| Line 18: | Line 18: | ||

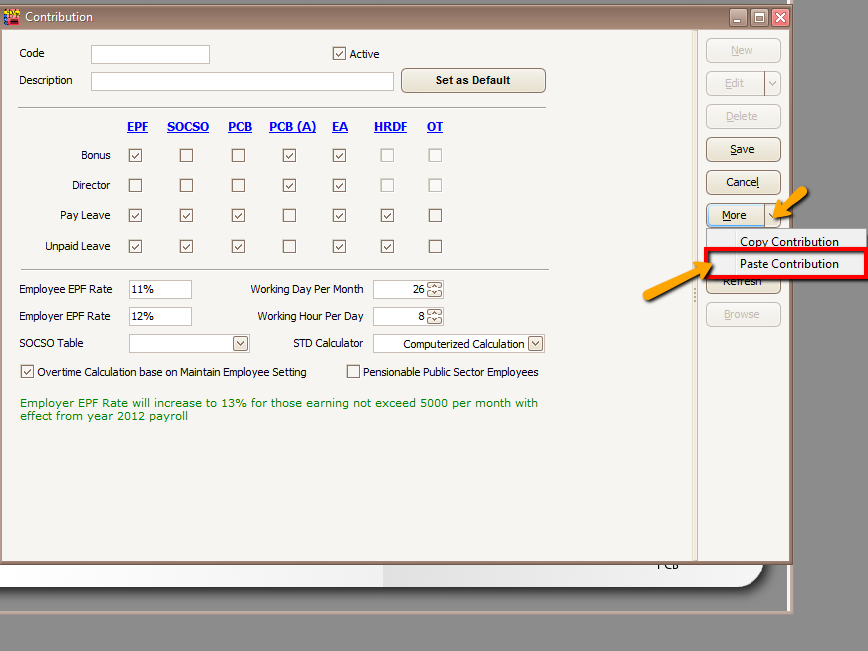

2. Select your default contribution and click on MORE | Copy Contribution. | 2. Select your default contribution and click on MORE | Copy Contribution. | ||

:[[File:EPF1.png]] | :[[File:EPF1.png]] | ||

3. Then | 3. Then <b>click on NEW then select More again and paste contribution that you have copy.</b> | ||

:[[File:Con5.png]] | :[[File:Con5.png]] | ||

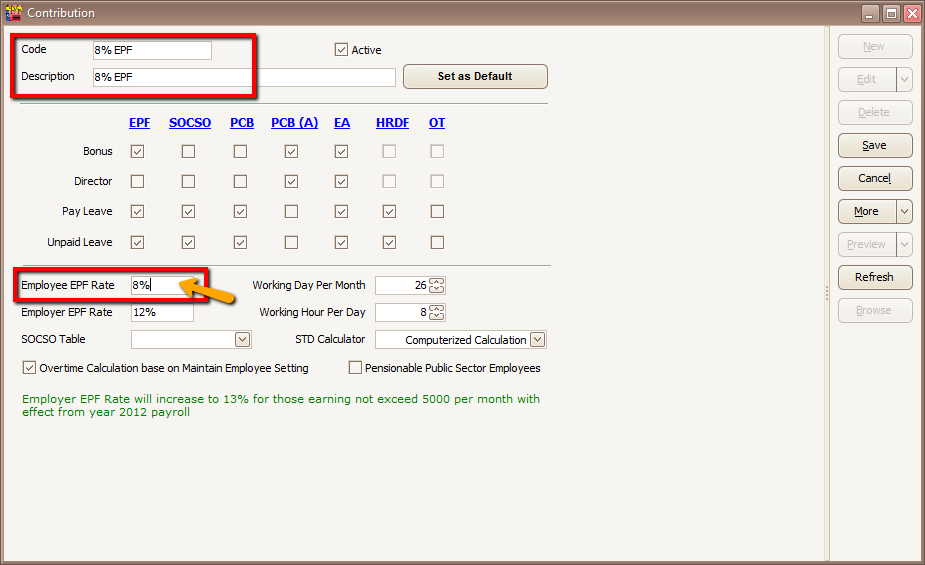

3. <b><u>Code and Description | :[[File:EPF2.png]] | ||

3. <b><u>You just have to change the Code and Description and change the employee EPF Rate from 11% to 8% and Save.</u></b> | |||

