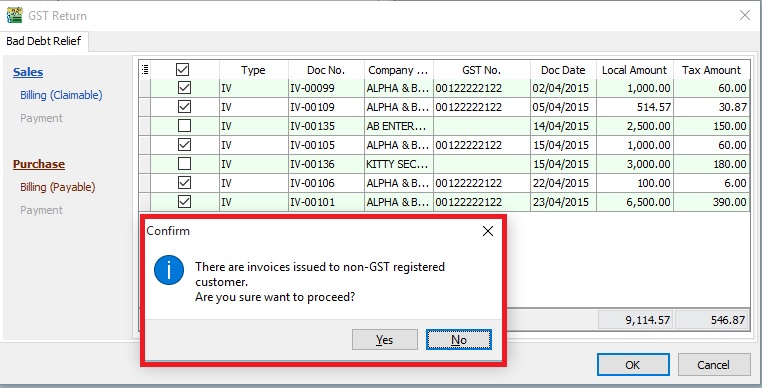

4. Press OK if get a "confirm" message prompted (see the screenshot below), it means there are some company do not have GST No. <br /> | :4. Press OK if get a "confirm" message prompted (see the screenshot below), it means there are some company do not have GST No. <br /> | ||

5. If you has confirmed that the company is '''Non-GST Registered person''' then you can press YES to proceed. <br /> | :5. If you has confirmed that the company is '''Non-GST Registered person''' then you can press YES to proceed. <br /> | ||

6. Otherwise press NO, you have to update the GST No at Maintain Customer to confirm the company is a '''GST Registered person''' before process the GST Return. <br /> | :6. Otherwise press NO, you have to update the GST No at Maintain Customer to confirm the company is a '''GST Registered person''' before process the GST Return. <br /> | ||

::[[File:03 GST BDR-GST Return2.jpg | 30PX]] | ::[[File:03 GST BDR-GST Return2.jpg | 30PX]] | ||

<br /> | <br /> | ||

| Line 76: | Line 74: | ||

''[GST | Print GST Listing...]'' | ''[GST | Print GST Listing...]'' | ||

Category | :Category '''Others''' will appeared in GST Listing if there is found bad debt relief (eg. AJS-BD, AJP-BD): <br /> | ||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

! Category : Others !! Local Amount !! Local Tax Amount | ! Category : Others !! style="text-align:right;"| Local Amount !! style="text-align:right;"| Local Tax Amount | ||

|- | |- | ||

| AJS-BD (Output Tax adjustment e.g: Bad Debt Recover, outstanding invoice > 6 months) || 17,000.00 || 1,020.00 | | AJS-BD (Output Tax adjustment e.g: Bad Debt Recover, outstanding invoice > 6 months) || style="text-align:right;"| 17,000.00 || style="text-align:right;"| 1,020.00 | ||

|- | |- | ||

| AJP-BD (Input Tax adjustment e.g: Bad Debt Relief) || 9,114.57 || 546.87 | | AJP-BD (Input Tax adjustment e.g: Bad Debt Relief) || style="text-align:right;"| 9,114.57 || style="text-align:right;"| 546.87 | ||

|} | |} | ||

<br /> | <br /> | ||

| Line 90: | Line 88: | ||

''[GST | Print GST-03...]'' | ''[GST | Print GST-03...]'' | ||

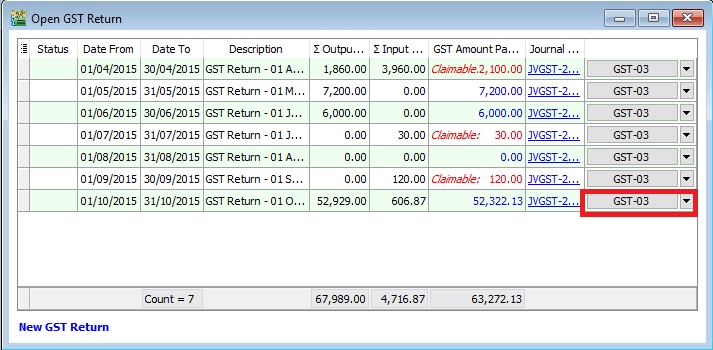

1. At GST Return screen, you can direct preview the GST-03 by click on the GST-03 button (see the screenshot below).<br /> | :1. At GST Return screen, you can direct preview the GST-03 by click on the GST-03 button (see the screenshot below).<br /> | ||

