| Line 40: | Line 40: | ||

2. Formula: <br /> | 2. Formula: <br /> | ||

Weight KG = ((GSM x Width x Length)/3100)/PKT | Weight KG = ((GSM x Width x Length)/3100)/PKT | ||

Weight MT = Weight KG/1000 '' | Weight MT = Weight KG/1000 | ||

<br /> | |||

''Both formula results are rounding up to 4 decimals.'' | |||

3. DIY Script:<br /> | 3. DIY Script:<br /> | ||

Revision as of 06:17, 6 November 2015

Introduction

Updates

Last Customisation Update : 06 Nov 2015

Criterias

Maintain Stock Item

[Stock | Maintain Stock Item...]

1. Stock Master Data.

| Types | Field Name | Data Types | Length | Usage |

|---|---|---|---|---|

| STD | Code | String | 30 | Product Code, eg. ACGAAA100SK-31004300 |

| STD | Description | String | 200 | Product Name, eg. Matt A/Paper China |

| STD | 2nd Description | String | 200 | Paper packaging size to be display in sales tax invoice, eg. 100gsm 31" x 43" |

| STD | Base UOM | String | 10 | stock unit of measurement, usually either enter as REAM or MT or PKT |

| DIY | GSM | Float | Size :10 SubSize: 2 |

GSM value for Weight KG calculation |

| DIY | Width | Float | Size :10 SubSize: 2 |

Width value for Weight KG calculation |

| DIY | Length | Float | Size :10 SubSize: 2 |

Length value for Weight KG calculation |

| DIY | PKT | Float | Size :10 SubSize: 2 |

PKT value for Weight KG calculation |

| DIY | Weight_MT | Float | Size :10 SubSize: 4 |

Weight MT value |

| DIY | Weight_KG | Float | Size :10 SubSize: 4 |

Weight Kgs value |

2. Formula:

Weight KG = ((GSM x Width x Length)/3100)/PKT Weight MT = Weight KG/1000

Both formula results are rounding up to 4 decimals.

3. DIY Script:

Var M : TDataSource;

begin M := TDataSource(Self.FindComponent('dsAccess')); M.DataSet.Edit; M.DataSet.FindField('UDF_Weight_KG').Value := SimpleRoundToEx((((M.DataSet.FindField('UDF_GSM').AsFloat* M.DataSet.FindField('UDF_Width').AsFloat* M.DataSet.FindField('UDF_Length').AsFloat)/3100)/M.DataSet.FindField('UDF_PKT').AsFloat),-4); M.DataSet.FindField('UDF_Weight_MT').Value := SimpleRoundToEx((M.DataSet.FindField('UDF_Weight_KG').AsFloat/1000),-4); end.

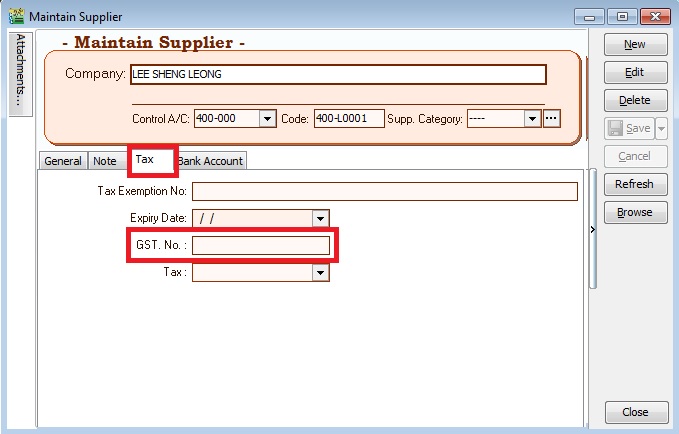

Maintain Supplier

[Supplier | Maintain Supplier…]

