| (36 intermediate revisions by the same user not shown) | |||

| Line 3: | Line 3: | ||

==Introduction== | ==Introduction== | ||

IM - "Import of goods with GST incurred". It means there is an input tax claimable. Tax rate is 6%. <br /> | :IM - "Import of goods with GST incurred". It means there is an input tax claimable. Tax rate is 6%. <br /> | ||

Purchase of goods from oversea supplier, the supplier invoice received will not incurred GST. However, the GST will be taken place when the goods are discharged out from the port to forwarder warehouse or direct to the buyer. Custom will incurred the GST on the total value stated in K1 form.<br /> | :Purchase of goods from oversea supplier, the supplier invoice received will not incurred GST. However, the GST will be taken place when the goods are discharged out from the port to forwarder warehouse or direct to the buyer. Custom will incurred the GST on the total value stated in K1 form.<br /> | ||

==GST IMPORTATION OF GOODS (IM)== | ==GST IMPORTATION OF GOODS (IM)== | ||

| Line 11: | Line 11: | ||

''[GST | Maintain Tax...]''<br /> | ''[GST | Maintain Tax...]''<br /> | ||

You can found the following tax code available in SQL Financial Accounting. <br /> | :You can found the following tax code available in SQL Financial Accounting. <br /> | ||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

| Line 23: | Line 23: | ||

===Oversea Supplier Invoice=== | ===Oversea Supplier Invoice=== | ||

''[Purchase | Purchase Invoice...]''<br /> | ''[Purchase | Purchase Invoice...]''<br /> | ||

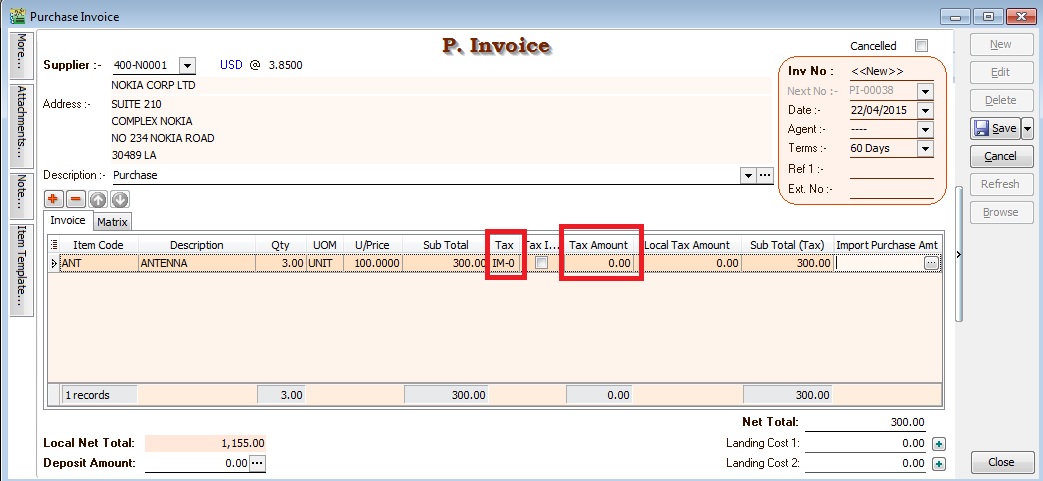

1. Create the oversea supplier invoice at Purchase Invoice. <br /> | :1. Create the oversea supplier invoice at Purchase Invoice. <br /> | ||

2. Select the tax code “IM-0”. Tax amount = 0.00 <br /> | :2. Select the tax code “IM-0”. Tax amount = 0.00 <br /> | ||

::[[File:GST-IM-PI-01.jpg | 440PX]] | ::[[File:GST-IM-PI-01.jpg | 440PX]] | ||

<br /> | <br /> | ||

=== | ===Received Forwarder Notification from K1 /Invoice=== | ||

Let's said in the K1 form details:-<br /> | :Let's said in the K1 form details:-<br /> | ||

