(→Tax) |

(→Tax) |

||

| Line 190: | Line 190: | ||

'''Tariff Code Setting'''<br /> | '''Tariff Code Setting'''<br /> | ||

This setting to customer who has the exemption certificate approved under '''Sales Tax (Person Exempted from Payment of Tax) Order 2018'''. | This setting apply to customer who has the exemption certificate approved under '''Sales Tax (Person Exempted from Payment of Tax) Order 2018'''. | ||

{| class="wikitable" | {| class="wikitable" | ||

|- | |- | ||

| Line 196: | Line 196: | ||

|- | |- | ||

| Tariff || | | Tariff || | ||

* | * Add tariff code of goods to be sold | ||

* Lookup: [[Maintain Tariff]] | * Lookup: [[Maintain Tariff]] | ||

|- | |- | ||

| Tax || | | Tax || | ||

* | * Select an appropriate tax code falls under Schedule A, B, and C. | ||

* '''Schedule A''' tax code : '''SEA''' | |||

* '''Schedule B''' tax code : '''SEB''' | |||

* '''Schedule C''' tax code : '''SEC1, SEC2, SEC3, SEC4, SEC5''' | |||

* Lookup: [[Maintain Tax]] | * Lookup: [[Maintain Tax]] | ||

|} | |} | ||

Revision as of 10:15, 13 September 2018

Menu: Customer | Maintain Customer...

Introduction

- To keep the customer profile data such as addresses, telephone, fax, email, contact person, credit limits, credit terms, etc. In other words, it is your customer contacts list.

New Customer

- To create NEW customer, CLICK on NEW button. See screenshot below.

- You will get a blank form to be fill-in with the customer data.

- You may start input the following fields:

| Field Name | Explanation & Properties |

|---|---|

| Company |

|

| Description 2 (UNDERLINE below Company) |

|

| Control A/c |

|

| Code |

|

| Cust Category |

|

General

| Field Name | Explanation & Properties |

|---|---|

| Branch Name |

|

| Address (4 lines) |

|

| Attention |

|

| Phone 1 & 2 |

|

| Fax 1 & 2 |

|

| |

| Area |

|

| Agent |

|

| Currency |

|

| Credit Terms |

|

| Credit Limit |

|

| Statement |

|

| Aging On |

|

| Price Tag |

|

Note

| Field Name | Explanation & Properties |

|---|---|

| Account Open Date |

|

| Remark |

|

| Biz Nature |

|

| Note |

|

| Status |

|

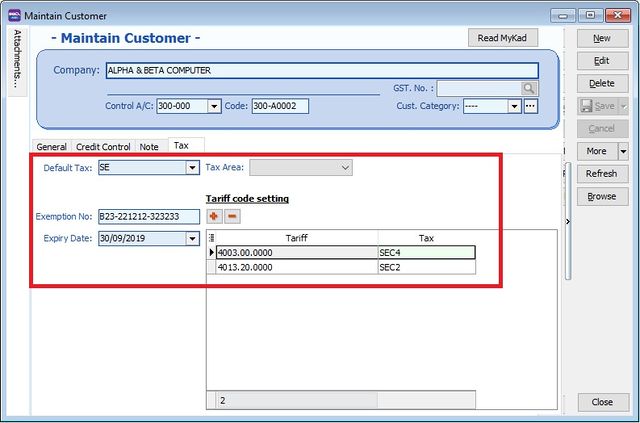

Tax

| Field Name | Explanation & Properties |

|---|---|

| Default Tax |

|

| Tax Area |

|

| Exemption No |

|

| Expiry Date |

|

Tariff Code Setting

This setting apply to customer who has the exemption certificate approved under Sales Tax (Person Exempted from Payment of Tax) Order 2018.

| Field Name | Explanation & Properties |

|---|---|

| Tariff |

|

| Tax |

|

Edit Customer

- You can EDIT the customer, CLICK on EDIT button. See screenshot below.

NOTE : 1. User able to EDIT the customer data depends on the user access rights granted. 2. Any EDITING the system will be audited (logged) with changes made.

Save Customer

- You have to SAVE the customer data before can be used. See screenshot below.

Delete Customer

- You can DELETE the unwanted customer data. See screenshot below.

