| Line 47: | Line 47: | ||

|}<br /> | |}<br /> | ||

=='''How to exlude the IRR for the capital goods disposal off?'''== | |||

:Disposal of asset are using the tax type '''SR''' to report as GST Tax Payable in GST-03. According to the IRR formula, this taxable amount must be excluded (o) from the total value of all taxable supplies (t). | :Disposal of asset are using the tax type '''SR''' to report as GST Tax Payable in GST-03. According to the IRR formula, this taxable amount must be excluded (o) from the total value of all taxable supplies (t). | ||

::'''IRR = (T-O) / (T+E-O)'''<br /> | ::'''IRR = (T-O) / (T+E-O)'''<br /> | ||

| Line 76: | Line 75: | ||

|}<br /> | |}<br /> | ||

===Steps=== | |||

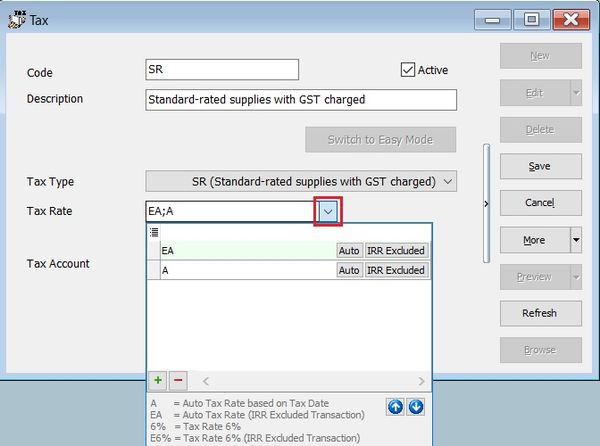

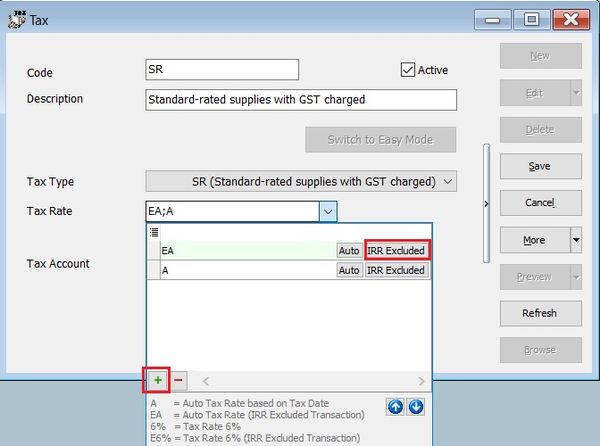

::1. Go to GST | Maintain Tax... | ::1. Go to GST | Maintain Tax... | ||

::2. Edit the '''SR''' tax code. | ::2. Edit the '''SR''' tax code. | ||

Revision as of 06:30, 11 April 2016

Introduction

- This guide will explains how Partial Exemption, Apportionment and Annual Adjustment are made in respect of residual input tax which is attributable to both taxable and exempt supplies in SQL Financial Accounting.

Partial Exemption Rules

Input Tax Recoverable Ratio (IRR)

- Formula:

- IRR = (T-O) / (T+E-O)

- T = SR + ZRL + ZRE + DS + OS + RS + GS

- E = ES

- O = ES43 (Incidental financial supplies)

- ES (Disposal of assets which are exempted eg. residential house)

- SR (Disposal of assets)

- DS (Self-recipient accounting transactions, ie. any supplies users make to themselves eg. imported services etc.)

- OS (Out of scope transactions which are not taxable in Malaysia)

- IRR = (T-O) / (T+E-O)

De Minus Rule (DMR)

- To satisfy the De Minus Rule:

- 1. DMR <= 5% and

- 2. Total Exempt Supply (ES) <= Rm5,000.00 per month

- Formula:

- DMR = ES / ES + (SR + ZRL + ZRE + DS + OS + RS + GS)

Input Tax Claimable Logic (Based on DMR)

- Below is the summary of the calculation logic based on DMR to determine the input tax claimable.

Tax Code Tax Rate Fulfill DMR? Input Tax Claimable (ITC) TX-RE 6% Yes ITC x 100% TX-RE 6% No Example TX-E43 6% N/A ITC x 100% TX-N43 6% Yes ITC x 100% TX-N43 6% No ITC x 0%

How to exlude the IRR for the capital goods disposal off?

- Disposal of asset are using the tax type SR to report as GST Tax Payable in GST-03. According to the IRR formula, this taxable amount must be excluded (o) from the total value of all taxable supplies (t).

- IRR = (T-O) / (T+E-O)

- T = SR + ZRL + ZRE + DS + OS + RS + GS

- E = ES

- O = ES43 (Incidental financial supplies)

- ES (Disposal of assets which are exempted eg. residential house)

- SR (Disposal of assets)

- DS (Self-recipient accounting transactions, ie. any supplies users make to themselves eg. imported services etc.)