{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

! style="text-align:left;"| Description !! style="text-align:right;"| Amount (MYR) !! Calculation | ! style="text-align:left;"| Description !! style="text-align:right;"| Amount (MYR) !! Calculation | ||

| Line 38: | Line 38: | ||

| Custom Duty (B) <br /> ''(assumed is 5%)'' || style="text-align:right;"| 57.75 || Rm1,155 x 5% | | Custom Duty (B) <br /> ''(assumed is 5%)'' || style="text-align:right;"| 57.75 || Rm1,155 x 5% | ||

|- | |- | ||

| | | Total Taxable Amount (C) || style="text-align:right;"| 1,212.75 || A + B | ||

|- | |- | ||

| GST - IM || style="text-align:right;"| 72.77 || C x 6% = Rm1,212.75 x 6% | | '''GST - IM''' || style="text-align:right;"| '''72.77''' || '''C x 6% = Rm1,212.75 x 6%''' | ||

|} | |}<br /> | ||

<br /> | |||

Usually, the forwarder will invoice to the principal company for the following details:- | :Usually, the forwarder will invoice to the principal company for the following details:- <br /> | ||

{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

! style="text-align:left;"| Description !! style="text-align:right;"| Net (MYR) !! style="text-align:right;"| GST !! style="text-align:right;"| Gross (MYR) | ! style="text-align:left;"| Description !! style="text-align:right;"| Net (MYR) !! style="text-align:right;"| GST !! style="text-align:right;"| Gross (MYR) | ||

| Line 60: | Line 59: | ||

|} | |} | ||

<br /> | <br /> | ||

'''NOTE : '''<br /> | |||

GST Import can be calculated in different way. It might based on total weight (ie. weight x container) or total meter square (ie,meter square x container). | |||

For example, | |||

'''GST Import''' = 30,000m2 x 10 containers x 6% = RM18,000.00 | |||

<br /> | |||

===Forwarder Invoice Entry (Purchase Invoice)=== | |||

''[ Purchase | Purchase Invoice...]''<br /> | |||

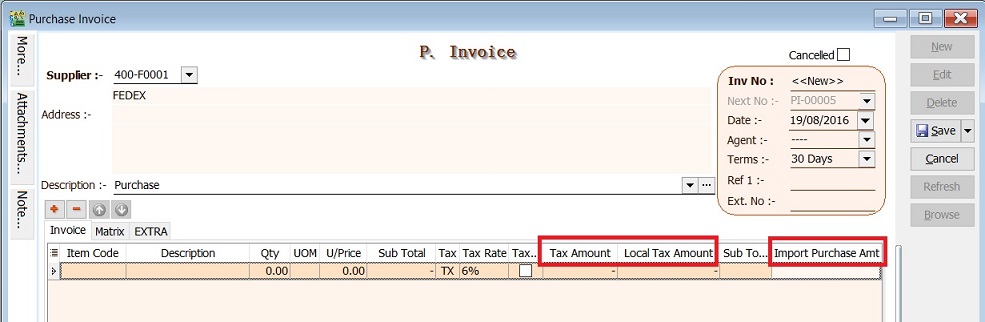

:1. Select the forwarder supplier code in Purchase Invoice.<br /> | |||

:2. Insert the following fields:-<br /> | |||

:* '''Tax Amount''' | |||

:* '''Local Tax Amount''' | |||

:* '''Import Purchase Amt (GST Import input)''' | |||

:* Import Curr.Code (for display only) | |||

:* Import Curr Rate (for display only)<br /> | |||

::[[File:GST-IM-PI-01b.jpg | 240PX]] | |||

<br /> | <br /> | ||

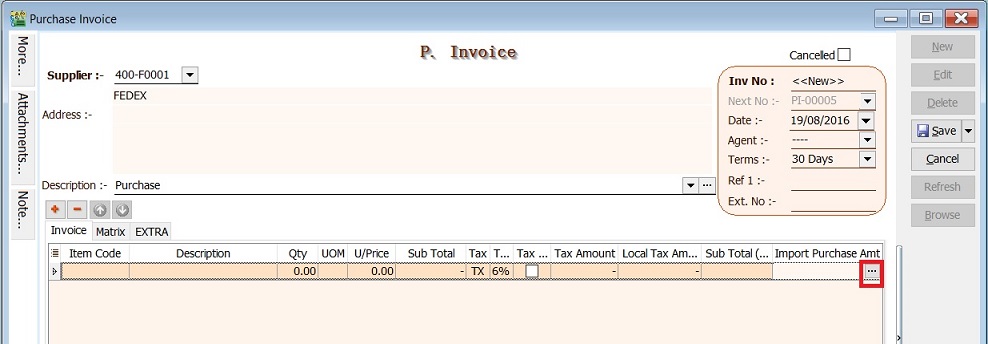

:3. Click on the side button in the Import Purchase Amt column. See screenshot below.<br /> | |||