::[[File: 04 GST BDR-GST Return-GST03.jpg | 40PX]] | ::[[File: 04 GST BDR-GST Return-GST03.jpg | 40PX]] | ||

<br /> | <br /> | ||

2. GST-03 result from the above sample data: <br /> | :2. GST-03 result from the above sample data: <br /> | ||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

! GST-03 # !! Description !! Amount | ! GST-03 # !! Description !! style="text-align:right;"| Amount | ||

|- | |- | ||

| 5a || Total Value of Standard Rated Supply || 0.00 | | 5a || Total Value of Standard Rated Supply || style="text-align:right;"| 0.00 | ||

|- | |- | ||

| 5b || Total Output Tax (Inclusive of Tax Value on Bad Debt Recovered & other Adjustments) || 1,020,.00 | | 5b || Total Output Tax (Inclusive of Tax Value on Bad Debt Recovered & other Adjustments) || style="text-align:right;"| 1,020,.00 | ||

|- | |- | ||

| 6a || Total Value of Standard Rate and Flat Rate Acquisitions || 0.00 | | 6a || Total Value of Standard Rate and Flat Rate Acquisitions || style="text-align:right;"| 0.00 | ||

|- | |- | ||

| 6b || Total Input Tax (Inclusive of Tax Value on Bad Debt Relief & other Adjustments) || 546.87 | | 6b || Total Input Tax (Inclusive of Tax Value on Bad Debt Relief & other Adjustments) || style="text-align:right;"| 546.87 | ||

|- | |- | ||

| 17 || Total Value of Bad Debt Relief Inclusive Tax || 9,661.44 | | 17 || Total Value of Bad Debt Relief Inclusive Tax || style="text-align:right;"| 9,661.44 | ||

|- | |- | ||

| 18 || Total Value of Bad Debt Relief Recovered Inclusive Tax || 0.00 | | 18 || Total Value of Bad Debt Relief Recovered Inclusive Tax || style="text-align:right;"| 0.00 | ||

|}<br /> | |}<br /> | ||

| Line 117: | Line 115: | ||

''[GST | Print GST Bad Debt Relief…]'' | ''[GST | Print GST Bad Debt Relief…]'' | ||

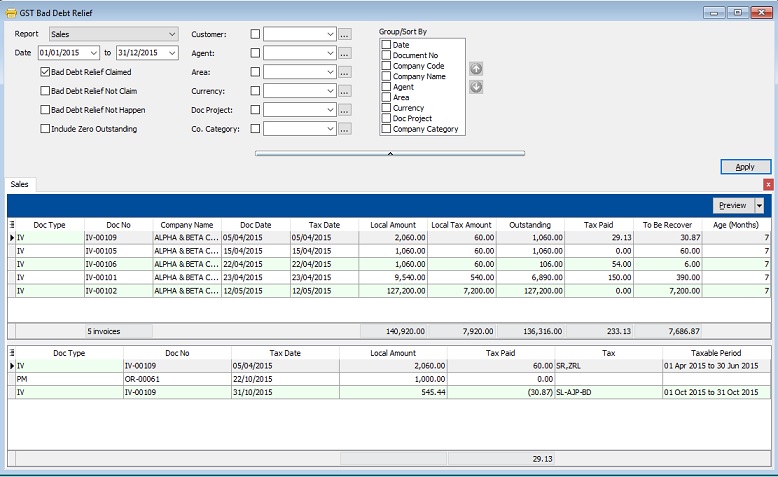

1. This report is help you to analyse the GST Bad Debt Relief happenings on each invoices.<br /> | :1. This report is help you to analyse the GST Bad Debt Relief happenings on each invoices.<br /> | ||

::[[File:01 GST Bad Debt Relief.jpg | 240PX]] | ::[[File:01 GST Bad Debt Relief.jpg | 240PX]] | ||

