| (103 intermediate revisions by one other user not shown) | |||

| Line 1: | Line 1: | ||

==Introduction== | ==Introduction== | ||

:''' | :1. MYTTx implementation date : '''01 September 2017'''. | ||

:'''Tourist''' means any person, whether he is a Malaysian national or otherwise, visiting any place in Malaysia for any of the following purposes, namely: | :2. '''TTx''' is a tax charged and levied on a '''tourist''' staying at any '''accommodation premises''' made available by an '''operator''' at the rate fixed by the Minister. It is the duty of the tourist to pay TTx to the operator. | ||

:3. '''Tourist''' means any person, whether he is a Malaysian national or otherwise, visiting any place in Malaysia for any of the following purposes, namely: | |||

::a) pleasure, recreation or holiday; | ::a) pleasure, recreation or holiday; | ||

::b) culture; | ::b) culture; | ||

| Line 13: | Line 15: | ||

::i) any other purpose which is not related to an occupation that is remunerated from the place visited. | ::i) any other purpose which is not related to an occupation that is remunerated from the place visited. | ||

:'''Accommodation premises''' means any building, including hostels, hotels, inns, boardinghouses, rest houses and lodging houses, held out by the proprietor, owner or manager, either wholly or partly, as offering lodging or sleeping accommodation to tourists for hire or any other form of reward, whether or not food or drink is also offered. | :4. '''Accommodation premises''' means any building, including hostels, hotels, inns, boardinghouses, rest houses and lodging houses, held out by the proprietor, owner or manager, either wholly or partly, as offering lodging or sleeping accommodation to tourists for hire or any other form of reward, whether or not food or drink is also offered. | ||

:5. Accommodation premises excludes ‘innovative’ accommodations such as Apache-type hotels, caravan, container, bustel, boat house, tree house, sleeping tube, tents, cruise, and such similar accommodations. [added in the '''GENERAL GUIDE ON TOURISM TAX''' revised on 29 Aug 2017] | |||

:6. '''Rate of tourism tax''' is fixed at a flat rate of '''RM10.00 per room per night'''. | |||

:7. '''Exemption from TTx''' are: | |||

::{| class="wikitable" | |||

|- | |||

! No. !! TTx Exempted List | |||

|- | |||

| 1 || a Malaysian national; or a permanent resident of Malaysia who holds MyPR card. | |||

|- | |||

| 2 || An operator who operates '''homestay''' as determined by the Ministry of Tourism and Culture Malaysia under the Pengalaman Homestay Malaysia Programme and is registered with Ministry of Tourism and Culture Malaysia. | |||

|- | |||

| 3 || An operator who operates '''kampungstay''' determined by the Ministry of Tourism and Culture Malaysia under the Visit My Kampung Kampungstay Programme and is registered with Ministry of Tourism and Culture Malaysia. | |||

|- | |||

| 4 || The Federal Government, State Government, statutory body, local authority or private higher educational institutions registered under Private Higher Educational Institutions Act 1996 [Act 555] operating accommodation premises that provide accommodation to any person for '''educational, training or welfare purposes'''.<br /> | |||

'''Example 25'''<br /> | |||

As an illustration of accommodation premises which are exempted from registration and collecting TTx under item (c) above are as follows:<br /> | |||

(i) Akademi Kastam Diraja Malaysia<br /> | |||

(ii) Lanai Kijang Bank Negara Malaysia<br /> | |||

(iii) Institut Latihan Dewan Bandaraya Kuala Lumpur<br /> | |||

(iv) HELP Residence, HELP University<br /> | |||

(v) Pusat Transit Gelandangan Kuala Lumpur<br /> | |||

|- | |||

| 5 || The employer operating accommodation premises as a facility to their employees. <br /> | |||

'''Example 26''' | |||

As an illustration of accommodation premises which are exempted from registration and collecting TTx under item (d) above are as follows:<br /> | |||

(i) Rumah Peranginan Persekutuan<br /> | |||

(ii) Rumah Rehat Kerajaan Negeri<br /> | |||

(iii) Rumah Peranginan Bank Negara Malaysia<br /> | |||

(iv) Rumah Peranginan Tenaga Nasional Berhad<br /> | |||

|- | |||

| 6 || Religious or welfare body who fully operates accommodation premises for the purpose of religious or welfare activities '''not for commercial purpose''' and registered under the written law and approved by the Minister responsible '''for religious or welfare matters'''. | |||

|- | |||

| 7 || An operator of accommodation premises '''having four or less than four rooms'''. ( <= 4 rooms) | |||

|} | |||

<br /> | |||

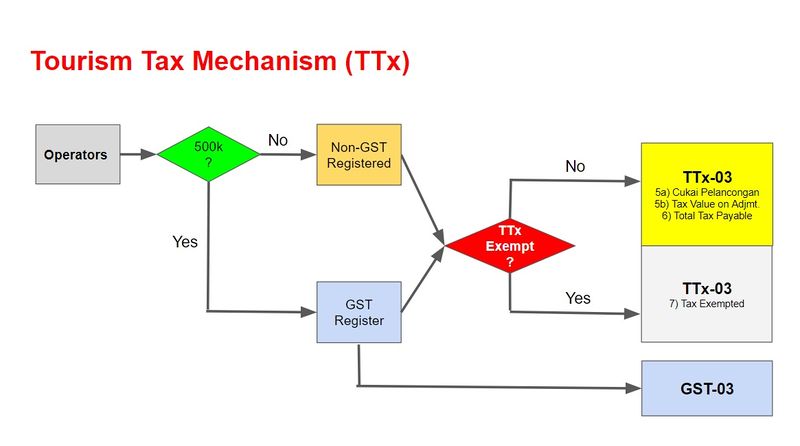

:Therefore, we have designed a database structure specially for business which has provide accommodation to tourists. | :Therefore, we have designed a database structure specially for business which has provide accommodation to tourists. | ||

:[[File:MyTTx-00c.jpg | 800px]] | |||

<br /> | |||

<br /> | |||

:''Source from '''Royal Malaysian Customs Department''' official page'' | |||

::List of Guidance about MYTTx : | |||

::1. [https://www.myttx.customs.gov.my/CTTAX/infopage/APPENDIX%20A%20-%20General%20Guide.pdf General Guide on Tourism Tax [Panduan Am Cukai Pelancongan<nowiki>]</nowiki>]<br /> | |||

::2. [https://www.myttx.customs.gov.my/CTTAX/infopage/APPENDIX%20B%20-%20Panduan%20Pendaftaran%20Cukai%20Pelancongan.pdf Guide on Registration]<br /> | |||

::3. [https://www.myttx.customs.gov.my/CTTAX/infopage/APPENDIX%20C%20-%20Panduan%20Mengisi%20Borang%20TTx-01.pdf Guideline to fill up Form TTx-01 [Panduan Mengisi Borang TTx-01<nowiki>]</nowiki>]<br /> | |||

::4. [https://www.myttx.customs.gov.my/CTTAX/infopage/APPENDIX%20D%20-%20Panduan%20Pengemukaan%20Penyata%20dan%20Pembayaran%20PUBLIC.pdf Guide on Return, Payment and Refund]<br /> | |||

::5. [https://www.myttx.customs.gov.my/CTTAX/infopage/APPENDIX%20E%20-%20Panduan%20Mengisi%20Borang%20TTx-03.pdf Guideline to fill up Form TTx-03 [Panduan Mengisi Borang TTx-03<nowiki>]</nowiki>]<br /> | |||

::6. [https://www.myttx.customs.gov.my/CTTAX/infopage/APPENDIX%20F%20-%20Panduan%20Mengisi%20Borang%20TTx-04.pdf Guideline to fill up Form TTx-04 [Panduan Mengisi Borang TTx-04<nowiki>]</nowiki>]<br /> | |||

