| (114 intermediate revisions by 2 users not shown) | |||

| Line 3: | Line 3: | ||

|- | |- | ||

| We had 4 Methods to Integrate/Link to SQL Accounting | | We had 4 Methods to Integrate/Link to SQL Accounting | ||

* [[SDK Live]] (Recommended) | * [[SDK Live]] (Recommended - For two way communication) | ||

* [[SQL | * [[SQL Acc XLS n MDB Import]] - XLS, XLSX, Json & CSV/TXT File (Format 2 - <span style="color:#0000ff">Bar(|),Comma(,),Semi Comma(;),Tilde(~)</span>) | ||

* [[SQL | * [[SQL XML Import]] - XML File | ||

* [[SQL | * [[SQL Text Import]] - CSV/TXT File (Format 1 - <span style="color:#0000ff">Semi Comma (;)</span> Only) | ||

||[[File:QR_SQLLink.jpg|150px|center]] | ||[[File:QR_SQLLink.jpg|150px|center]] | ||

|} | |} | ||

==SQL Accounting | ==SQL Accounting & Firebird Program== | ||

* [https://www.sql.com.my/download/demo/sqlacc-setup.exe SQL Accounting] | |||

* [https://github.com/FirebirdSQL/firebird/releases/download/R3_0_4/Firebird-3.0.4.33054_0_x64.exe Firebird 64 bit] | |||

* [https://download.sql.com.my/customer/Fairy/Steps-InstallnCreateSampleDB.gif Installation Guide] | |||

==Database== | ==Database== | ||

===Sample DB=== | ===Sample DB=== | ||

* [ | * [https://download.sql.com.my/customer/Fairy/Testing-2022-05-18.zip GSTnSST-SampleDB] | ||

* | * [https://download.sql.com.my/customer/Fairy/Steps-RestoreDB.gif Restore DB Guide] | ||

===Empty DB=== | ===Empty DB=== | ||

| Line 40: | Line 41: | ||

Before wanted to Import/Post to SQL Accounting Database, below information/setting must set in the SQL Accounting<br /> | Before wanted to Import/Post to SQL Accounting Database, below information/setting must set in the SQL Accounting<br /> | ||

01. Click ''Tools | Options... | Customer'' <br> | 01. Click ''Menu: View'' <br> | ||

: Untick(UnSelect) the option | |||

:* Command Navigator | |||

:* Tabbed Docking | |||

:* Allow Multiple Windows | |||

:* Enable Windows Task Bar | |||

02. Click ''Menu: Tools | Options... | Customer'' <br> | |||

: Tick(Select) the option | : Tick(Select) the option | ||

:* Use Cash Sales No. for Payment Received | :* Use Cash Sales No. for Payment Received | ||

| Line 49: | Line 57: | ||

:* 5 Cents Rounding (Cash Sales) | :* 5 Cents Rounding (Cash Sales) | ||

03. Click ''Menu: Tools | Options... | Miscellaneous '' <br> | |||

: Untick(UnSelect) the option | : Untick(UnSelect) the option | ||

:* Prompt Negative Stock Quantity Dialog Box | :* Prompt Negative Stock Quantity Dialog Box | ||

:* Prompt Duplicate Cheque Number | :* Prompt Duplicate Cheque Number | ||

04. Click ''Menu: Tools | Maintain User... | New'' | |||

: Create New User (eg POS) | : Create New User (eg POS) | ||

05. Click ''Menu: Tools | Maintain User... | Access Right'' | |||

: Tick (Select) the option | : Tick (Select) the option | ||

:* '''Override Customer Credit Control''' under the '''Group : Customer''' | :* '''Override Customer Credit Control''' under the '''Group : Customer''' | ||

:* '''Override Sales Min/Max Price''' under the '''Group : Sales''' | |||

:* '''Override Acceptable Transaction Date''' under the '''Group : Tools''' | |||

:* '''Save on Negative Quantity''' under the '''Group : Stock''' | |||

: Untick (UnSelect) the option | : Untick (UnSelect) the option | ||

::Under the '''Group : Sales''' | ::Under the '''Group : Sales''' | ||

::* Prompt Replace Unit Price Dialog | ::* Prompt Replace Unit Price Dialog | ||

::* Show Payment / Change Dialog in Cash Sales | ::* Show Payment / Change Dialog in Cash Sales | ||

