| Line 147: | Line 147: | ||

| 1. || '''SERVICE-CHARGE''' || Service Charge || SERVICE-CHARGE || || Untick | | 1. || '''SERVICE-CHARGE''' || Service Charge || SERVICE-CHARGE || || Untick | ||

|} | |} | ||

::'''UOM Tab''' | ::'''UOM Tab - use to preset the types of room rate.''' | ||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

Revision as of 04:37, 14 August 2017

Introduction

- TTx is a tax charged and levied on a tourist staying at any accommodation premises made available by an operator at the rate fixed by the Minister. It is the duty of the tourist to pay TTx to the operator.

- Tourist means any person, whether he is a Malaysian national or otherwise, visiting any place in Malaysia for any of the following purposes, namely:

- a) pleasure, recreation or holiday;

- b) culture;

- c) religion;

- d) visiting friends or relatives;

- e) sports;

- f) business;

- g) meetings, conferences, seminars or conventions;

- h) studies or research;

- i) any other purpose which is not related to an occupation that is remunerated from the place visited.

- Accommodation premises means any building, including hostels, hotels, inns, boardinghouses, rest houses and lodging houses, held out by the proprietor, owner or manager, either wholly or partly, as offering lodging or sleeping accommodation to tourists for hire or any other form of reward, whether or not food or drink is also offered.

- Therefore, we have designed a database structure specially for business which has provide accommodation to tourists.

Modules Require

- SQL Accounting Basic

- DIY field

- DIY script

- See below the overview of MyTTx process flow:

MyTTx Database

Last Customisation Update : 14 Aug 2017

- 1. Get the NEW database structure for MyTTx (in backup format) from this link

- 2. Restore this backup.

- 3. Enter the user ID and password with “ADMIN” to login.

History New/Updates/Changes

Last Customisation Update :

- Not available

Understanding MyTTx Settings

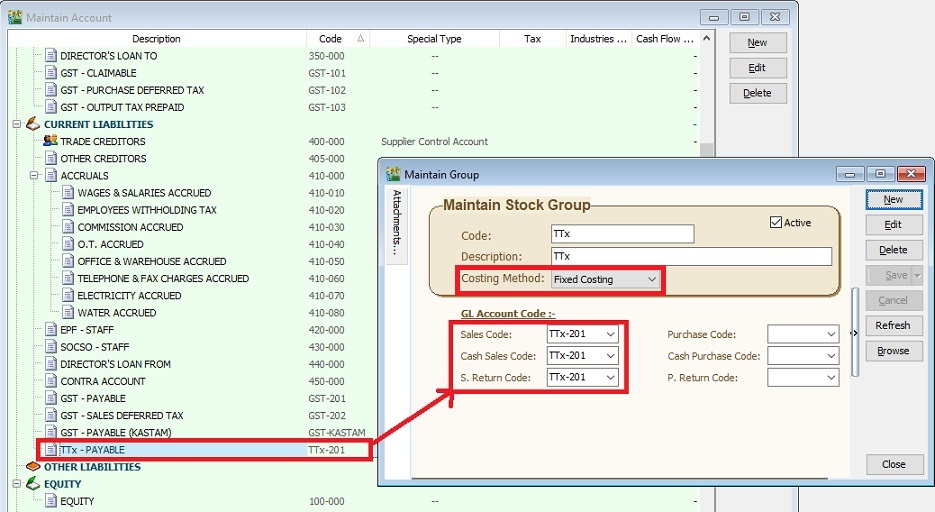

MyTTx - Maintain Account

[GL | Maintain Account...]

GL Account Description TTx-201 TTx - Payable

MyTTx - Maintain Stock Group

[Stock | Maintain Stock Group...]

Stock Group Description Costing Method Sales Code Cash Sales Code S.Return Code TTx TTx Fixed Costing TTx-201 TTx-201 TTx-201

MyTTx - Maintain Stock Item

[Stock | Maintain Stock Item…]

- MyTTx list settings are:

No. Code Description Item Group Base UOM Ref.Price Output Tax Stock Control 1. TTx TTx TTx ROOM/NIGHT 10.00 NS Untick 2. TTxE TTx Exempted TTx ROOM/NIGHT 0.00 NS Untick

NOTE: 1. For GST registered person, output tax must set to NS. NS - Matters to be treated as neither a supply of goods nor a supply of services, and no GST chargeable (0%) 2. For Non-GST registered person, output tax must LEAVE IT BLANK.

Understanding Room Settings

Room - Maintain Account

[GL | Maintain Account...]

GL Account Description 500-000 SALES

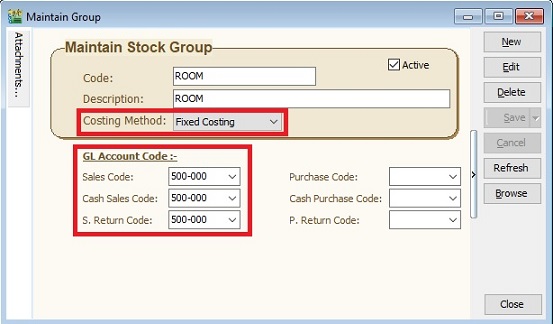

Room - Maintain Stock Group

[Stock | Maintain Stock Group...]