<br /> | |||

==Modules Require== | ==Modules Require== | ||

# SQL Accounting | # SQL Accounting (S&P) | ||

# DIY field | # DIY field | ||

# DIY script | # DIY script | ||

<br /> | <br /> | ||

==MyTTx Database== | ==MyTTx Database== | ||

Last Customisation Update : ''' | Last Customisation Update : '''29 Aug 2017''' | ||

:1. MyTTx database consists of: | |||

::a. Compliance of '''Tax Invoice / Invoice''' format follow the MYTTx and GST standard. | |||

::b. '''MYTTx preset setting''' ready. | |||

::c. '''TTx-03''' form. | |||

: | :2. Click on the link below and get the backup file for MYTTx database structure: | ||

: | ::[http://www.sql.com.my/document/MYTTx_TestingCompany-%5bTTx-01Sept2017%5d-2017-09-18-sqlacc.zip MYTTx-Testing Company] | ||

: | :3. Restore this backup.<br /> | ||

:4. Enter the user ID and password with “ADMIN” to login.<br /> | |||

===History New/Updates/Changes=== | ===History New/Updates/Changes=== | ||

| Line 38: | Line 90: | ||

* Not available | * Not available | ||

==MyTTx Settings== | ==MyTTx Basic Settings (Compulsory)== | ||

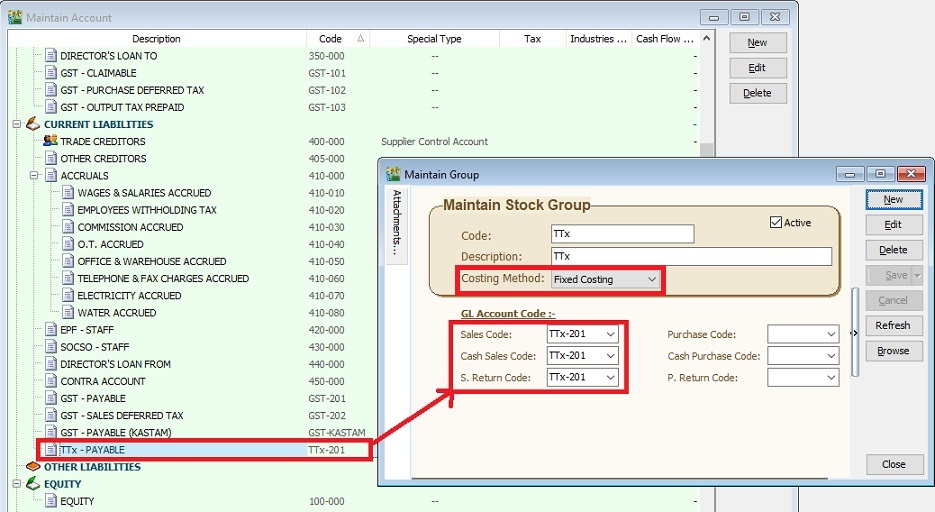

===MyTTx - Maintain Account=== | ===MyTTx - Maintain Account=== | ||

''[GL | Maintain Account...]'' | ''[GL | Maintain Account...]'' | ||

:Under Current Liabilities, create a new GL Accouunt for: | |||

:{| class="wikitable" | :{| class="wikitable" | ||

|- | |- | ||

| Line 48: | Line 101: | ||

|} | |} | ||

<br /> | <br /> | ||

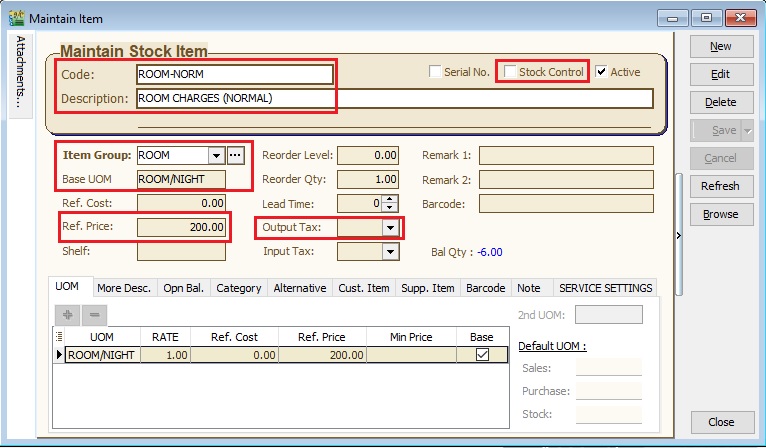

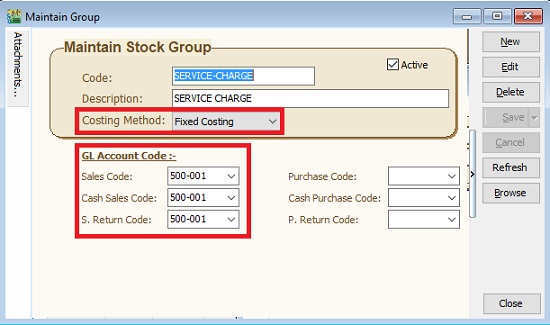

===MyTTx - Maintain Stock Group=== | ===MyTTx - Maintain Stock Group=== | ||

''[Stock | Maintain Stock Group...]'' | ''[Stock | Maintain Stock Group...]'' | ||

:Stock Group setting for TTx: | |||

:{| class="wikitable" | :{| class="wikitable" | ||

|- | |- | ||

| Line 58: | Line 113: | ||

::[[File:MyTTx-01.jpg]] | ::[[File:MyTTx-01.jpg]] | ||

<br /> | <br /> | ||

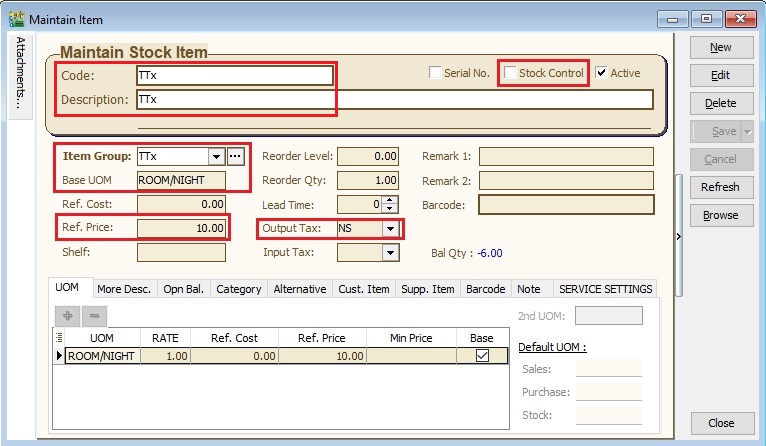

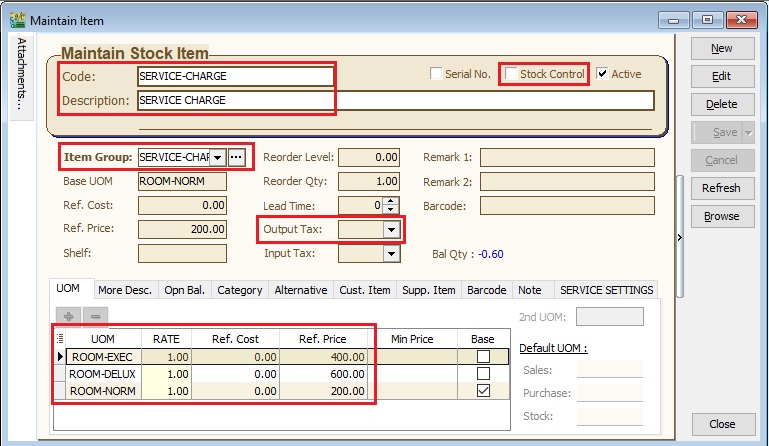

===MyTTx - Maintain Stock Item=== | ===MyTTx - Maintain Stock Item=== | ||

''[Stock | Maintain Stock Item…]'' | ''[Stock | Maintain Stock Item…]'' | ||

:[[File:MyTTx-02a.jpg]] | :[[File:MyTTx-02a.jpg]] | ||

<br /> | <br /> | ||

:MyTTx list settings are: | :MyTTx list settings are '''compulsory''' to follow : | ||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

| Line 72: | Line 128: | ||

|} | |} | ||

'''NOTE:''' | '''NOTE:''' | ||

1. For GST registered person, output tax must set to '''NS'''. | 1. '''For GST registered person''', output tax must set to '''NS'''. | ||