NOTE : 1. User able to DELETE the customer data depends on the user access rights granted.

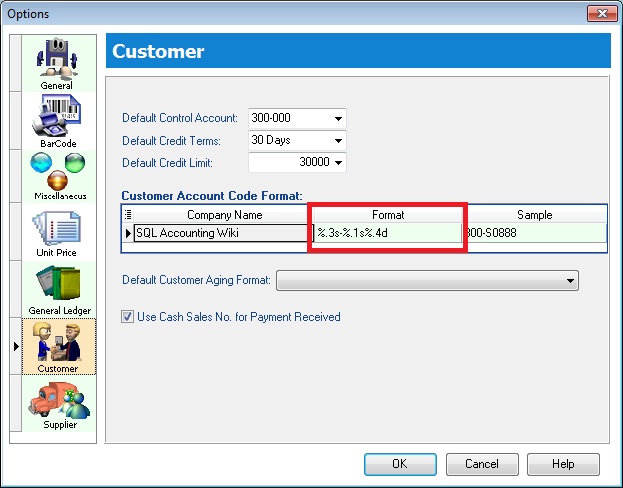

Customer Code Format

- Customer code can be AUTO generate or overwrite it manually. See screenshot below.

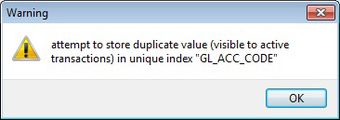

IMPORTANT : 1. Every customer code is unique. 2. If the system found there is an duplicate code trying to save, users will be notify by warning message. See screenshot below.

- You can set the customer code format via Tools | Options...(Customer). See screenshot below.

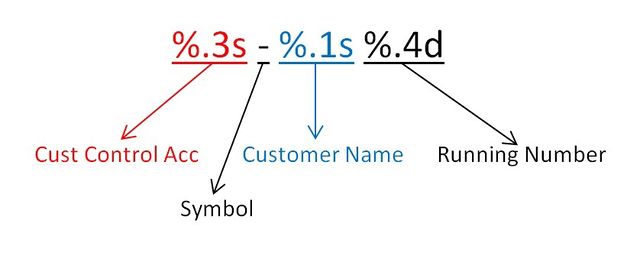

- Explanation of the Customer Code Format:

- For example,

| Company Name | Customer Control Acc | Format | Result |

|---|---|---|---|

| ABCD SDN BHD |

301-000 |

%.1s-%.1s%.1d |

3-A-1 |

| ABCD SDN BHD |

301-000 |

%.2s-%.2s%.2d |

30-AB-01 |

| ABCD SDN BHD |

301-000 |

%.3s-%.3s%.3d |

301-ABC-001 |

| ABCD SDN BHD |

301-000 |

%.4s-%.4s%.4d |

301--ABCD-0001 |

Credit Control

- Credit Control use to control the customer outstanding within the specific overdue and credit limit given. See screenshot below.

IMPORTANT : 1. Depends on the user access rights to the Customer Credit Control. 2. Override credit limit can be granted in the user access control.

Credit/Overdue Limit

- Credit limit is the limit to set based on the total outstanding.

- Overdue limit is the limit to set based on the overdue outstanding only.

- Tick "Add PD Cheque to Credit Limit" to include any post dated payment to increase the credit limit.

Exceed Credit/Overdue Limit

- Credit Control can be apply to the following document type :-

1. QT - Quotation 2. SO - Sales Order 3. DO - Delivery Order 4. IV - Sales Invoice 5. CS - Cash Sales 6. DN - Debit Note

- You have tick "Apply To" in order to set the further action (eg. unblock, block or override) to control the exceed credit and overdue limit. See screenshot below.

| Control Type | Action | ALLOW EXCEED |

|---|---|---|

| Exceed Credit Limit | Unblock | YES |

| Exceed Credit Limit | Block | NO |

| Exceed Credit Limit | Override | PASSWORD REQUIRED |

| Exceed Overdue Limit | Unblock | YES |

| Exceed Overdue Limit | Block | NO |

| Exceed Overdue Limit | Override | PASSWORD REQUIRED |

Suspended

- You have tick "Apply To" any document type in order to tick the SUSPENDED.

- At the same times, you can input the suspended message to prompt to the user when they try to save the documents. See screenshot below.