::[[File:GST-IM-PI-02.jpg | 240PX]] | |||

<br /> | |||

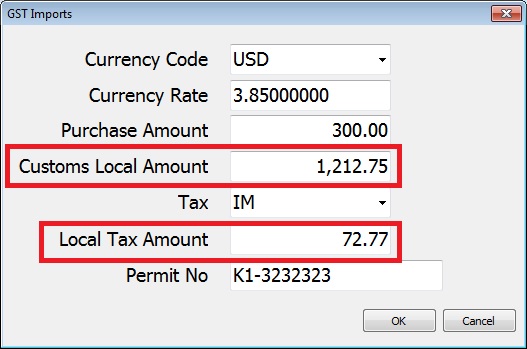

:4. You have to input the info according to 2.3. Received Forwarder Notification from K1 /Invoice example.<br /> | |||

::{| class="wikitable" | |||

|- | |||

! Field Name !! Input Value !! Explanation | |||

|- | |||

| Currency Code || USD || Currency to the goods purchased | |||

|- | |||

| Currency Rate || 3.85 || Follow K1 exchange rate | |||

|- | |||

| Purchase Amount || 300.00 || Goods foreign value as stated in K1 form | |||

|- | |||

| Custom Local Amount || 1,212.50 || Follow K1 total taxable amount.<br /> Formula = Purchase Amount + Custom Duty + Excise Duty (if any) | |||

|- | |||

| Tax || IM || 6% | |||

|- | |||

| Tax Amount || 72.77 || 1,212.75 x 6% | |||

|- | |||

| Permit No || K1-3232323 || Key-in the K1 no. | |||

|}<br /> | |||

::[[File:GST-IM-PI-03.jpg | 240PX]]<br /> | |||

= | :5. After press OK to exit the GST Import screen, the purchase invoice item description will be updated as “Purchase Value USD 300.00@3.8500 = RM 1,155.00, Permit No: K1-32323232” from the GST Import entered. <br /> | ||

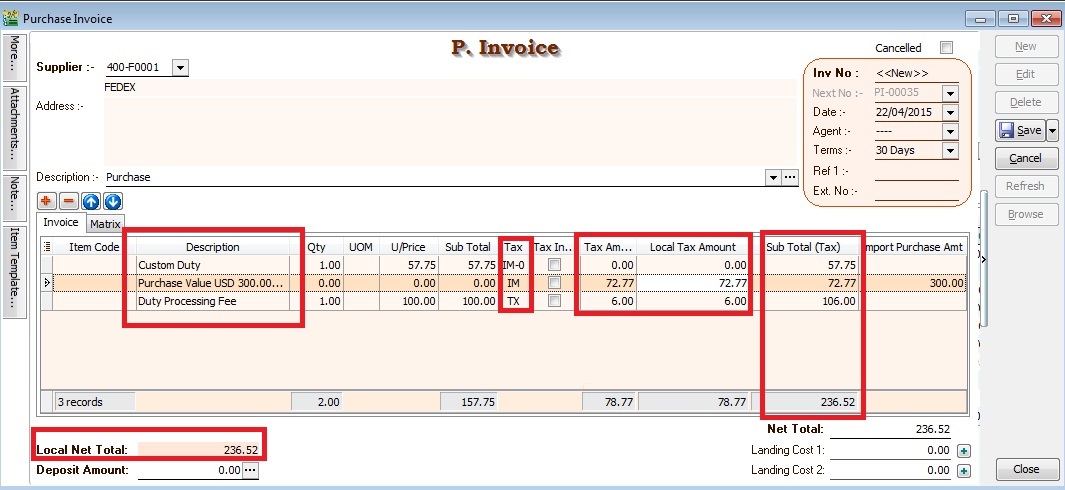

:6. Below is the sample of Forwarder invoice entry.<br /> | |||

::[[File:GST-IM-PI-04.jpg | 240PX]]<br /> | |||

<br /> | |||

1. | :In summary: | ||

2. | ::{| class="wikitable" | ||

|- | |||

! Line # !! style="text-align:left;"| Description !! style="text-align:right;"| Sub Total !! style="text-align:right;"| Tax !! style="text-align:right;"| Tax Amount !! style="text-align:right;"| Sub Total (Tax) | |||

|- | |||

| 1 || Est. Duties (Import&/Excise Duty) || style="text-align:right;"| 57.75 || IM-0 || style="text-align:right;"| 0.00 || style="text-align:right;"| 57.75 | |||