'''NS''' - Matters to be treated as neither a supply of goods nor a supply of services, and no GST chargeable '''(0%)''' | |||

2. For Non-GST registered person, output tax must '''LEAVE IT BLANK'''. | 2. '''For Non-GST registered person''', output tax must '''LEAVE IT BLANK'''. | ||

<br /> | <br /> | ||

| Line 101: | Line 157: | ||

:[[File:MyTTx-04a.jpg]] | :[[File:MyTTx-04a.jpg]] | ||

<br /> | <br /> | ||

:Example of the room list | :1. You can create different room types as different item code. | ||

:2. Example of the room types settings list are: | |||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

| Line 173: | Line 230: | ||

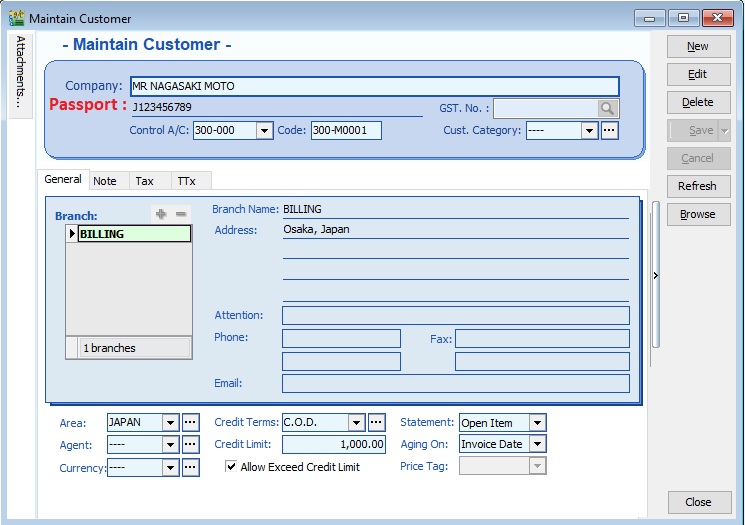

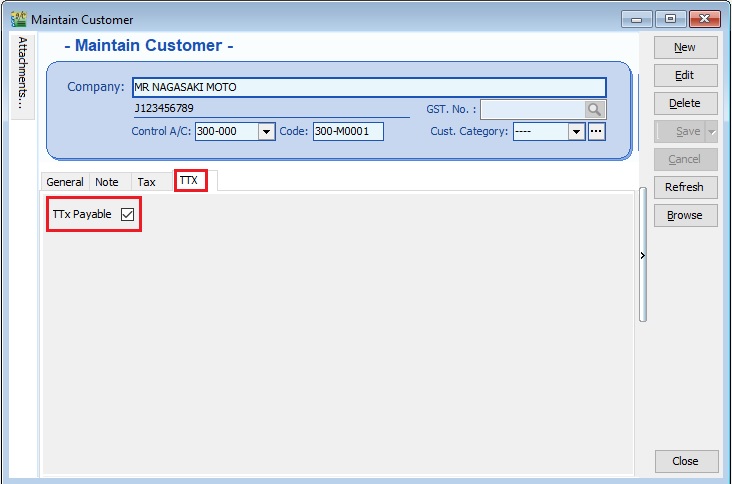

:1. You can maintain all the guest particular details at Maintain Customer. | :1. You can maintain all the guest particular details at Maintain Customer. | ||

:2. Record the '''passport no''' at company name 2. See the screenshot below. | :2. Record the '''passport no''' at company name 2. See the screenshot below. | ||

:[[File:MyTTx- | :[[File:MyTTx-07a.jpg]] | ||

<br /> | |||

:3. Tick on '''TTX Payable''' checkbox if he/she is '''NOT''' a Malaysian national or a permanent resident who holds MyPR card. | |||