06. Must be had/valid in SQL Accounting | |||

{| class="wikitable" style="margin: 1em auto 1em auto;" | {| class="wikitable" style="margin: 1em auto 1em auto;" | ||

|- | |- | ||

! Field !! | ! Field !! In SQL Accounting | ||

|- | |- | ||

| Customer Code || Customer => Maintain Customer | | Customer Code || Customer => Maintain Customer | ||

| Line 95: | Line 105: | ||

|} | |} | ||

07. Below is Optional (i.e. if had post/import item code to SQL Accounting) | |||

{| class="wikitable" style="margin: 1em auto 1em auto;" | {| class="wikitable" style="margin: 1em auto 1em auto;" | ||

|- | |- | ||

| Line 122: | Line 132: | ||

==Table/Fields Detail== | ==Table/Fields Detail== | ||

* Updated | * Updated 05 Oct 2024 | ||

* | * [https://docs.google.com/spreadsheets/d/1K-eWqe-NHfJfqn9kaoJc4m5YZCvKmGw7WmHqV5Hj6XU/edit?usp=sharing DetailSpec] | ||

===Normal Used Table Name=== | ===Normal Used Table/Biz Object Name=== | ||

---Sales Side--- | ---Sales Side--- | ||

{| class="wikitable" style="margin: 1em auto 1em auto;" | |||

|- | |||

! Biz Object !! Description | |||

|- | |||

| align="center" | AR_Customer || Maintain Customer | |||

|- | |||

| align="center" | SL_IV || Sales Invoice | |||

|- | |||

| align="center" | SL_CS || Cash Sales | |||

|- | |||

| align="center" | SL_CN || Sales Credit Note | |||

|- | |||

| align="center" | SL_DN || Sales Debit Note | |||

|- | |||

| align="center" | AR_PM || Customer Payment | |||

|- | |||

| align="center" | AR_IV || Customer Invoice | |||

|- | |||

| align="center" | AR_DN || Customer Debit Note | |||

|- | |||

| align="center" | AR_CN || Customer Credit Note | |||

|} | |||

---Purchase Side--- | ---Purchase Side--- | ||

{| class="wikitable" style="margin: 1em auto 1em auto;" | |||

|- | |||

! Biz Object !! Description | |||

|- | |||

| align="center" | AP_Supplier || Maintain Supplier | |||

|- | |||

| align="center" | PH_PI || Purchase Invoice | |||

|- | |||

| align="center" | PH_CP || Cash Purchase | |||

|- | |||

| align="center" | PH_SC || Purchase Return | |||

|- | |||

| align="center" | PH_SD || Purchase Debit Note | |||

|- | |||

| align="center" | AP_SP || Supplier Payment | |||

|- | |||

| align="center" | AP_PI || Supplier Invoice | |||

|- | |||

| align="center" | AP_SD || Supplier Debit Note | |||

|- | |||

| align="center" | AP_SC || Supplier Credit Note | |||

|} | |||

| Line 165: | Line 203: | ||

===Method 1 (Recommended)=== | ===Method 1 (Recommended)=== | ||

It will be had 4 transactions | It will be had 4 transactions | ||

1. RM1000 - Post to SL_CS & P_PaymentMethod field is empty & P_Amount field is 0 | 1. RM1000 - Post to SL_CS & (<span style="color:#0000ff">P_DocNo, P_PaymentMethod</span> field is empty & <span style="color:#0000ff">P_Amount, P_PaidAmount</span> field is 0) | ||

2. RM700 by Cash - Post to AR_PM | 2. RM700 by Cash - Post to AR_PM | ||

3. RM200 by MasterCard - Post to AR_PM | 3. RM200 by MasterCard - Post to AR_PM | ||

| Line 210: | Line 248: | ||

==FAQ== | ==FAQ== | ||

===Prompt | ===Prompt <code>Invalid class string, ProdID: "SQLAcc.BizApp"</code> error while try to link to SQL Accounting.=== | ||

# Login SQL Accounting | # Login SQL Accounting | ||

# Click Tools | Options | # Click Tools | Options | General | ||

# Click Register & follow wizard | # Click Register & follow wizard | ||

# Exit SQL Accounting | # Exit SQL Accounting | ||

| Line 223: | Line 261: | ||

# Run the above steps again | # Run the above steps again | ||

===Prompt | ===Prompt <code>Access Violation</code> when import.=== | ||

: This happen due to | : This happen due to | ||

: | |||

: The fieldname is not match with SQL Accounting (eg SQLAcc fieldname UDF_Width yr had call for UDF_Weight) | |||