:[[File:Con6.png]] | :[[File:Con6.png]] | ||

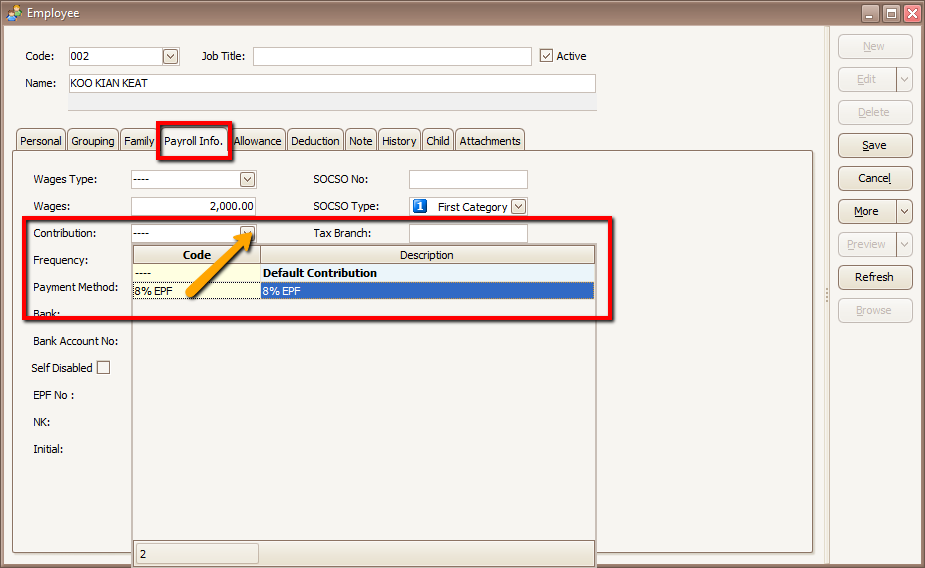

4. under <b> Human Resource | Maintain Employee | Edit the Employee and under the " Payroll Info" tab assign the employee contribution accordingly.</b> | 4. under <b> Human Resource | Maintain Employee | Edit the Employee and under the " Payroll Info" tab assign the employee contribution accordingly.</b> | ||

Revision as of 08:44, 3 February 2016

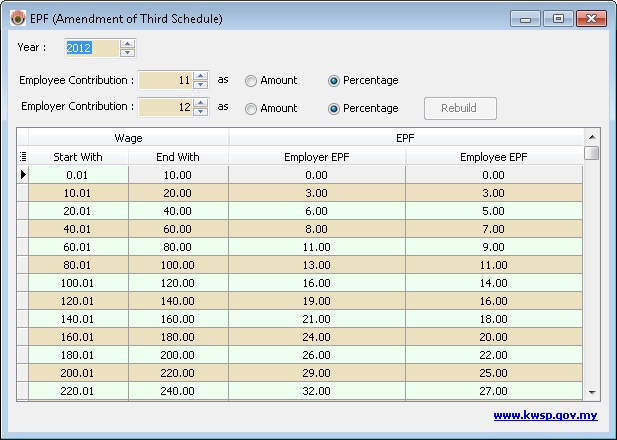

View | View EPF Table

Introduction

This function is to show a list of EPF Amount which is need to be pay/deduct from the Salary by Employee & Employer .

EPF Table

User can manually change the Rate by Amount or by percentage.

Just Click Rebuild after the changes.

Any changes here will not affect the Process of Payroll.

Government Official Portal

EPF Rule

The Government has agreed to lower employees’ contribution to the Employee’s Provident Fund (EPF) by 3% beginning March 2016 to December 2017 as part of the revised Budget 2016, so you may set SQL Payroll System from 11% to 8%.