:[[File:MyTTx-07c.jpg]] | |||

<br /> | <br /> | ||

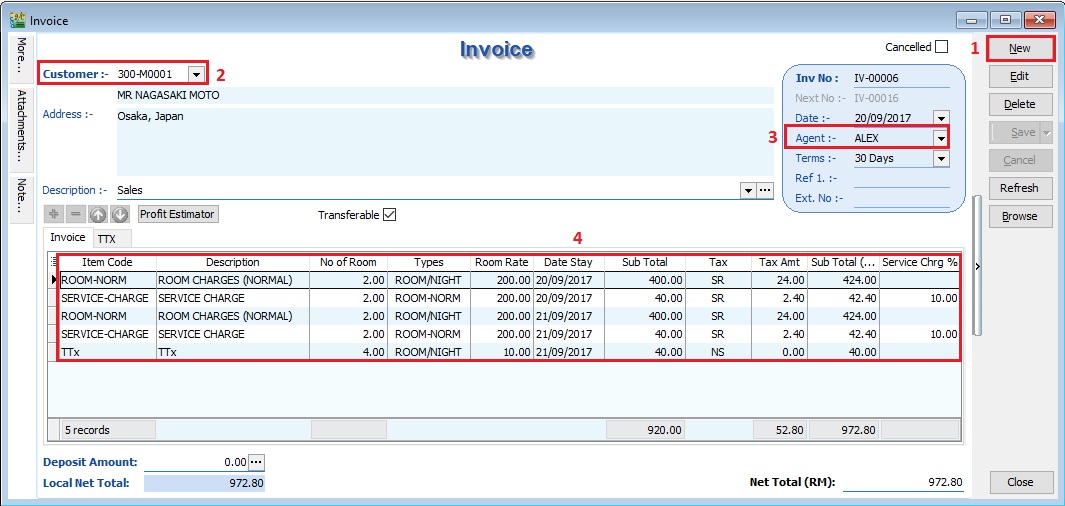

==Record of Tax Invoice / Invoice== | ==Record of Tax Invoice / Invoice== | ||

''[Sales | Invoice...]'' | ''[Sales | Invoice...]'' | ||

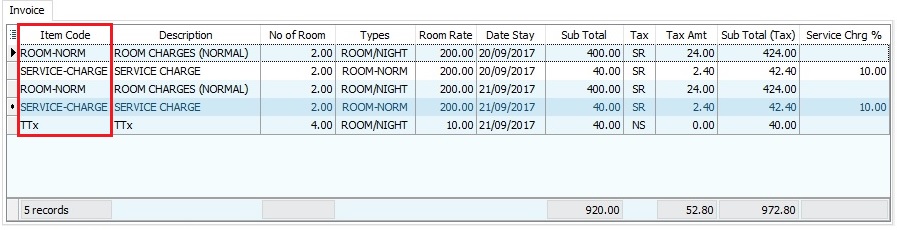

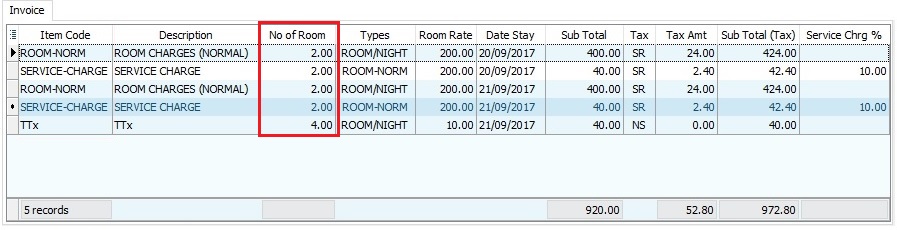

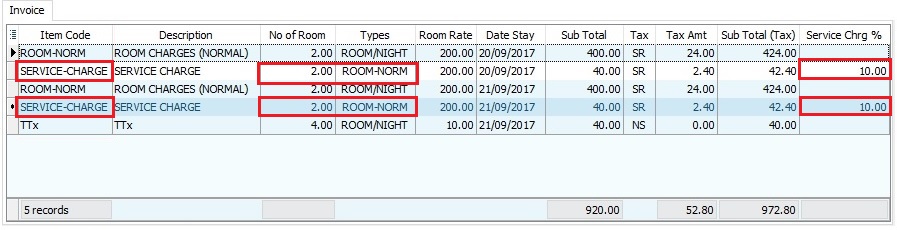

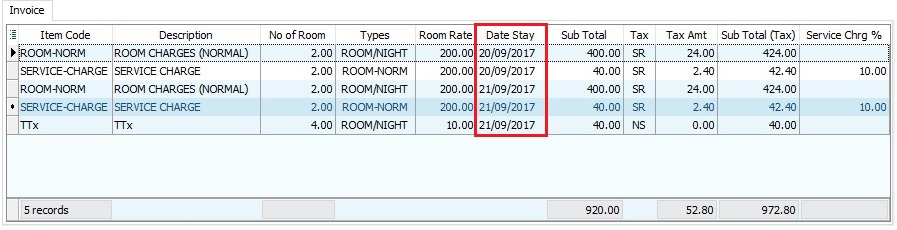

:[[File:MyTTx- | :[[File:MyTTx-08i.jpg]] | ||

:{| class="wikitable" | |||

|- | |||

! No. !! Field Name !! Original Field Name || DIY Field | |||

|- | |||

| 1 || Item Code || Item Code || | |||

|- | |||

| 2 || Description || Description || | |||

|- | |||

| 3 || '''No of Room''' || '''UDF_Room_Qty''' || YES | |||

|- | |||

| 4 || '''Types''' || '''UOM''' || | |||

|- | |||

| 5 || '''Room Rate''' || '''Unit Price''' || | |||

|- | |||

| 6 || '''Date Stay''' || '''Delivery Date''' || | |||

|- | |||

| 7 || Sub Total || Sub Total || | |||

|- | |||

| 8 || Tax || Tax || | |||

|- | |||

| 9 || Tax Amt || Tax Amt || | |||

|- | |||

| 10 || Sub Total(Tax) || Sub Total(Tax) || | |||

|- | |||

| 11 || '''Service Chrg %''' || '''UDF_Service_Rate''' || YES | |||

|} | |||

::1. Click on '''New'''. | ::1. Click on '''New'''. | ||

::2. Select a customer (guest). | ::2. Select a customer (guest). | ||

'''Tips:''' | |||

[[File:MyTTx-08j.jpg]] | |||

a. '''TTx Payable''' checkbox is based from Maintain Customer. | |||

b. You can '''override''' during the invoice entry. | |||

c. For example, the system will auto correct to '''TTx Exempted''' if the '''TTX Payable''' checkbox is unticked. | |||

<br /> | |||

::3. Select an agent (eg. front desk agent). | ::3. Select an agent (eg. front desk agent). | ||

::4. Enter the room, service charges, date stay, TTx at the details parts. | ::4. Enter the room, service charges, date stay, TTx at the details parts. | ||

| Line 190: | Line 284: | ||

:[[File:MyTTx-08c.jpg]] | :[[File:MyTTx-08c.jpg]] | ||

::8. Enter the '''Date Stay'''. | ::8. Enter the '''Date Stay'''. | ||

:[[File:MyTTx- | :[[File:MyTTx-08d.jpg]] | ||

::9.To confirm the Invoice, click on '''Save'''. | ::9.To confirm the Invoice, click on '''Save'''. | ||

::10. You can '''preview/print''' the Tax Invoice or Invoice. | ::10. You can '''preview/print''' the Tax Invoice or Invoice. | ||

<br /> | <br /> | ||

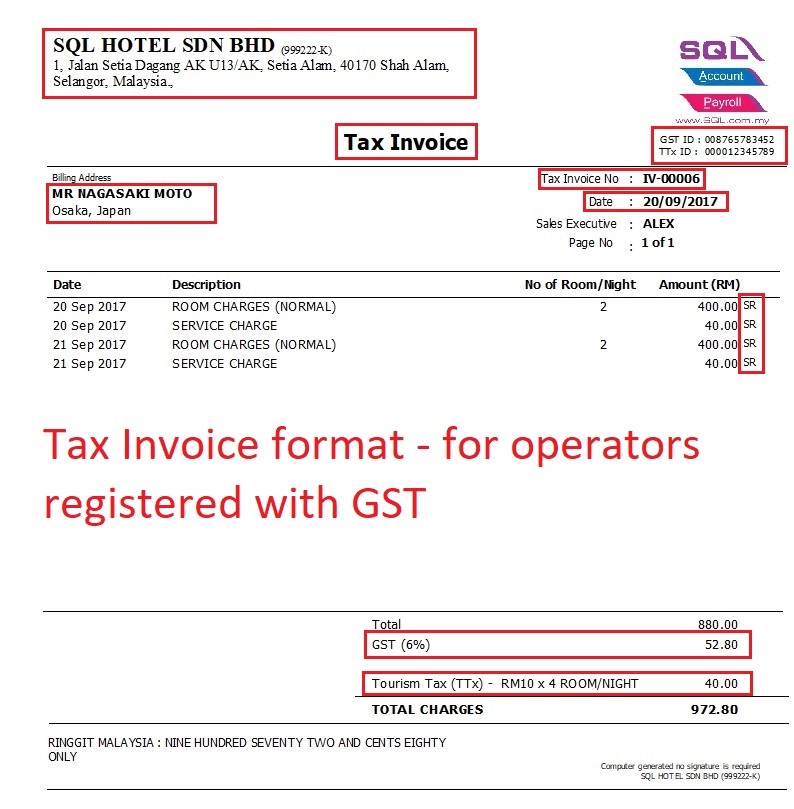

===Sample of '''Tax Invoice''' (For GST Registered Person)=== | ===Sample of '''Full Tax Invoice''' (For GST Registered Person)=== | ||

::[[File:MyTTx-09.jpg]] | ::[[File:MyTTx-09.jpg]] | ||

<br /> | <br /> | ||

:1. Full Tax Invoice requires the following information for operators registered with GST: | |||

::a) the word ‘tax invoice’ in a prominent place; | |||

::b) the tax invoice serial number; | |||

::c) the date of issuance of the tax invoice; | |||

::d) the name, address and identification number of the supplier; | |||

::e) the name and address of the person to whom the goods or services are supplied; | |||

::f) a description sufficient to identify the goods or services supplied; | |||

::g) for each description, distinguish the type of supply for zero rate, standard rate and exempt, the quantity of the goods or the extent of the services supplied and the amount payable, excluding tax; | |||

::h) any discount offered; | |||

::i) the total amount payable excluding tax, the rate of tax and the total tax chargeable to be shown separately; | |||

:2. The '''additional details''' required in the tax invoices are as follows: | |||

::a) the Tourism Tax Identification Number of the operator; and | |||

::b) the rate and amount of TTx payable, separately from the charges for the accommodation provided by the operator. | |||