<br /> | <br /> | ||

2. Let said the IV-00109 has the following details:-<br /> | :2. Let said the IV-00109 has the following details:-<br /> | ||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

! Seq !! Description !! Amount !! Tax !! Tax Amount !! Amount with Tax | ! Seq !! Description !! Amount !! Tax !! style="text-align:right;"| Tax Amount !! style="text-align:right;"| Amount with Tax | ||

|- | |- | ||

| 1 || Sales of coconut can drinks || 1,000.00 || SR || 60.00 || 1,060.00 | | 1 || Sales of coconut can drinks || 1,000.00 || SR || style="text-align:right;"| 60.00 || style="text-align:right;"| 1,060.00 | ||

|- | |- | ||

| 2 || Sales of coconut || 1,000.00 || ZRL || 0.00 || 1,000.00 | | 2 || Sales of coconut || 1,000.00 || ZRL || style="text-align:right;"| 0.00 || style="text-align:right;"| 1,000.00 | ||

|} | |} | ||

<br /> | <br /> | ||

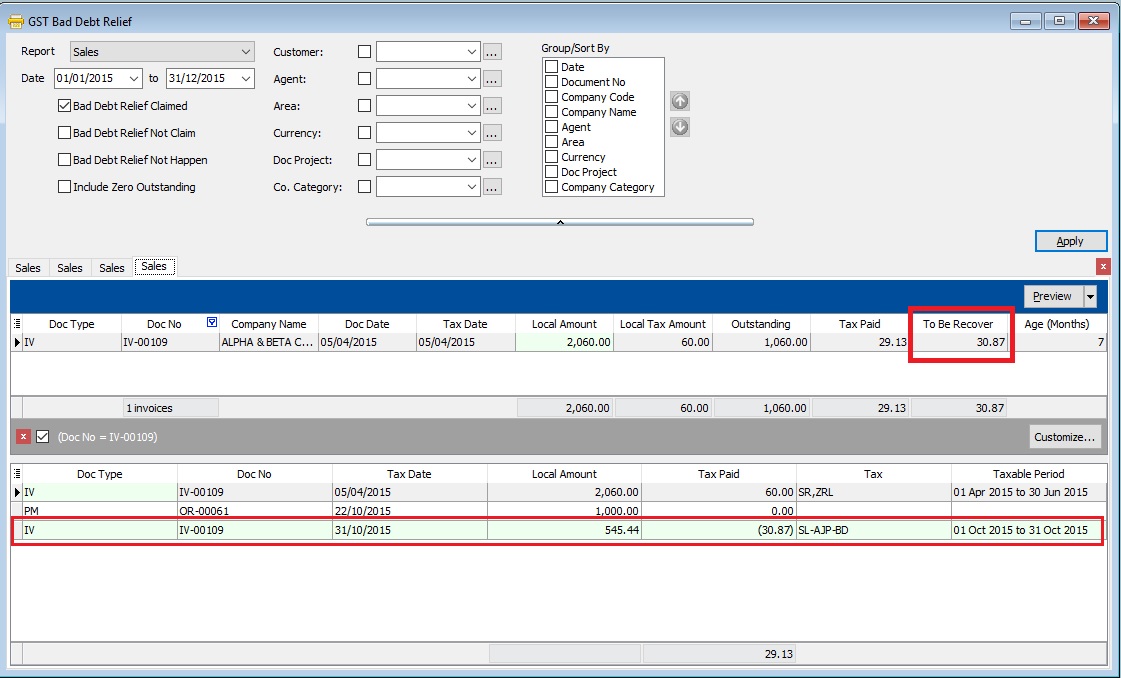

3. From the below report, it tells you that the bad debt relief claimed and to be recover at '''Rm30.87''' for IV-00109. You can found at the detail that the bad debt relief claimed at '''Taxable Period 01 Oct 2015 to 31 Oct 2015'''. | :3. From the below report, it tells you that the bad debt relief claimed and to be recover at '''Rm30.87''' for IV-00109. You can found at the detail that the bad debt relief claimed at '''Taxable Period 01 Oct 2015 to 31 Oct 2015'''. | ||