EPF Contributions Set At 8% For Employees

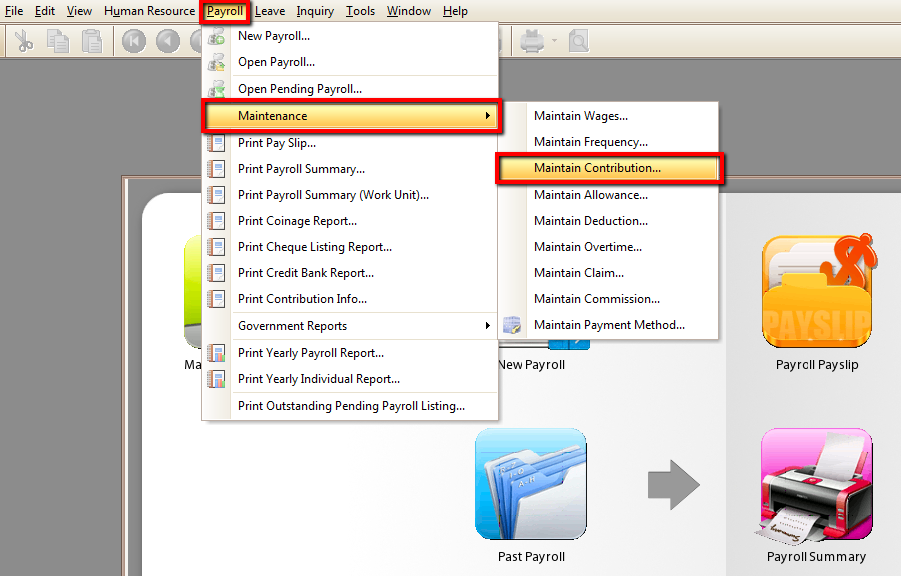

1. Payroll | Maintenance | Maintain Contribution.

2. Select your default contribution and click on MORE | Copy Contribution.

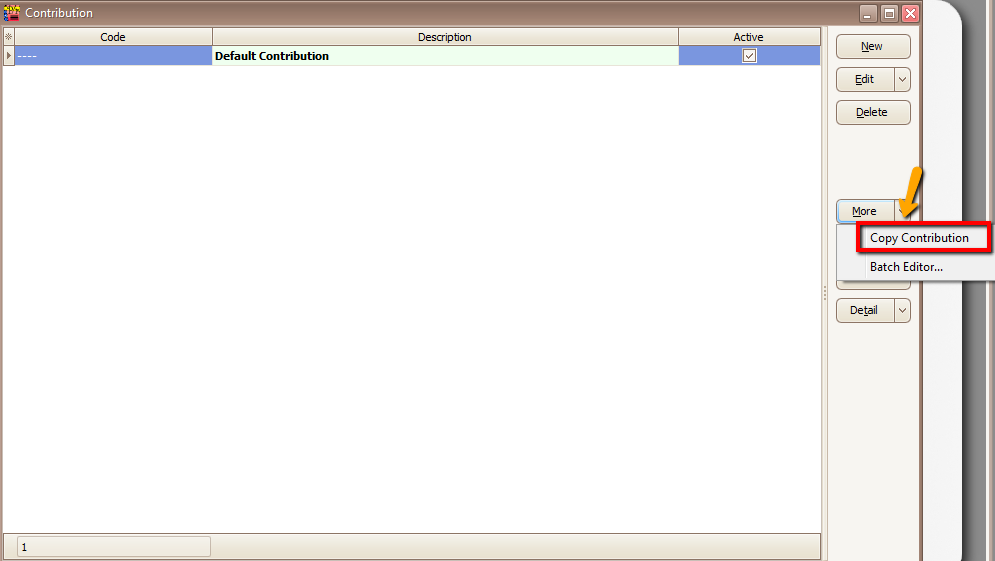

3. Then click on NEW then select More again and paste contribution that you have copy.

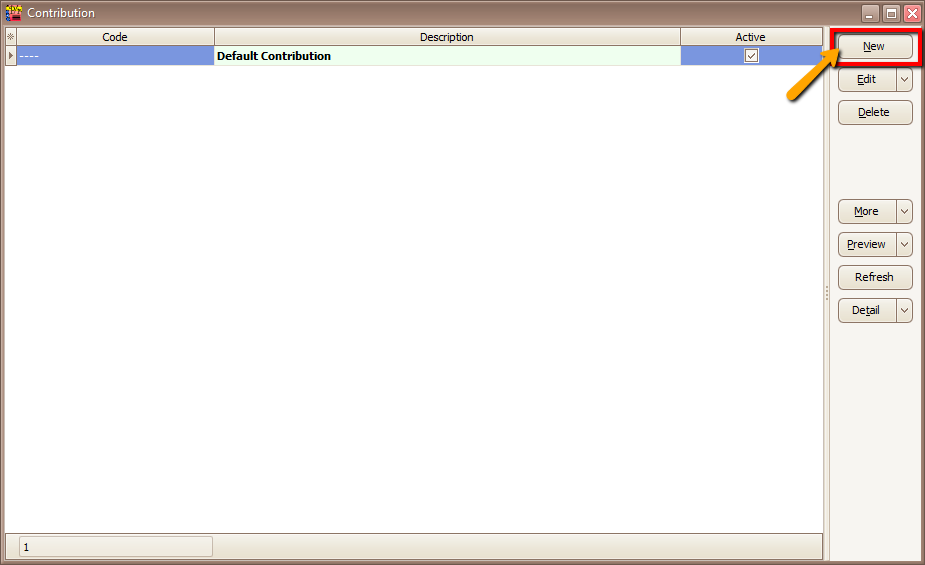

3. You just have to change the Code and Description and change the employee EPF Rate from 11% to 8% and Save.

4. under Human Resource | Maintain Employee | Edit the Employee and under the " Payroll Info" tab assign the employee contribution accordingly.

EPF Contributions Can Remain At 11% For Employees

The Government has agreed to lower employees’ contribution to the Employee’s Provident Fund (EPF) by 3% beginning March 2016 to December 2017 as part of the revised Budget 2016.

However, employees will have the option of maintaining their contribution to EPF at 11%.