- OS (Out of scope transactions which are not taxable in Malaysia)

- IRR = (T-O) / (T+E-O)

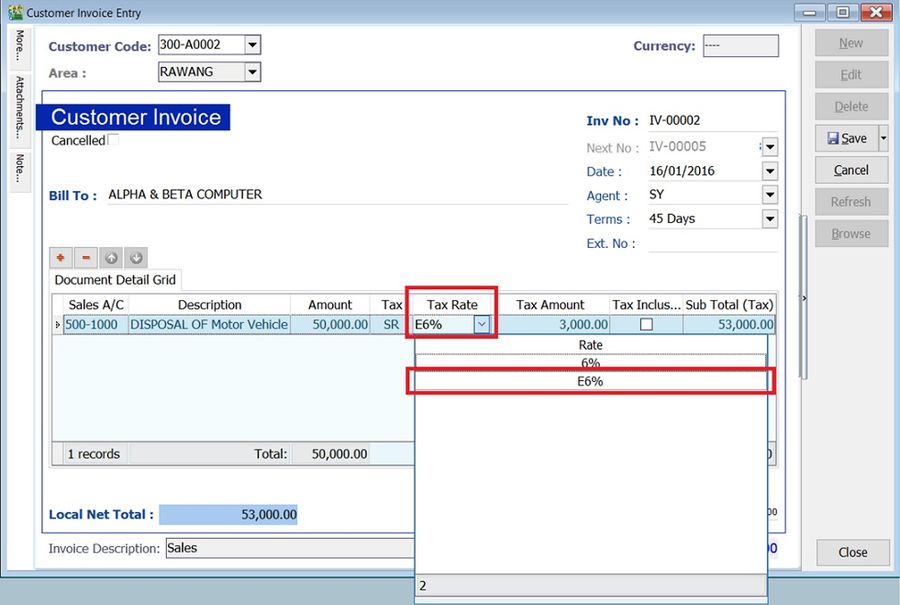

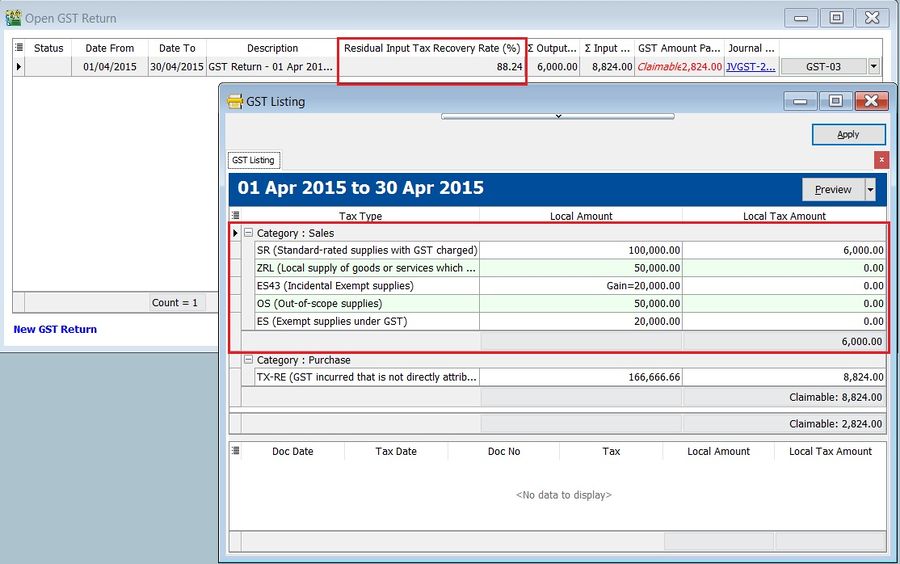

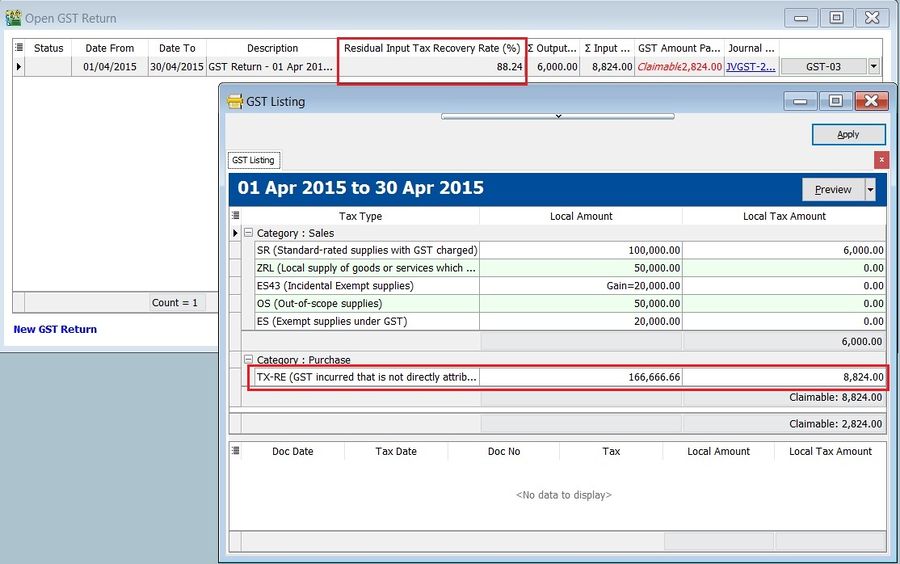

- For example, Mixed Co. Sdn Bhd., whose current tax year ends on 31 December 2016, has in his taxable period of April 2015, made some mixed supplies and at the same time incurred residual input tax as follows.

RM t Value of all taxable supplies, exclusive of tax 200,000.00 e Value all of exempt supplies 40,000.00 o Value of a capital goods disposal off (exclusive of tax) 50,000.00 o Value of incidental exempt supplies 20,000.00 Residual Input Tax Incurred 10,000.00

Steps

Note: 1. Tax Rate set as EA or E6%. 2. E = Exclude from IRR formula.

IRR calculation:

Calculation RM t Value of all taxable supplies, exclusive of tax 100,000 (SR) + 50,000 (ZRL) + 50,000 (OS) 200,000 e Value all of exempt supplies 20,000 (ES) + 20,000 (ES43) 40,000 o Value of a capital goods disposal off (exclusive of tax) 50,000 (SR with tax rate E6%) 50,000 o Value of incidental exempt supplies 20,000 (ES43) 20,000 Residual Input Tax Incurred 166,666.66 X 6% (TX-RE) 10,000.00