1. Create new seller name (eg. company name or person name).

2. Click on Tax tab to input the GST No (if applicable).

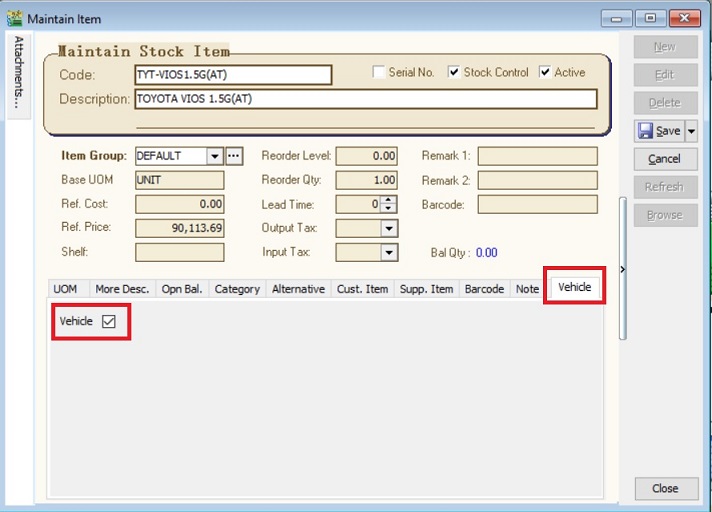

Maintain Stock Item

[Stock | Maintain Stock Item…]