<br /> | |||

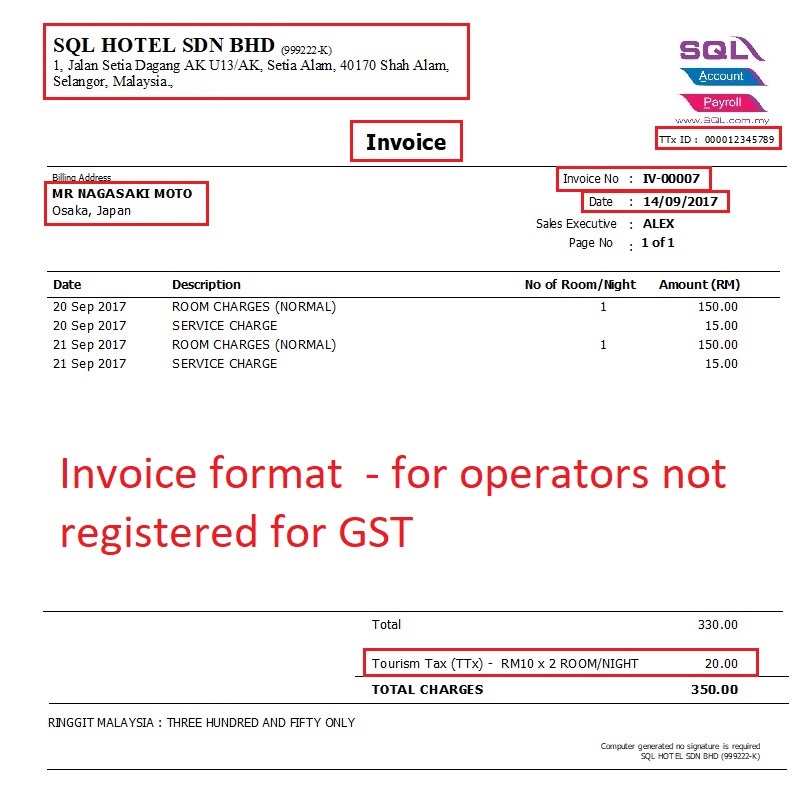

===Sample of '''Invoice''' (For Non-GST Registered Person)=== | ===Sample of '''Invoice''' (For Non-GST Registered Person)=== | ||

::[[File:MyTTx-10.jpg]] | ::[[File:MyTTx-10.jpg]] | ||

| Line 209: | Line 318: | ||

==Adjustment Using Debit/Credit Note== | ==Adjustment Using Debit/Credit Note== | ||

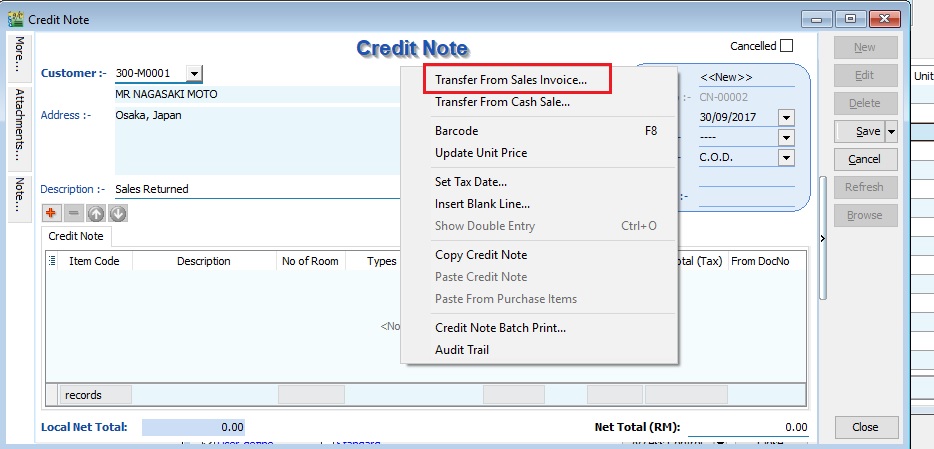

===Credit Note=== | |||

''[Sales | Credit Note...]'' | ''[Sales | Credit Note...]'' | ||

:1. Click on '''New'''. | |||

:2. Select a customer (guest). | |||

:3. Right click on the '''Credit Note''' title. See the screenshot below. | |||

::[[File:MyTTx-11a.jpg]] | |||

<br /> | |||

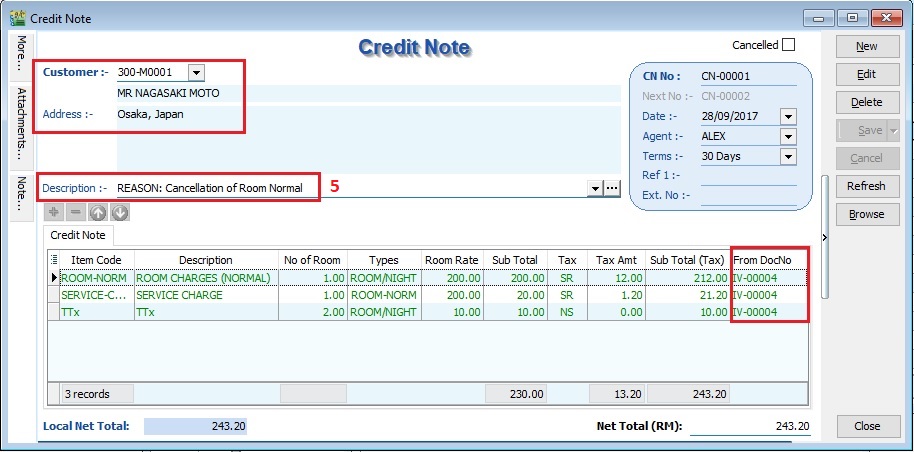

:4. Select the tax invoice/invoice to transfer for CN adjustment. | |||

:5. State the reason at the document description. See the screenshot below. | |||

::[[File:MyTTx-11b.jpg]] | |||

<br /> | |||

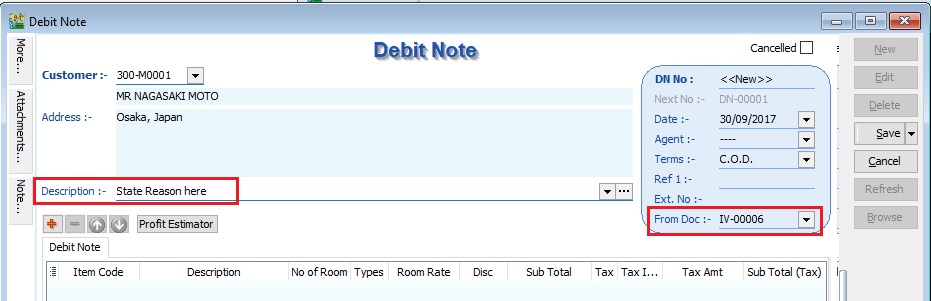

===Debit Note=== | |||

''[Sales | Debit Note...]'' | |||

:1. Click on '''New'''. | |||

:2. Select a customer (guest). | |||

:3. Select a Tax Invoice/Invoice at '''From Doc'''. See the screenshot below. | |||

::[[File:MyTTx-11c.jpg]] | |||

<br /> | |||

:4. State the reason at the document description. | |||

==Print TTX-03 form== | ==Print TTX-03 form== | ||

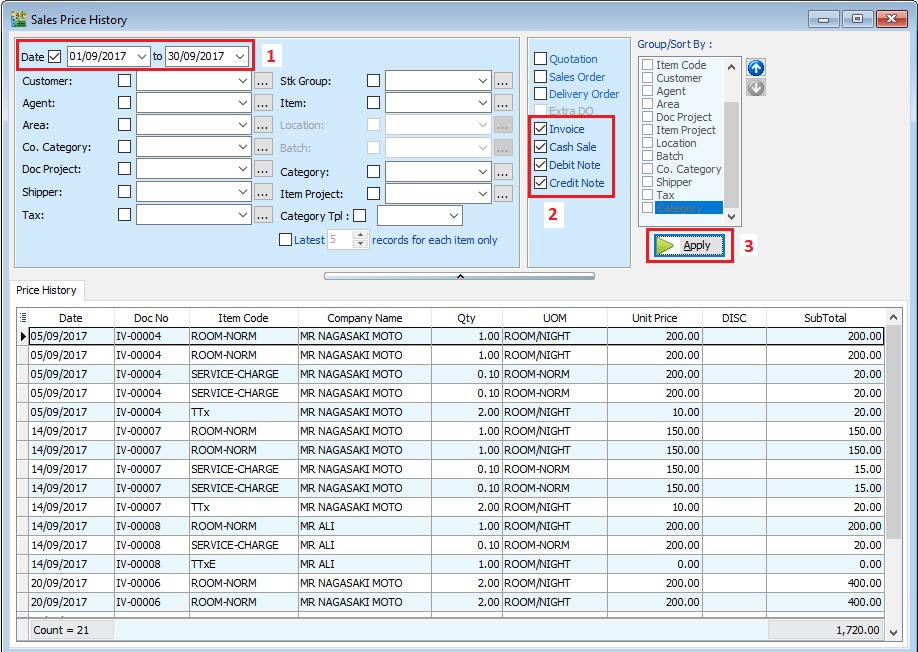

''[Sales | Print Sales Price History...]'' | ''[Sales | Print Sales Price History...]'' | ||