# Old version of SQL Acc Import program, try update the SQL Acc Import program | # Old version of SQL Acc Import program, try update the SQL Acc Import program | ||

# The fieldname had the empty space at the beginning and/or end (norm happen if import from Excel) eg 'DocNo ' or ' DocNo' instead of 'DocNo' | # The fieldname had the empty space at the beginning and/or end (norm happen if import from Excel) eg 'DocNo ' or ' DocNo' instead of 'DocNo' | ||

| Line 232: | Line 271: | ||

: Yes all import will loss the ''Transfer'' status (i.e. if import DO & IV will treat as different) except using SDK import with condition | : Yes all import will loss the ''Transfer'' status (i.e. if import DO & IV will treat as different) except using SDK import with condition | ||

===Which field should I map/insert to for | ===Which field should I map/insert to for Credit Note & Debit Note for Invoice Number, Invoice Date & Reason?=== | ||

: In Generally(Recommended) you can use below field (All in Header Field) | : In Generally(Recommended) you can use below field (All in Header Field) | ||

{| class="wikitable" style="margin: 1em auto 1em auto;" | {| class="wikitable" style="margin: 1em auto 1em auto;" | ||

| Line 256: | Line 295: | ||

|} | |} | ||

===Can I post/import to SQL Accounting in | ===Can I post/import to SQL Accounting in Monthly Basis?=== | ||

: No for GST Era. It advice able to do '''Daily''' Basis posting/import as user had more time to verify if posting/import had Error/Problem | : No for GST/SST Era. It advice able to do '''Daily''' Basis posting/import as user had more time to verify if posting/import had Error/Problem | ||

: Below is the proper steps to do posting/import | : Below is the proper steps to do posting/import | ||

::* Backup | ::* Backup | ||

| Line 288: | Line 327: | ||

: 03. Data redundancy as 2 same data for different system | : 03. Data redundancy as 2 same data for different system | ||

: 04. Avoid wasting time on Sync correctness stock data between 2 system | : 04. Avoid wasting time on Sync correctness stock data between 2 system | ||

Related Ref : [https://wiki.sql.com.my/wiki/SDK_Live#Can_I_control_my_Stock_when_I_link_with_other_Application.3F Can I control my Stock when I link with other Application?] | |||

===Can SQL Acc accept negative amount?=== | ===Can SQL Acc accept negative amount?=== | ||

| Line 293: | Line 334: | ||

:No all document amount(DocAmt field) must not below 0 | :No all document amount(DocAmt field) must not below 0 | ||

===Is there any setting for transaction without | ===Is there any setting for transaction without Tax?=== | ||

: No there is no special setting. All you had to do is to set the following field to | : No there is no special setting. All you had to do is to set the following field to | ||

{| class="wikitable" style="margin: 1em auto 1em auto;" | {| class="wikitable" style="margin: 1em auto 1em auto;" | ||

| Line 323: | Line 364: | ||

|} | |} | ||

<div style="float: right;"> [[#top|[top]]]</div> | <div style="float: right;"> [[#top|[top]]]</div> | ||

===Prompt | ===Prompt <code>Could not convert variant of type (Null) into type (Integer)</code> error while try to post (eg Invoice)=== | ||

: Make sure the database you login is had Started the GST. | : Make sure the database you login is had Started the GST. | ||

| Line 339: | Line 379: | ||

! Add TaxRate Field Script/Code | ! Add TaxRate Field Script/Code | ||

|- | |- | ||

| | | | ||

... | ... | ||

lDtl.FindField('TAX').AsString := 'SR'; | lDtl.FindField('TAX').AsString := 'SR'; | ||

| Line 354: | Line 393: | ||

===Is there any changes in Linking for the SST?=== | ===Is there any changes in Linking for the SST?=== | ||

* GST to No SST | * GST to No SST | ||

: May follow [https://wiki.sql.com.my/wiki/SQL_Accounting_Linking# | : May follow [https://wiki.sql.com.my/wiki/SQL_Accounting_Linking#Is_there_any_setting_for_transaction_without_Tax? Non GST] | ||