1. Create the car model at Maintain Stock Item. For example, TOYOTA VIOS 1.5G(AT)

2. Click on Vehicle tab to define this item is a "Vehicle".

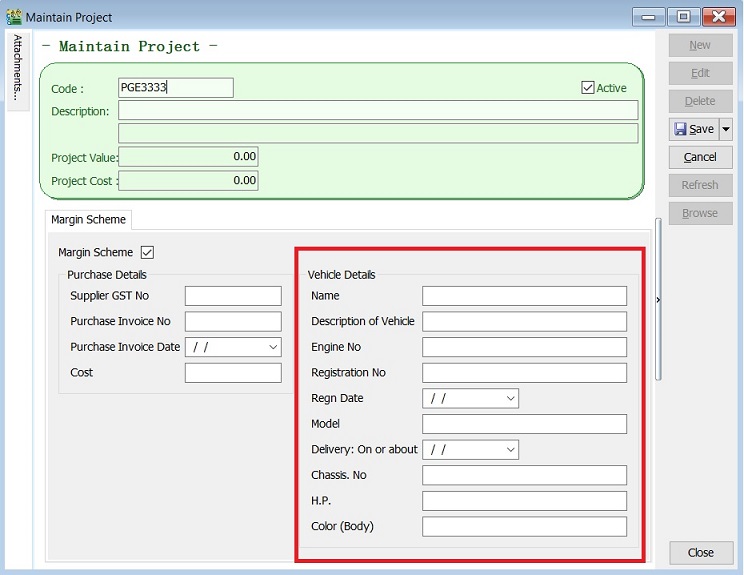

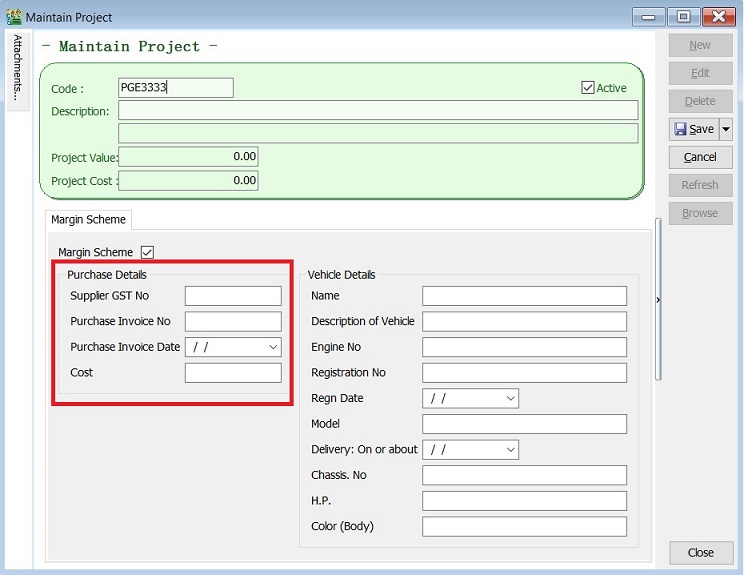

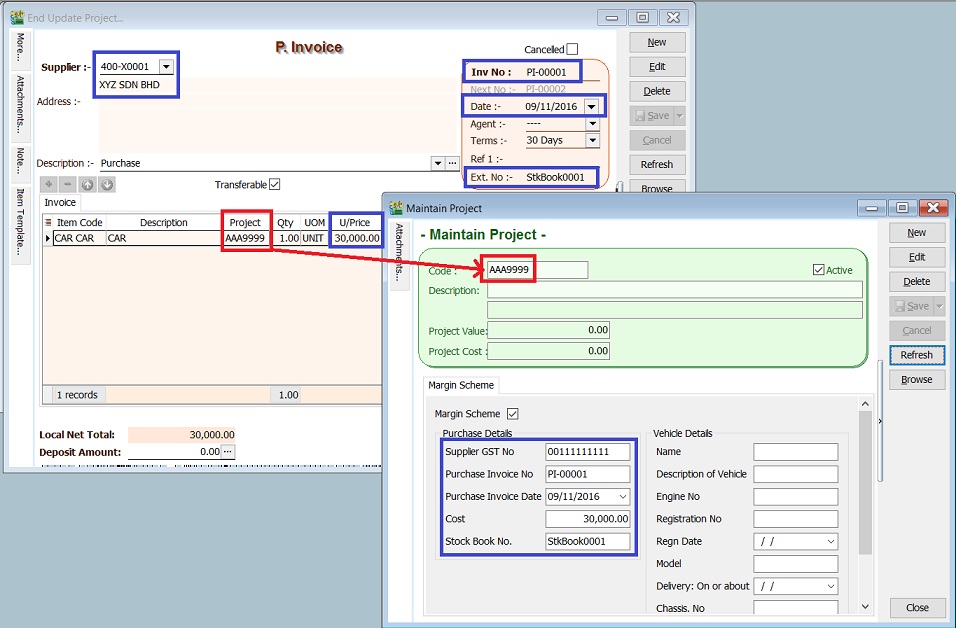

Maintain Project

[Tools | Maintain Project…]

1. Create the second car plate number in Maintain Project.

2. Update the Vehicle detail.

3. Leave BLANK to Purchase Invoice Date, Purchase Invoice No and Cost. It will auto update when you are select the project code and save at the Purchase Invoice.

Record Purchase of Second Hand Car Value

[Purchase | Purchase Invoice…]

1. Enter the purchase value of second car at Purchase Invoice. (eg. RM30,000 )

2. You must select the correct car plate number from Project. (eg. PGE3333)

3. Supplier GST No, Purchase invoice number, date and cost will be update automatically after you have save the purchase invoice.

| Purchase Detail | Update from |

|---|---|

| Supplier GST No | Maintain Supplier |

| Purchase Invoice No | Purchase Invoice |

| Purchase Invoice Date | Purchase Invoice |

| Cost | Purchase Invoice |

NOTE :