::[[File:MyTTx-12.jpg]] | |||

<br /> | |||

:1. Select the '''date range''' ('''Taxable Period'''). | |||

:2. Tick the following document types. | |||

:* Invoice | |||

:* Cash Sale | |||

:* Debit Note (adjustment) | |||

:* Credit Note (adjustment) | |||

:3. Click '''Apply'''. | |||

:4. Preview / print the '''TTx-03''' form. | |||

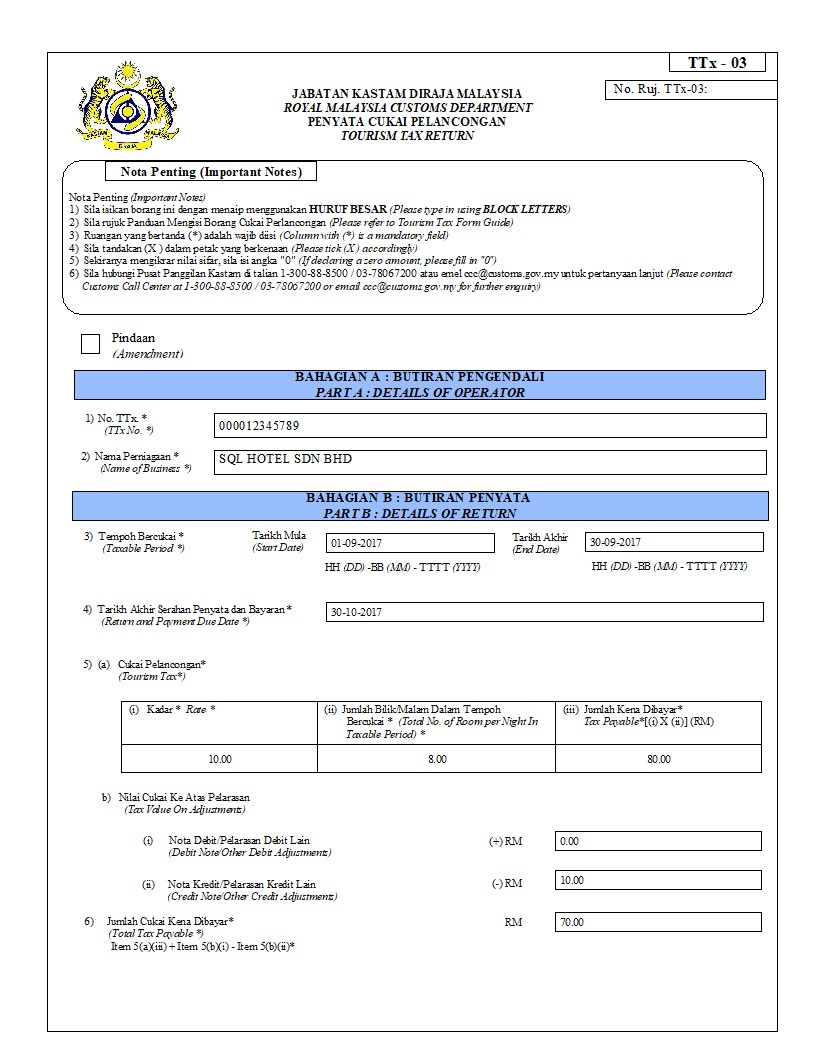

===Sample of TTx-03 generated from SQL Account=== | |||

:'''Page 1''' | |||

::[[File:TTx-03.1.jpg]] | |||

<br /> | |||

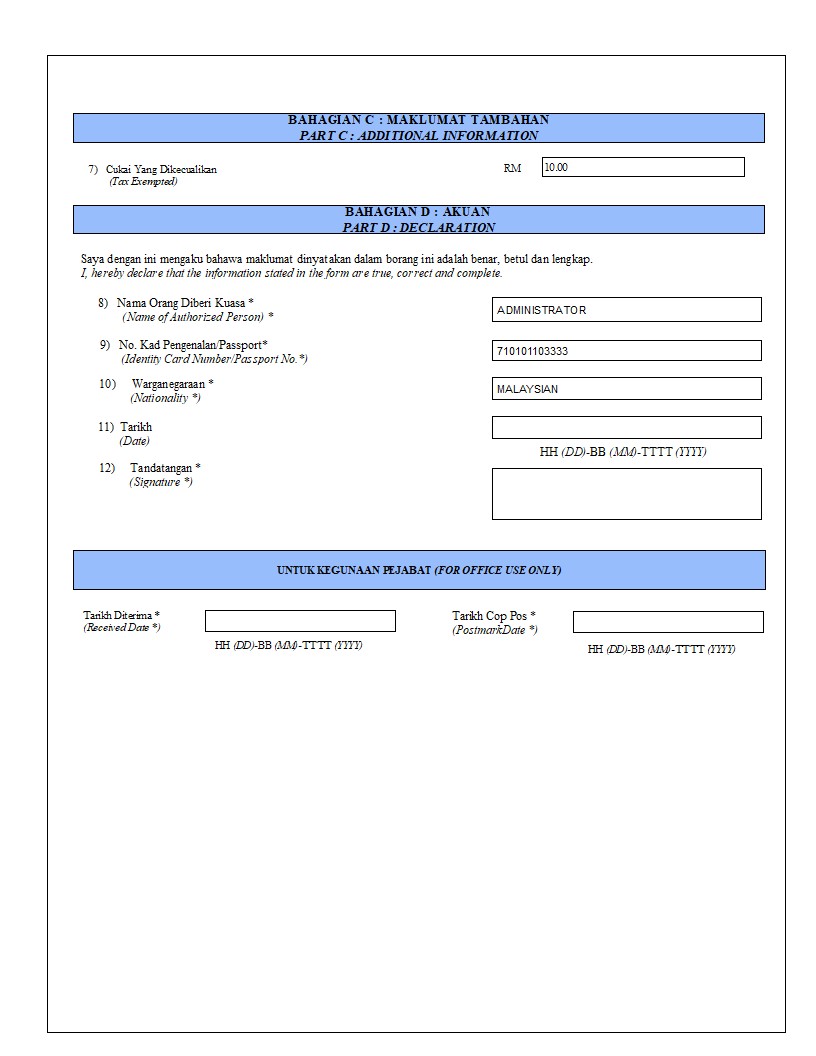

:'''Page 2''' | |||

::[[File:TTx-03.2.jpg]] | |||

<br /> | |||

===TTx-03 Part A - Detail of Operator=== | |||

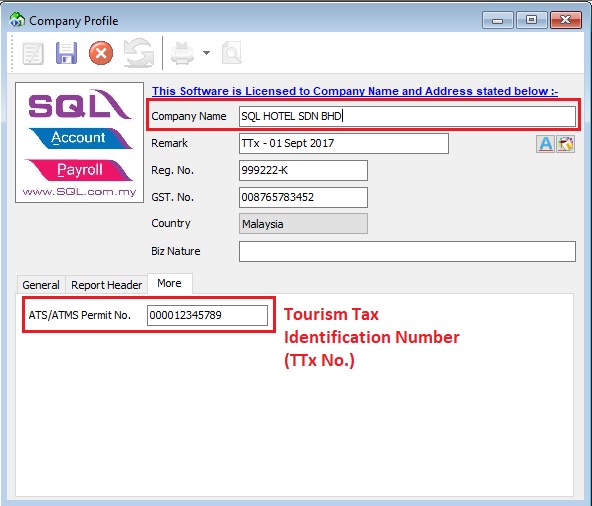

''[File | Company Profile...]'' | |||

:1. Click Edit the Company Profile. | |||

:2. Click to the '''More''' tab. | |||

:3. Enter the '''Tourism Tax Identification number''' in ATS/ATMS Permit No. | |||