* GST to SST | * GST to SST | ||

| Line 360: | Line 399: | ||

{| class="wikitable" style="margin: 1em auto 1em auto;" | {| class="wikitable" style="margin: 1em auto 1em auto;" | ||

|- | |- | ||

! Tax Code !! Description !! Rate | ! Tax Code !! Description !! Rate !! Required Tariff Code | ||

|- | |- | ||

| ST5 || Sales Tax || 5% | | ST5 || Sales Tax || align="center" | 5% || align="center" |Y | ||

|- | |- | ||

| ST || Sales Tax || 10% | | ST || Sales Tax || align="center" | 10% || align="center" |Y | ||

|- | |- | ||

| SV || Service Tax || 6% | | SV || Service Tax || align="center" | 6% (8% From 01 Mar 2024) || align="center" |Y | ||

|- | |- | ||

| STE || Sales Tax Exempted || | | STE || Sales Tax Exempted || || align="center" |N | ||

|} | |} | ||

| Line 377: | Line 416: | ||

| TARIFF ||String||align="center" |20||align="center" |C|||| | | TARIFF ||String||align="center" |20||align="center" |C|||| | ||

* Tariff or HS Code | * Tariff or HS Code | ||

* Mandatory - If posting to GL, | * Mandatory - If posting to | ||

: - GL Payment Voucher & GL Official Receipt | |||

: - Customer Invoice, Debit Note & Credit Note | |||

: - Supplier Invoice, Debit Note & Credit Note | |||

: - All Sales & Purchase Module without '''Item Code''' | |||

* No Required - If posting Sales & Purchase with '''Item Code''' | |||

|} | |||

<div style="float: right;"> [[#top|[top]]]</div> | |||

===How to SQL Accounting handle if had Discount/Cash Voucher?=== | |||

: You can treat the Discount/Cash Voucher as Part of item row but is in Negative UnitPrice | |||

[[File:SQLLink-03.jpg|800px|center]] | |||

===Begin 11 Oct 2019 the Company ROC/BRN will increase to 12 digit characters. Any changes in Linking?=== | |||

: Yes if user is upgrade to Version 875.782 & above. | |||

: Table Affected | |||

::- SY_PROFILE => File | Company Profile | |||

::- AR_CUSTOMER => Customer | Maintain Customer | |||

::- AP_SUPPLIER => Supplier | Maintain Supplier | |||

: Field Changes | |||

::- Original Name '''REGISTERNO''' change to <span style="color:#0000ff">BRN</span> | |||

::- New Field <span style="color:#0000ff">BRN2</span> | |||

::- New Field Size for both Fields <span style="color:#0000ff">30</span> | |||

[https://www.ssm.com.my/Lists/Announcement/AnnouncementDetails.aspx?ID=134 SSM Announcement] or [https://download.sql.com.my/customer/Fairy/Announcement-NewROC.pdf PDF] | |||

===Is there any changes in Linking for the E-Invoicing?=== | |||

New Field Added<br> | |||

Available in Version 5.2024.983.848 & above | |||

{| class="mw-collapsible mw-collapsed wikitable" | |||

! Maintain Customer & Maintain Supplier | |||

|- | |||

| | |||

{| class="wikitable" style="margin: 1em auto 1em auto;" | |||

! Field Name !! Field Type !! Field Size !! Remarks | |||

|- | |||

| TIN ||String||align="center" |14|| Company Tax Register Number | |||

|- | |||

| IDTYPE ||Integer || || | |||

* 0 - Empty | |||

* 1 - Reg No | |||

* 2 - NRIC | |||

* 3 - Passport | |||

* 4 - ARMY | |||

|- | |||

| IDNO ||String||align="center" |20|| This field will depend on the ID Type selected | |||

|- | |||

| TOURISMNO ||String||align="center" |17|| This is only applicable to tourism tax registrant, which may consist of hotel operators and online travel operators | |||

|- | |||

| SIC ||String||align="center" |10|| | |||

* Malaysia Standard Industrial Classification (MSIC) Codes | |||

* https://sdk.myinvois.hasil.gov.my/codes/#msic-codes | |||

* Available in Version (TBA) | |||

* Maintain Supplier Only | |||

|- | |||

| SUBMISSIONTYPE ||Integer ||align="center" | 0|| | |||

* Available in Version 5.2024.992.854 & above | |||

* 0 = None | |||

* 17 = E-Invoice/Self Billing(for Maintain Supplier) | |||

* 18 = Consolidate | |||

|- | |||

| IRBM_CLASSIFICATION ||String||align="center" |3|| | |||

* Maintain Supplier Only | |||

* Category of products or services being billed as a result of a commercial transaction. More than 1 classification codes can be added for goods / services included in the e-Invoice. | |||