::[[File:01 GST BDR-Claimed.jpg | 40PX]] | ::[[File:01 GST BDR-Claimed.jpg | 40PX]] | ||

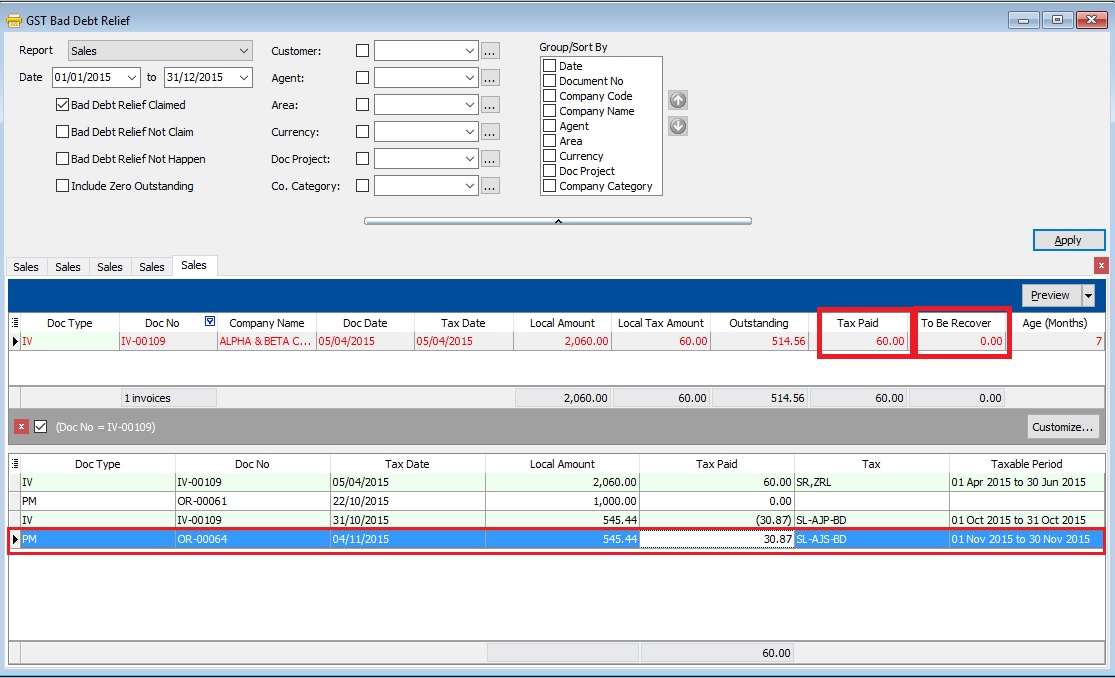

4. After the IV-00109 has been full settlement in month Nov 2015, you will found the full tax paid '''Rm60.00''' and to be recover will be shown as 0. You can found at the detail that the bad debt relief recovered at '''Taxable Period 01 Nov 2015 to 30 Nov 2015'''. | :4. After the IV-00109 has been full settlement in month Nov 2015, you will found the full tax paid '''Rm60.00''' and to be recover will be shown as 0. You can found at the detail that the bad debt relief recovered at '''Taxable Period 01 Nov 2015 to 30 Nov 2015'''. | ||

::[[File:01 GST BDR-Recovered.jpg| 40PX]] | ::[[File:01 GST BDR-Recovered.jpg| 40PX]] | ||

5. There are some option can choose to apply the GST Bad Debt Relief for further checking:<br /> | :5. There are some option can choose to apply the GST Bad Debt Relief for further checking:<br /> | ||

::'''Sales''' | ::'''Sales''' | ||

::{| class="wikitable" | ::{| class="wikitable" | ||

| Line 172: | Line 170: | ||

<br /> | <br /> | ||

6. Click Preview button. You can found the following report list. | :6. Click Preview button. You can found the following report list. | ||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

| Line 189: | Line 187: | ||

<br /> | <br /> | ||

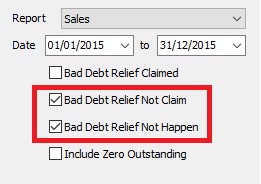

'''TIPS 1 : ''' To print the '''bad debt relief unclaimed letter'''.<br /> | |||

'' | 1. Select the '''Date Parameter''' as '''the GST effective date onwards'''. | ||