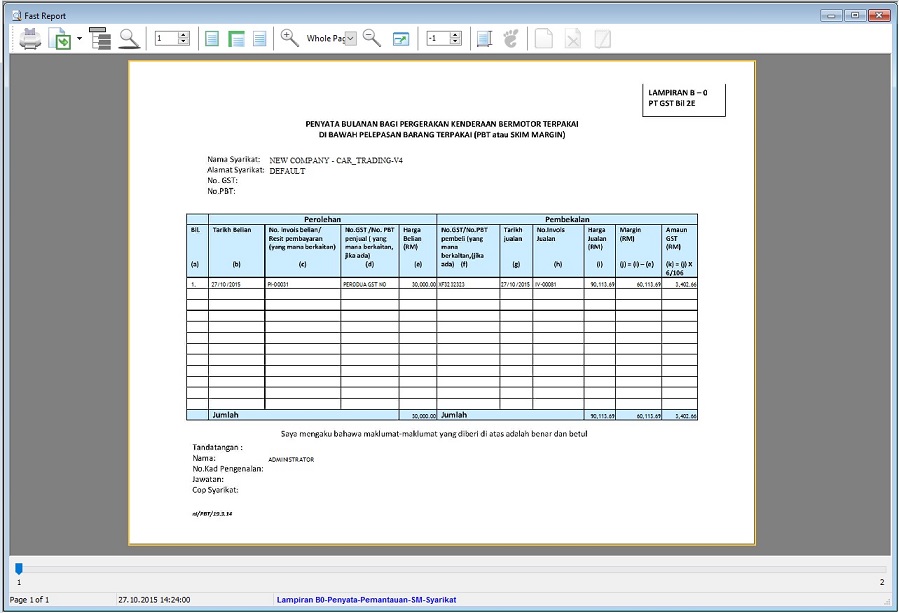

1. This information is required to show in Lampiran 07 -Monthly Report for Relief for Secondhand Goods or Margin Scheme (MS).

2. Auto update to project purchase detail (Purchase No, Purchase Date and Cost) if tax amount is zero

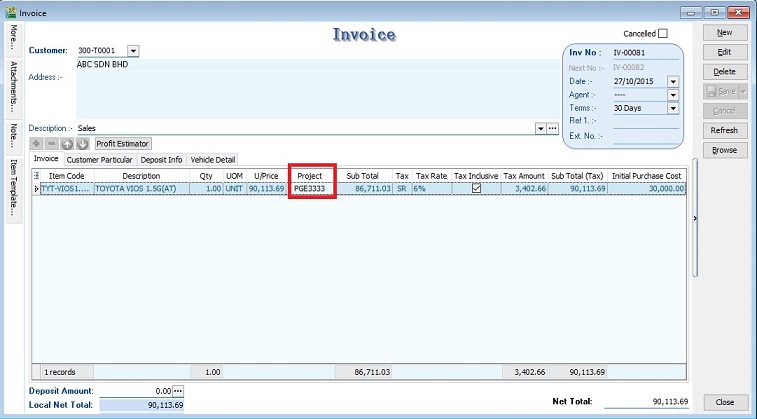

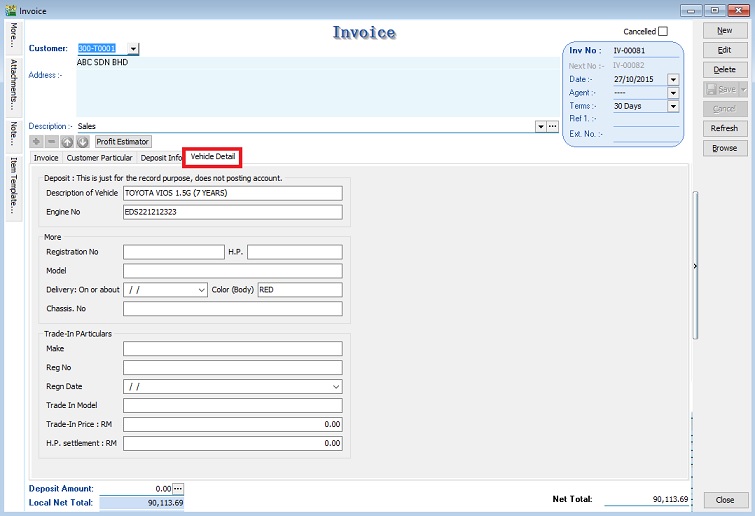

Record Sale of Second Hand Car Value

[Sales | Invoice…]