* https://sdk.myinvois.hasil.gov.my/codes/classification-codes/ | |||

* Available in Version 5.2024.990.852 & above | |||

|- | |||

| POSTCODE ||String||align="center" |10|| The identifier for an addressable group of properties according to the relevant postal service | |||

|- | |||

| CITY ||String||align="center" |50|| The common name of the city, town or village, where the Customer/Supplier address is located. | |||

|- | |||

| STATE ||String||align="center" |50|| | |||

* The state of a country. | |||

* https://sdk.myinvois.hasil.gov.my/codes/state-codes/ | |||

|- | |||

| COUNTRY ||String||align="center" |2|| | |||

* A code that identifies the country. | |||

* May refer to Country List [https://docs.google.com/spreadsheets/d/1TcFVqH1VCJ5SjHAt2VCHIeTTcQVUjtIBxLaZGGM0E5k/edit?gid=1859696683#gid=1859696683 Here] | |||

|} | |} | ||

|} | |||

{| class="mw-collapsible mw-collapsed wikitable" | |||

! Maintain Stock Item | |||

|- | |||

| | |||

{| class="wikitable" style="margin: 1em auto 1em auto;" | |||

! Field Name !! Field Type !! Field Size !! Remarks | |||

|- | |||

| IRBM_CLASSIFICATION ||String||align="center" |3|| | |||

* Category of products or services being billed as a result of a commercial transaction. More than 1 classification codes can be added for goods / services included in the e-Invoice. | |||

* https://sdk.myinvois.hasil.gov.my/codes/classification-codes/ | |||

|} | |||

|} | |||

Available in Version 5.2024.990.852 & above | |||

{| class="mw-collapsible mw-collapsed wikitable" | |||

! Sales & Purchase Data Entry - Header | |||

|- | |||

| | |||

{| class="wikitable" style="margin: 1em auto 1em auto;" | |||

! Field Name !! Field Type !! Field Size !! Remarks | |||

|- | |||

| EIVDATETIME || DateTime ||align="center" |0|| | |||

* E-Invoicing Submitted Date time in the UTC timezone | |||

* eg 19/07/2024 7:17:43 AM | |||

|- | |||

| IRBM_UUID ||String||align="center" |26|| | |||

* E-Invoicing Submited respond UUID | |||

*eg FSEP22A4Y5BFGGWAX95N943811 | |||

|- | |||

| IRBM_LONGID ||String||align="center" |50|| | |||

* E-Invoicing Submited respond Long UUID | |||

* eg TM9AFNQ0M76T07BTX95NX43J10CzvSE31712365482 | |||

|- | |||

| IRBM_STATUS ||Integer ||align="center" |0|| | |||

* E-Invoicing Submited Status | |||

* https://sdk.myinvois.hasil.gov.my/faq/ | |||

* eg 2 | |||

|- | |||

| POSTCODE ||String||align="center" |10|| The identifier for an addressable group of properties according to the relevant postal service | |||

|- | |||

| CITY ||String||align="center" |50|| The common name of the city, town or village, where the Customer/Supplier address is located. | |||

|- | |||

| STATE ||String||align="center" |50|| | |||

* The state of a country. | |||

* https://sdk.myinvois.hasil.gov.my/codes/state-codes/ | |||

|- | |||

| COUNTRY ||String||align="center" |2|| | |||

* A code that identifies the country. | |||

* May refer to Country List [https://docs.google.com/spreadsheets/d/1TcFVqH1VCJ5SjHAt2VCHIeTTcQVUjtIBxLaZGGM0E5k/edit?gid=1859696683#gid=1859696683 Here] | |||

|- | |||

| DPOSTCODE ||String||align="center" |10|| The identifier for an addressable group of properties according to the relevant postal service | |||