|- | |||

| 2 || Est. GST Import (RM1,212.75 x 6%) || style="text-align:right;"| 0.00 || IM || style="text-align:right;"| 72.77 || style="text-align:right;"| 72.77 | |||

|- | |||

| 3 || Duty Processing Fee || style="text-align:right;"| 100.00 || TX || style="text-align:right;"| 6.00 || style="text-align:right;"| 106.00 | |||

|- | |||

| || '''Total Payable''' || || || || style="text-align:right;"| '''236.52''' | |||

|} | |||

<br /> | |||

:: | ==Other Supporting Documents Related to Import== | ||

:All imported goods, both dutiable or not, must be declared in the prescribed forms and be submitted to the customs station at the place of import. The prescribed forms are the following: | |||

::1. Customs Form no. 1 '''(K1)''': Declaration of goods imported | |||

:::: * Import for dutiable and non-dutiable goods.<br /> | |||

::2. Customs Form no. 2 '''(K2)''': Declaration of goods to be exported | |||

:::: * Export for dutiable and non-dutiable goods.<br /> | |||

::3. Customs Form no. 3 '''(K3)''': Application/ Permit to transport goods within the Federation/Malaysia | |||

:::: * Import & Export of dutiable and non-dutiable goods within Malysia<br /> | |||

::4. Customs Form no. 8 '''(K8)''': Application/ Permit to tranship/remove goods | |||

:::: * Declaration of duty not paid goods | |||

::::::::a) By rail - Pasir Gudang declared K8 to rail the containers from Pasir Gudang to Port Klang without paying the duty. Port Klang declared K1 to clear the containers by paying duty. (Dutiable cargo) | |||

::::::::b) Transhipment - From one port tranship from another port. K8 can move container from westport to northport and vice versa without paying duty.<br /> | |||

::5. Customs Form no. 9 '''(K9)''': Requisition/ Permit to remove dutiable goods from customs control | |||

:::: * Clear dutiable cargo slowly out from bonded warehouse. K8 declares for the container truck into bonded warehouse and K9 clears the cargo partial by partial out from the warehouse probably due to high duty charges. | |||

<br /> | <br /> | ||

:Supporting documents for the declaration forms are as follows: | |||

::# Delivery order | |||

::# Packing list | |||

::# Original invoice | |||

::# Bill of lading | |||

::# Certificate of origin | |||

::# Import licenses which may be required by a proper officer of customs | |||

==Highlight Changes== | |||

{| class="wikitable" | |||

|- | |||

! Date !! Initiated by !! Remarks | |||

|- | |||

| 28 March 2015 || Loo || Initial document. | |||

|- | |||

| 22 April 2015 || Loo || Update K1 and new screenshot | |||

|- | |||

| 24 June 2015 || Loo || For forwarder invoice, tax code IM should refer to Local Tax Amount instead of Tax Amount. | |||

|} | |||

==See also== | ==See also== | ||

* [ | * [[GST Treatment: How to report GST-03 item 16 Capital Goods Acquired for Purchase of machinery from Oversea]] | ||

* [[GST Treatment: ATS]] | |||

Latest revision as of 02:31, 13 May 2017

Import Goods (IM)

Introduction

- IM - "Import of goods with GST incurred". It means there is an input tax claimable. Tax rate is 6%.

- Purchase of goods from oversea supplier, the supplier invoice received will not incurred GST. However, the GST will be taken place when the goods are discharged out from the port to forwarder warehouse or direct to the buyer. Custom will incurred the GST on the total value stated in K1 form.

GST IMPORTATION OF GOODS (IM)

Tax Code

[GST | Maintain Tax...]

- You can found the following tax code available in SQL Financial Accounting.

Tax Code Description Tax Rate % IM-0 Import of goods with no GST incurred (for Foreign Supplier Account) 0% IM Import of goods with GST incurred 6%

Oversea Supplier Invoice

[Purchase | Purchase Invoice...]

- 1. Create the oversea supplier invoice at Purchase Invoice.