[[File:01 GST BDR-UnclaimLetter.jpg | 40PX]] | 2. Tick both '''Bad Debt Relief Not Claim''' and '''Bad Debt Relief Not Happen''' to apply follow by preview.<br /> | ||

[[File:01 GST BDR-UnclaimLetter.jpg | 40PX]]<br /> | |||

3. This letter applicable to customer has maintained '''GST No''' in Maintain Customer only. | |||

<br /> | <br /> | ||

Latest revision as of 06:36, 17 March 2016

GST Bad Debt Relief

Introduction

- A taxable person may claim bad debt relief subject to the requirements and conditions set forth under sec.58 of the GSTA 2014 and the person has not received any payment or part of the payment in respect of the taxable supply from the debtor after the sixth month from the date of supply.

- The bad debt relief may be claimed if - (amended on 28 Oct 2015 from DG Decision)

- (a) requirements under s.58 GSTA and Part X of GST Regulations 2014 are fulfilled; and

- (b) the supply is made by a GST registered person to another GST registered person

- The bad debt relief shall be claimed immediately in the taxable period after the expiry of the sixth month from the date of supply. If the bad debt relief is not claimed by the supplier in the immediate taxable period immediately after the expiry of the sixth month, then the taxable person has to notify the Director General (DG) within 30 days after the expiry of the sixth month on his intention to claim at a later date.

- A GST registered person who has made the input tax claim but fails to pay his supplier within six months from the date of supply shall account for output tax immediately after the expiry of the sixth month (s.38(9) GSTA).

- The word ‘month’ in sec.58 refers to calendar month or complete month –

- Example: Invoice issued at 15 th January 2017. For monthly taxable period, the sixth month expires at the end of June and the bad debt relief shall be claimed in July taxable period.

Maintain Tax

[GST | Maintain Tax...]

- Below tax code will be AUTO used for Bad Debt Relief matter when process GST Return:

Tax Code Description Tax Acc Entry Explanation SL-AJP-BD Input Tax adjustment e.g: Bad Debt Relief DR GST-Claimable

CR GST-Sales Deferred TaxFor customer bad debt relief claim SL-AJS-BD Output Tax adjustment e.g: Bad Debt Recover, outstanding invoice > 6 months DR Sales Deferred Tax

CR GST-PayableFor customer bad debt relief recovered PH-AJP-BD Input Tax adjustment e.g: Bad Debt Relief DR GST-Claimable

CR GST-Purchase Deferred TaxFor supplier bad debt relief recovered PH-AJS-BD Output Tax adjustment e.g: Bad Debt Recover, outstanding invoice > 6 months DR GST-Purchase Deferred Tax

CR GST-PayableFor supplier bad debt relief payable

Maintain Customer

[Customer | Maintain Customer...]

- 1. There is one condition to determine the bad debt relief can be claimed if -

- (a) requirements under s.58 GSTA and Part X of GST Regulations 2014 arefulfilled; and

- (b) the supply is made by a GST registered person to another GST registered person

- (a) requirements under s.58 GSTA and Part X of GST Regulations 2014 arefulfilled; and

- 2. Therefore, you need to update the GST No for your customer who is GST registered person. See the screenshot below.

Process GST Returns

[GST | New GST Return...]

- 1. Process GST Return. For example, process from 01/10/2015 to 31/10/2015.

- 2. Bad Debt Relief screen will be prompted (see the screenshot below) if the system found there are outstanding Tax Invoices has expired at 6 months.

- 3. Sales documents from the company has empty GST No will be unticked. You can tick the documents if you think this company is a GST Registered person.

Tips:To avoid to tick the documents manually for GST Registered company, please go to update the GST no at Maintain Customer.

- 4. Press OK if get a "confirm" message prompted (see the screenshot below), it means there are some company do not have GST No.

- 5. If you has confirmed that the company is Non-GST Registered person then you can press YES to proceed.

- 6. Otherwise press NO, you have to update the GST No at Maintain Customer to confirm the company is a GST Registered person before process the GST Return.