|- | |||

| DCITY ||String||align="center" |50|| The common name of the city, town or village, where the Customer/Supplier address is located. | |||

|- | |||

| DSTATE ||String||align="center" |50|| | |||

* The state of a country. | |||

* https://sdk.myinvois.hasil.gov.my/codes/state-codes/ | |||

|- | |||

| DCOUNTRY ||String||align="center" |2|| | |||

* A code that identifies the country. | |||

* May refer to Country List [https://docs.google.com/spreadsheets/d/1TcFVqH1VCJ5SjHAt2VCHIeTTcQVUjtIBxLaZGGM0E5k/edit?gid=1859696683#gid=1859696683 Here] | |||

|- | |||

| SALESTAXNO ||String||align="center" |25|| | |||

|- | |||

| SERVICETAXNO ||String||align="center" |25|| | |||

|- | |||

| TIN ||String||align="center" |14|| Company Tax Register Number | |||

|- | |||

| IDTYPE ||Integer || || | |||

* 0 - Empty | |||

* 1 - Reg No | |||

* 2 - NRIC | |||

* 3 - Passport | |||

* 4 - ARMY | |||

|- | |||

| IDNO ||String||align="center" |20|| This field will depend on the ID Type selected | |||

|- | |||

| TOURISMNO ||String||align="center" |17|| This is only applicable to tourism tax registrant, which may consist of hotel operators and online travel operators | |||

|- | |||

| SIC ||String||align="center" |10|| | |||

* Malaysia Standard Industrial Classification (MSIC) Codes | |||

* https://sdk.myinvois.hasil.gov.my/codes/#msic-codes | |||

* Maintain Supplier Only | |||

|- | |||

| INCOTERMS ||String||align="center" |20|| A set of international trade rules that define the responsibilities of buyers and suppliers.The input of special characters is not allowed. | |||

|- | |||

| SUBMISSIONTYPE ||Integer ||align="center" | 0|| | |||

* Available in Version 5.2024.992.854 & above | |||

* 0 = None | |||

* 17 = E-Invoice/Self Billing(for Purchase Only) | |||

* 18 = Consolidate | |||

|} | |||

|} | |||

{| class="mw-collapsible mw-collapsed wikitable" | |||

! Sales & Purchase Data Entry - Detail | |||

|- | |||

| | |||

{| class="wikitable" style="margin: 1em auto 1em auto;" | |||

! Field Name !! Field Type !! Field Size !! Remarks | |||

|- | |||

| TAXEXEMPTIONREASON ||String||align="center" |300|| | |||

* Available in Version 5.2024.992.854 & above | |||

* For Tax Exemption Code use only | |||

|- | |||

| IRBM_CLASSIFICATION ||String||align="center" |3|| | |||

* Category of products or services being billed as a result of a commercial transaction. More than 1 classification codes can be added for goods / services included in the e-Invoice. | |||

* https://sdk.myinvois.hasil.gov.my/codes/classification-codes/ | |||

|} | |||

|} | |||

Available in Version 5.2024.990.852 & above | |||

{| class="mw-collapsible mw-collapsed wikitable" | |||

! Maintain Currency | |||

|- | |||

| | |||

{| class="wikitable" style="margin: 1em auto 1em auto;" | |||

! Field Name !! Field Type !! Field Size !! Remarks | |||

|- | |||

| ISOCODE ||String||align="center" |3|| | |||

* https://sdk.myinvois.hasil.gov.my/codes/countries/ | |||

|} | |||

|} | |||

* <big>Need assistance? May email to '''support@sql.com.my'''</big> | |||

Latest revision as of 05:07, 24 October 2024

Introduction

We had 4 Methods to Integrate/Link to SQL Accounting

|

SQL Accounting & Firebird Program

Database

Sample DB

Empty DB

- At the Login Screen Click 2 dot Button

- Click Create New Database

- Follow the wizard

|

Things To Consider Before Import/Post

Before wanted to Import/Post to SQL Accounting Database, below information/setting must set in the SQL Accounting

01. Click Menu: View

- Untick(UnSelect) the option

- Command Navigator

- Tabbed Docking

- Allow Multiple Windows

- Enable Windows Task Bar

02. Click Menu: Tools | Options... | Customer

- Tick(Select) the option

- Use Cash Sales No. for Payment Received

- Untick(UnSelect) the option

- Perform Tax / Local Amount Rounding

- 5 Cents Rounding (Sales Invoice)