EPF said in a statement that members could fill up a form and submit it to their employers so that they can contribute more than the statutory rate.

“Employers will then forward the notices to the nearest EPF branch,” the government agency said.

The notice, labelled Notis 17A Khas 2016, would be made available for download from EPF’s website beginning 2 February. The new monthly contribution rate (Schedule Three) can be downloaded from Feb 16, EPF said.

The move to cut employee contributions from 11% to 8% was among 11 restructured and recalibrated measures to ensure the economy and country’s financial position remain on the right track. Below is the form that you can print out and submit:

http://www.sql.com.my/document/KWSP17A__Khas_2016___29012016_SQLPayroll.pdf

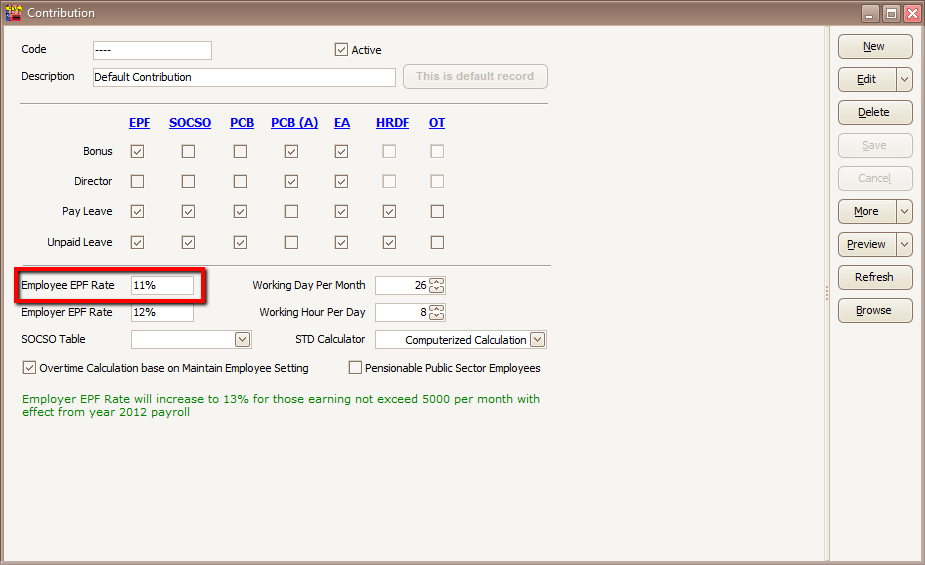

1. After you submit the form, in SQL Payroll you just have to click on Payroll | Maintenance | Maintain Contribution.

2. You just have to make sure that your Employee EPF rate is 11%.