Stock Group Description Costing Method Sales Code Cash Sales Code S.Return Code ROOM ROOM Fixed Costing 500-000 500-000 500-000

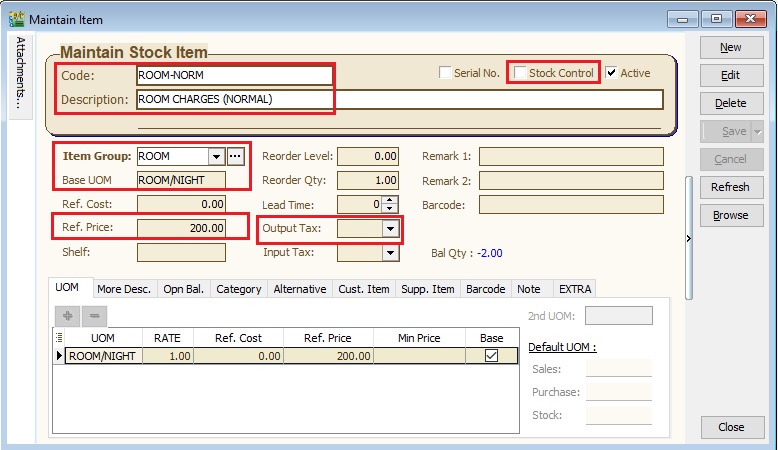

Room - Maintain Stock Item

[Stock | Maintain Stock Item…]

- Example of the room list settings are:

No. Code Description Item Group Base UOM Ref.Price Output Tax Stock Control 1. ROOM-NORM NORMAL-ROOM CHARGES ROOM ROOM/NIGHT 200.00 Untick 2. ROOM-EXEC EXECUTIVE-ROOM CHARGES ROOM ROOM/NIGHT 400.00 Untick 3. ROOM-DELUX DELUXE-ROOM CHARGES ROOM ROOM/NIGHT 600.00 Untick

NOTE: For GST or Non-GST registered person, output tax always LEAVE IT BLANK.

Understanding Service Charge Settings

Service Charge - Maintain Account

[GL | Maintain Account...]

GL Account Description 500-001 SERVICE CHARGES

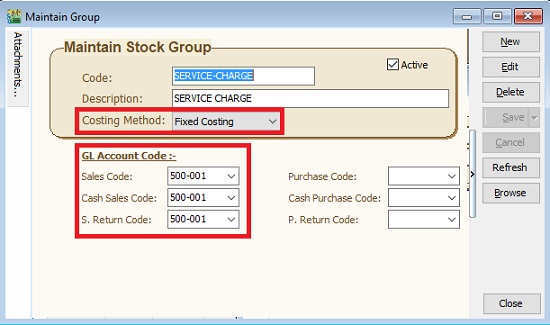

Service Charge - Maintain Stock Group

[Stock | Maintain Stock Group...]

Stock Group Description Costing Method Sales Code Cash Sales Code S.Return Code SERVICE-CHARGE SERVICE CHARGE Fixed Costing 500-001 500-001 500-001

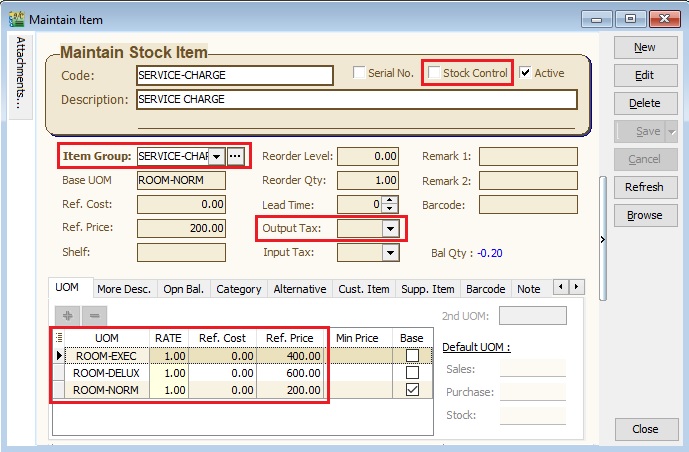

Service Charge - Maintain Stock Item

[Stock | Maintain Stock Item…]

- Example of the Service Charge setting:

No. Code Description Item Group Output Tax Stock Control 1. SERVICE-CHARGE Service Charge SERVICE-CHARGE Untick

- UOM Tab - use to preset the types of room rate.

No. UOM RATE Ref.Price 1. ROOM-NORM 1.00 200.00 2. ROOM-EXEC 1.00 400.00 3. ROOM-DELUX 1.00 600.00

NOTE: For GST or Non-GST registered person, output tax always LEAVE IT BLANK.