::[[File:MyTTx-14.jpg]] | |||

<br /> | |||

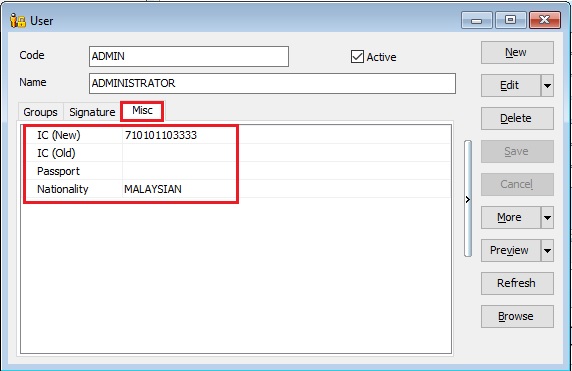

===TTx-03 Part D - Declaration Part=== | |||

''[User | Maintain User...]'' | |||

:Under '''Misc''' tab, you can update the following info as required in TTx-03 form. | |||

:* IC (New) | |||

:* IC (Old) | |||

:* Passport | |||

:* Nationality | |||

::[[File:MyTTx-13.jpg]] | |||

<br /> | |||

Latest revision as of 04:24, 8 October 2018

Introduction

- 1. MYTTx implementation date : 01 September 2017.

- 2. TTx is a tax charged and levied on a tourist staying at any accommodation premises made available by an operator at the rate fixed by the Minister. It is the duty of the tourist to pay TTx to the operator.

- 3. Tourist means any person, whether he is a Malaysian national or otherwise, visiting any place in Malaysia for any of the following purposes, namely:

- a) pleasure, recreation or holiday;

- b) culture;

- c) religion;

- d) visiting friends or relatives;

- e) sports;

- f) business;

- g) meetings, conferences, seminars or conventions;

- h) studies or research;

- i) any other purpose which is not related to an occupation that is remunerated from the place visited.

- 4. Accommodation premises means any building, including hostels, hotels, inns, boardinghouses, rest houses and lodging houses, held out by the proprietor, owner or manager, either wholly or partly, as offering lodging or sleeping accommodation to tourists for hire or any other form of reward, whether or not food or drink is also offered.

- 5. Accommodation premises excludes ‘innovative’ accommodations such as Apache-type hotels, caravan, container, bustel, boat house, tree house, sleeping tube, tents, cruise, and such similar accommodations. [added in the GENERAL GUIDE ON TOURISM TAX revised on 29 Aug 2017]

- 6. Rate of tourism tax is fixed at a flat rate of RM10.00 per room per night.

- 7. Exemption from TTx are:

No. TTx Exempted List 1 a Malaysian national; or a permanent resident of Malaysia who holds MyPR card. 2 An operator who operates homestay as determined by the Ministry of Tourism and Culture Malaysia under the Pengalaman Homestay Malaysia Programme and is registered with Ministry of Tourism and Culture Malaysia. 3 An operator who operates kampungstay determined by the Ministry of Tourism and Culture Malaysia under the Visit My Kampung Kampungstay Programme and is registered with Ministry of Tourism and Culture Malaysia. 4 The Federal Government, State Government, statutory body, local authority or private higher educational institutions registered under Private Higher Educational Institutions Act 1996 [Act 555] operating accommodation premises that provide accommodation to any person for educational, training or welfare purposes.

Example 25

As an illustration of accommodation premises which are exempted from registration and collecting TTx under item (c) above are as follows:

(i) Akademi Kastam Diraja Malaysia

(ii) Lanai Kijang Bank Negara Malaysia

(iii) Institut Latihan Dewan Bandaraya Kuala Lumpur

(iv) HELP Residence, HELP University

(v) Pusat Transit Gelandangan Kuala Lumpur

5 The employer operating accommodation premises as a facility to their employees.

Example 26 As an illustration of accommodation premises which are exempted from registration and collecting TTx under item (d) above are as follows:

(i) Rumah Peranginan Persekutuan

(ii) Rumah Rehat Kerajaan Negeri

(iii) Rumah Peranginan Bank Negara Malaysia

(iv) Rumah Peranginan Tenaga Nasional Berhad

6 Religious or welfare body who fully operates accommodation premises for the purpose of religious or welfare activities not for commercial purpose and registered under the written law and approved by the Minister responsible for religious or welfare matters. 7 An operator of accommodation premises having four or less than four rooms. ( <= 4 rooms)

- Therefore, we have designed a database structure specially for business which has provide accommodation to tourists.

- Source from Royal Malaysian Customs Department official page

- List of Guidance about MYTTx :

- 1. General Guide on Tourism Tax [Panduan Am Cukai Pelancongan]

- 2. Guide on Registration

- 3. Guideline to fill up Form TTx-01 [Panduan Mengisi Borang TTx-01]

- 4. Guide on Return, Payment and Refund

- 5. Guideline to fill up Form TTx-03 [Panduan Mengisi Borang TTx-03]

- 6. Guideline to fill up Form TTx-04 [Panduan Mengisi Borang TTx-04]

Modules Require

- SQL Accounting (S&P)

- DIY field

- DIY script

MyTTx Database

Last Customisation Update : 29 Aug 2017

- 1. MyTTx database consists of:

- a. Compliance of Tax Invoice / Invoice format follow the MYTTx and GST standard.

- b. MYTTx preset setting ready.

- c. TTx-03 form.

- 2. Click on the link below and get the backup file for MYTTx database structure:

- 3. Restore this backup.

- 4. Enter the user ID and password with “ADMIN” to login.

History New/Updates/Changes

Last Customisation Update :

- Not available

MyTTx Basic Settings (Compulsory)

MyTTx - Maintain Account

[GL | Maintain Account...]

- Under Current Liabilities, create a new GL Accouunt for:

GL Account Description TTx-201 TTx - Payable

MyTTx - Maintain Stock Group

[Stock | Maintain Stock Group...]

- Stock Group setting for TTx:

Stock Group Description Costing Method Sales Code Cash Sales Code S.Return Code TTx TTx Fixed Costing TTx-201 TTx-201 TTx-201

MyTTx - Maintain Stock Item

[Stock | Maintain Stock Item…]

- MyTTx list settings are compulsory to follow :

No. Code Description Item Group Base UOM Ref.Price Output Tax Stock Control 1. TTx TTx TTx ROOM/NIGHT 10.00 NS Untick 2. TTxE TTx Exempted TTx ROOM/NIGHT 0.00 NS Untick

NOTE:

1. For GST registered person, output tax must set to NS.

NS - Matters to be treated as neither a supply of goods nor a supply of services, and no GST chargeable (0%)

2. For Non-GST registered person, output tax must LEAVE IT BLANK.

Room Settings

Room - Maintain Account

[GL | Maintain Account...]