- 2. Select the tax code “IM-0”. Tax amount = 0.00

Received Forwarder Notification from K1 /Invoice

- Let's said in the K1 form details:-

Description Amount (MYR) Calculation Goods Value (A) 1,155.00 USD300 x 3.8500 Custom Duty (B)

(assumed is 5%)57.75 Rm1,155 x 5% Total Taxable Amount (C) 1,212.75 A + B GST - IM 72.77 C x 6% = Rm1,212.75 x 6%

- Usually, the forwarder will invoice to the principal company for the following details:-

Description Net (MYR) GST Gross (MYR) Est. Duties (Import&/Excise Duty) 57.75 Est. GST Import (RM1,212.75 x 6%) 72.77 Est Duties + GST Import 130.52 130.52 Duty Processing Fee 100.00 6.00 106.00 Total Payable 236.52

NOTE :

GST Import can be calculated in different way. It might based on total weight (ie. weight x container) or total meter square (ie,meter square x container). For example, GST Import = 30,000m2 x 10 containers x 6% = RM18,000.00

Forwarder Invoice Entry (Purchase Invoice)

[ Purchase | Purchase Invoice...]

- 1. Select the forwarder supplier code in Purchase Invoice.

- 2. Insert the following fields:-

- Tax Amount

- Local Tax Amount

- Import Purchase Amt (GST Import input)

- Import Curr.Code (for display only)

- Import Curr Rate (for display only)

- 4. You have to input the info according to 2.3. Received Forwarder Notification from K1 /Invoice example.

Field Name Input Value Explanation Currency Code USD Currency to the goods purchased Currency Rate 3.85 Follow K1 exchange rate Purchase Amount 300.00 Goods foreign value as stated in K1 form Custom Local Amount 1,212.50 Follow K1 total taxable amount.

Formula = Purchase Amount + Custom Duty + Excise Duty (if any)Tax IM 6% Tax Amount 72.77 1,212.75 x 6% Permit No K1-3232323 Key-in the K1 no.

- 5. After press OK to exit the GST Import screen, the purchase invoice item description will be updated as “Purchase Value USD 300.00@3.8500 = RM 1,155.00, Permit No: K1-32323232” from the GST Import entered.

- 6. Below is the sample of Forwarder invoice entry.

- In summary:

Line # Description Sub Total Tax Tax Amount Sub Total (Tax) 1 Est. Duties (Import&/Excise Duty) 57.75 IM-0 0.00 57.75 2 Est. GST Import (RM1,212.75 x 6%) 0.00 IM 72.77 72.77 3 Duty Processing Fee 100.00 TX 6.00 106.00 Total Payable 236.52

Other Supporting Documents Related to Import

- All imported goods, both dutiable or not, must be declared in the prescribed forms and be submitted to the customs station at the place of import. The prescribed forms are the following:

- 1. Customs Form no. 1 (K1): Declaration of goods imported

- * Import for dutiable and non-dutiable goods.

- * Import for dutiable and non-dutiable goods.

- 2. Customs Form no. 2 (K2): Declaration of goods to be exported

- * Export for dutiable and non-dutiable goods.

- * Export for dutiable and non-dutiable goods.

- 3. Customs Form no. 3 (K3): Application/ Permit to transport goods within the Federation/Malaysia

- * Import & Export of dutiable and non-dutiable goods within Malysia

- * Import & Export of dutiable and non-dutiable goods within Malysia

- 4. Customs Form no. 8 (K8): Application/ Permit to tranship/remove goods

- * Declaration of duty not paid goods

- a) By rail - Pasir Gudang declared K8 to rail the containers from Pasir Gudang to Port Klang without paying the duty. Port Klang declared K1 to clear the containers by paying duty. (Dutiable cargo)

- b) Transhipment - From one port tranship from another port. K8 can move container from westport to northport and vice versa without paying duty.

- * Declaration of duty not paid goods

- 5. Customs Form no. 9 (K9): Requisition/ Permit to remove dutiable goods from customs control

- * Clear dutiable cargo slowly out from bonded warehouse. K8 declares for the container truck into bonded warehouse and K9 clears the cargo partial by partial out from the warehouse probably due to high duty charges.

- 1. Customs Form no. 1 (K1): Declaration of goods imported

- Supporting documents for the declaration forms are as follows:

- Delivery order

- Packing list

- Original invoice

- Bill of lading

- Certificate of origin

- Import licenses which may be required by a proper officer of customs

Highlight Changes

| Date | Initiated by | Remarks |

|---|---|---|

| 28 March 2015 | Loo | Initial document. |

| 22 April 2015 | Loo | Update K1 and new screenshot |

| 24 June 2015 | Loo | For forwarder invoice, tax code IM should refer to Local Tax Amount instead of Tax Amount. |