Margin Scheme Input

1. Enter the sale value of second car at Invoice. (eg.RM90,113.69)

2. You must select the correct car plate number from Project.(eg.PGE3333)

3. Initial Purchase Cost will auto upadate after select the project (car plate number).

4. Tax amount will be calculated based on Margin Scheme method.(See screenshot below)

- a. Sellng Price = 90,113.69

- b. Purchase Cost = 30,000.00

- c. Margin = 90,113.69 – 30,000.00 = 60,113.69

- d. Tax amount = 60,113.69 x 6/106 = 3,402.66

- a. Sellng Price = 90,113.69

6. Invoice no, invoice date, selling price, margin, and margin tax amount will be shown in Lampiran 07 -Monthly Report for Relief for Secondhand Goods or Margin Scheme (MS)

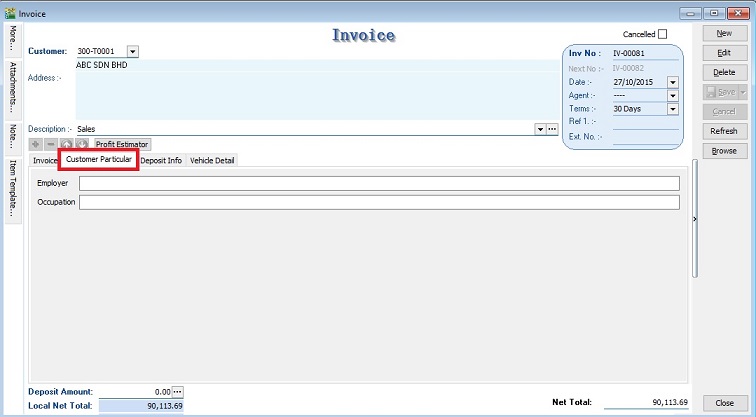

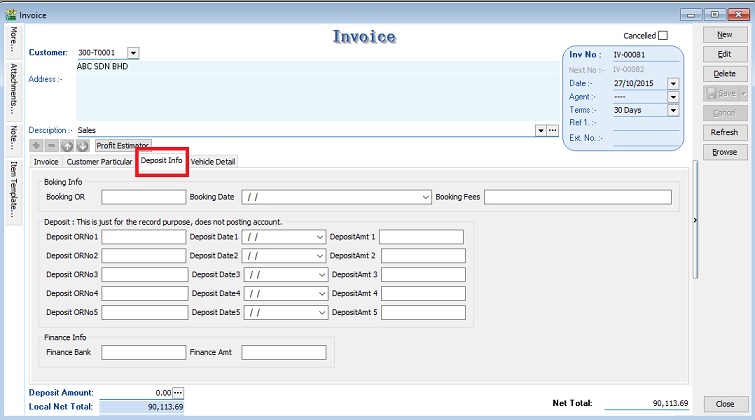

Other Information

1. Customer Particular tab.

2. Deposit Info (For record purpose, no posting to account).

3. Vehichle Detail (Auto retrieve from Vehicle Detail in Maintain Project).

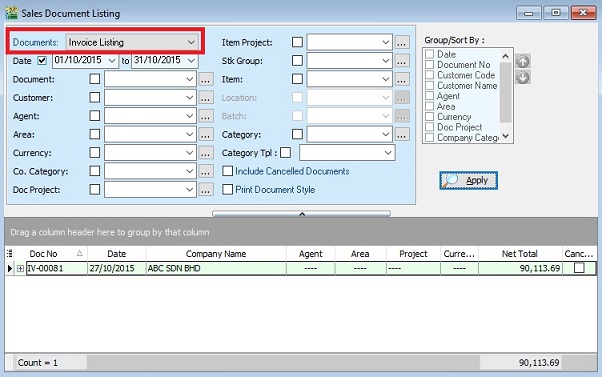

Print for GST Lampiran 07 (Lampiran B0-Penyata-Pemantauan-SM-Syarikat)

[Sales | Print Sales Document Listing…]

1. Select document to “Invoice Listing” and click APPLY.

2. Click on preview or print. Select the report name “Lampiran B0-Penyata-Pemantauan-SM-Syarikat”.

See also

- Others Customisation