GL Account Description 500-000 SALES

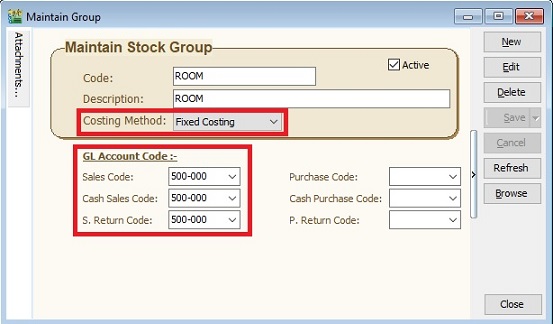

Room - Maintain Stock Group

[Stock | Maintain Stock Group...]

Stock Group Description Costing Method Sales Code Cash Sales Code S.Return Code ROOM ROOM Fixed Costing 500-000 500-000 500-000

Room - Maintain Stock Item

[Stock | Maintain Stock Item…]

- 1. You can create different room types as different item code.

- 2. Example of the room types settings list are:

No. Code Description Item Group Base UOM Ref.Price Output Tax Stock Control 1. ROOM-NORM NORMAL-ROOM CHARGES ROOM ROOM/NIGHT 200.00 Untick 2. ROOM-EXEC EXECUTIVE-ROOM CHARGES ROOM ROOM/NIGHT 400.00 Untick 3. ROOM-DELUX DELUXE-ROOM CHARGES ROOM ROOM/NIGHT 600.00 Untick

NOTE: For GST or Non-GST registered person, output tax always LEAVE IT BLANK.

Service Charge Settings

Service Charge - Maintain Account

[GL | Maintain Account...]

GL Account Description 500-001 SERVICE CHARGES

Service Charge - Maintain Stock Group

[Stock | Maintain Stock Group...]

Stock Group Description Costing Method Sales Code Cash Sales Code S.Return Code SERVICE-CHARGE SERVICE CHARGE Fixed Costing 500-001 500-001 500-001

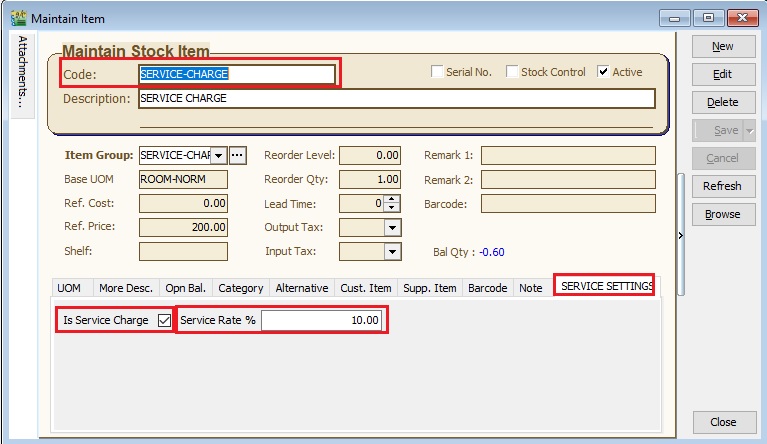

Service Charge - Maintain Stock Item

[Stock | Maintain Stock Item…]

- 1. Example of the Service Charge setting:

No. Code Description Item Group Output Tax Stock Control 1. SERVICE-CHARGE Service Charge SERVICE-CHARGE Untick

- 2. UOM Tab can be use to preset the types of room rate.

No. UOM RATE Ref.Price 1. ROOM-NORM 1.00 200.00 2. ROOM-EXEC 1.00 400.00 3. ROOM-DELUX 1.00 600.00

- 3. SERVICE SETTINGS

NOTE: For GST or Non-GST registered person, output tax always LEAVE IT BLANK.

New Guest Details

[Customer | Maintain Customer...]

- 1. You can maintain all the guest particular details at Maintain Customer.

- 2. Record the passport no at company name 2. See the screenshot below.

- 3. Tick on TTX Payable checkbox if he/she is NOT a Malaysian national or a permanent resident who holds MyPR card.

Record of Tax Invoice / Invoice

[Sales | Invoice...]

No. Field Name Original Field Name DIY Field 1 Item Code Item Code 2 Description Description 3 No of Room UDF_Room_Qty YES 4 Types UOM 5 Room Rate Unit Price 6 Date Stay Delivery Date 7 Sub Total Sub Total 8 Tax Tax 9 Tax Amt Tax Amt 10 Sub Total(Tax) Sub Total(Tax) 11 Service Chrg % UDF_Service_Rate YES

- 1. Click on New.

- 2. Select a customer (guest).

Tips:a. TTx Payable checkbox is based from Maintain Customer. b. You can override during the invoice entry. c. For example, the system will auto correct to TTx Exempted if the TTX Payable checkbox is unticked.

- 3. Select an agent (eg. front desk agent).

- 4. Enter the room, service charges, date stay, TTx at the details parts.

- 5. Select the room, service charges and TTx at Item Code column.

- 6. Enter the number of rooms to be stay at No of Room column.

- 7. For service charges, select the types of the room (eg. room normal or executive) to calculate the service charge % on the room type rate.

- 8. Enter the Date Stay.

- 9.To confirm the Invoice, click on Save.

- 10. You can preview/print the Tax Invoice or Invoice.

Sample of Full Tax Invoice (For GST Registered Person)

- 1. Full Tax Invoice requires the following information for operators registered with GST:

- a) the word ‘tax invoice’ in a prominent place;

- b) the tax invoice serial number;

- c) the date of issuance of the tax invoice;

- d) the name, address and identification number of the supplier;

- e) the name and address of the person to whom the goods or services are supplied;

- f) a description sufficient to identify the goods or services supplied;

- g) for each description, distinguish the type of supply for zero rate, standard rate and exempt, the quantity of the goods or the extent of the services supplied and the amount payable, excluding tax;

- h) any discount offered;

- i) the total amount payable excluding tax, the rate of tax and the total tax chargeable to be shown separately;

- 2. The additional details required in the tax invoices are as follows:

- a) the Tourism Tax Identification Number of the operator; and

- b) the rate and amount of TTx payable, separately from the charges for the accommodation provided by the operator.

Sample of Invoice (For Non-GST Registered Person)

- For operators not registered for GST, details to be include in the invoice, receipt or other document to the tourist are as follows:

- a) the invoice serial number;

- b) the date of the invoice;

- c) the name, address and the Tourism Tax Identification Number of the operator;

- d) the name and address of the person to whom the accommodation premises are provided; and

- e) the rate and amount of TTx payable, separately from the charges for the accommodation provided by the operator.

Adjustment Using Debit/Credit Note

Credit Note

[Sales | Credit Note...]

- 1. Click on New.

- 2. Select a customer (guest).

- 3. Right click on the Credit Note title. See the screenshot below.

- 4. Select the tax invoice/invoice to transfer for CN adjustment.

- 5. State the reason at the document description. See the screenshot below.

Debit Note

[Sales | Debit Note...]

- 1. Click on New.

- 2. Select a customer (guest).

- 3. Select a Tax Invoice/Invoice at From Doc. See the screenshot below.

- 4. State the reason at the document description.

Print TTX-03 form

[Sales | Print Sales Price History...]

- 1. Select the date range (Taxable Period).

- 2. Tick the following document types.

- Invoice

- Cash Sale

- Debit Note (adjustment)

- Credit Note (adjustment)

- 3. Click Apply.

- 4. Preview / print the TTx-03 form.

Sample of TTx-03 generated from SQL Account

TTx-03 Part A - Detail of Operator

[File | Company Profile...]

- 1. Click Edit the Company Profile.

- 2. Click to the More tab.

- 3. Enter the Tourism Tax Identification number in ATS/ATMS Permit No.

TTx-03 Part D - Declaration Part

[User | Maintain User...]

- Under Misc tab, you can update the following info as required in TTx-03 form.

- IC (New)

- IC (Old)

- Passport

- Nationality