GST Listing

[GST | Print GST Listing...]

- Category Others will appeared in GST Listing if there is found bad debt relief (eg. AJS-BD, AJP-BD):

Category : Others Local Amount Local Tax Amount AJS-BD (Output Tax adjustment e.g: Bad Debt Recover, outstanding invoice > 6 months) 17,000.00 1,020.00 AJP-BD (Input Tax adjustment e.g: Bad Debt Relief) 9,114.57 546.87

GST-03

[GST | Print GST-03...]

- 1. At GST Return screen, you can direct preview the GST-03 by click on the GST-03 button (see the screenshot below).

- 2. GST-03 result from the above sample data:

GST-03 # Description Amount 5a Total Value of Standard Rated Supply 0.00 5b Total Output Tax (Inclusive of Tax Value on Bad Debt Recovered & other Adjustments) 1,020,.00 6a Total Value of Standard Rate and Flat Rate Acquisitions 0.00 6b Total Input Tax (Inclusive of Tax Value on Bad Debt Relief & other Adjustments) 546.87 17 Total Value of Bad Debt Relief Inclusive Tax 9,661.44 18 Total Value of Bad Debt Relief Recovered Inclusive Tax 0.00

Print GST Bad Debt Relief

[GST | Print GST Bad Debt Relief…]

- 2. Let said the IV-00109 has the following details:-

Seq Description Amount Tax Tax Amount Amount with Tax 1 Sales of coconut can drinks 1,000.00 SR 60.00 1,060.00 2 Sales of coconut 1,000.00 ZRL 0.00 1,000.00

- 3. From the below report, it tells you that the bad debt relief claimed and to be recover at Rm30.87 for IV-00109. You can found at the detail that the bad debt relief claimed at Taxable Period 01 Oct 2015 to 31 Oct 2015.

- 4. After the IV-00109 has been full settlement in month Nov 2015, you will found the full tax paid Rm60.00 and to be recover will be shown as 0. You can found at the detail that the bad debt relief recovered at Taxable Period 01 Nov 2015 to 30 Nov 2015.

- 5. There are some option can choose to apply the GST Bad Debt Relief for further checking:

- Sales

Checkbox Explanation Bad Debt Relief Claimed GST bad debt relief that you HAVE TICKED to claim on outstanding invoices when process your GST returns. Bad Debt Relief Not Claim GST bad debt relief that you DO NOT TICKED to claim on outstanding invoices when process your GST returns. Bad Debt Relief Not Happen Outstanding invoices the GST Amount not expired at 6 months GST bad debt relief. Include Zero Outstanding To include the outstanding invoices are zero.

- Purchase

Checkbox Explanation Bad Debt Relief Paid GST bad debt relief have paid on the outstanding supplier invoices when process your GST returns. Bad Debt Relief Not Pay GST bad debt relief not pay yet on the outstanding supplier invoices. It could be due to late receive the supplier invoice. Bad Debt Relief Not Happen Outstanding invoices the GST Amount not expired at 6 months GST bad debt relief. Include Zero Outstanding To include the outstanding invoices are zero.

- 6. Click Preview button. You can found the following report list.

# Report Name Usage 1 GST Bad Debt Relief - Sales GST Bad Debt Relief Listing with detail based on the checkbox ticked. 2 GST-BM Bad Debt Relief-Unclaimed Letter 1 Bahasa Malaysia bad debt relief unclaimed letter format 1 to Director General 3 GST-BM Bad Debt Relief-Unclaimed Letter 2 Bahasa Malaysia bad debt relief unclaimed letter format 2 to Director General 4 GST-EN Bad Debt Relief-Unclaimed Letter 1 English version bad debt relief unclaimed letter format 1 to Director General 5 GST-EN Bad Debt Relief-Unclaimed Letter 2 English version bad debt relief unclaimed letter format 2 to Director General

TIPS 1 : To print the bad debt relief unclaimed letter.

1. Select the Date Parameter as the GST effective date onwards. 2. Tick both Bad Debt Relief Not Claim and Bad Debt Relief Not Happen to apply follow by preview.

3. This letter applicable to customer has maintained GST No in Maintain Customer only.