- 5 Cents Rounding (Cash Sales)

03. Click Menu: Tools | Options... | Miscellaneous

- Untick(UnSelect) the option

- Prompt Negative Stock Quantity Dialog Box

- Prompt Duplicate Cheque Number

04. Click Menu: Tools | Maintain User... | New

- Create New User (eg POS)

05. Click Menu: Tools | Maintain User... | Access Right

- Tick (Select) the option

- Override Customer Credit Control under the Group : Customer

- Override Sales Min/Max Price under the Group : Sales

- Override Acceptable Transaction Date under the Group : Tools

- Save on Negative Quantity under the Group : Stock

- Untick (UnSelect) the option

- Under the Group : Sales

- Prompt Replace Unit Price Dialog

- Show Payment / Change Dialog in Cash Sales

- Under the Group : Sales

06. Must be had/valid in SQL Accounting

| Field | In SQL Accounting |

|---|---|

| Customer Code | Customer => Maintain Customer |

| Supplier Code | Supplier => Maintain Supplier |

| Terms Code | Tools => Maintain Terms |

| Project Code | Tools => Maintain Project |

| Sales/Purchase Account Code | GL => Maintain Account |

| Sales/Purchase Return Account Code | GL => Maintain Account |

| Cash/Bank Account Code | Tools => Maintain Payment Method (Created from Maintain Account) |

| Agent Code | Tools => Maintain Agent |

| Area Code | Tools => Maintain Area |

| Currency Code | Tools => Maintain Currency |

| Tax Code | Tools => Maintain Tax (if had GST) |

07. Below is Optional (i.e. if had post/import item code to SQL Accounting)

| Field | Location/Form |

|---|---|

| Item Code | Stock => Maintain Stock Item |

| Location Code | Stock => Maintain Location |

| Batch Code | Stock => Maintain Batch |

|

Table/Fields Detail

- Updated 05 Oct 2024

- DetailSpec

Normal Used Table/Biz Object Name

---Sales Side---

| Biz Object | Description |

|---|---|

| AR_Customer | Maintain Customer |

| SL_IV | Sales Invoice |

| SL_CS | Cash Sales |

| SL_CN | Sales Credit Note |

| SL_DN | Sales Debit Note |

| AR_PM | Customer Payment |

| AR_IV | Customer Invoice |

| AR_DN | Customer Debit Note |

| AR_CN | Customer Credit Note |

---Purchase Side---

| Biz Object | Description |

|---|---|

| AP_Supplier | Maintain Supplier |

| PH_PI | Purchase Invoice |

| PH_CP | Cash Purchase |

| PH_SC | Purchase Return |

| PH_SD | Purchase Debit Note |

| AP_SP | Supplier Payment |

| AP_PI | Supplier Invoice |

| AP_SD | Supplier Debit Note |

| AP_SC | Supplier Credit Note |

Posting Information

- Detail Data should Group by Stock Group/Category & TaxType (ZRL or SR) & Itemcode (if wanted import itemcode)

- Eg. Cafe can be group by

- - Food - SR

- - Food - ZRL

- - Beverage

- - Service Charges

- - Rounding

- Eg. Today got 10 transactions

- - 8 is Simplified Invoice - Group as 1 Doc No - POS-00001

- - 2 is Full Tax Invoice/Credit Sales Invoice - 1 by 1 in - POS-00002, POS-00003

- All can post to SL_CS & AR_PM

- Below is example Today Total Simplified Invoice Sales is RM1000

Method 1 (Recommended)

It will be had 4 transactions

1. RM1000 - Post to SL_CS & (P_DocNo, P_PaymentMethod field is empty & P_Amount, P_PaidAmount field is 0) 2. RM700 by Cash - Post to AR_PM 3. RM200 by MasterCard - Post to AR_PM 4. RM100 by CreditCard - Post to AR_PM

Pros : Easy to Edit or Delete the transactions

Cons : Many Posting document

Method 2

It will be had 3 transactions

1. RM700 by Cash - Post to SL_CS P_PaymentMethod field 2. RM200 by MasterCard - Post to AR_PM 3. RM100 by CreditCard - Post to AR_PM

Pros : Less Posting document

Cons :

- Not Easy to Edit or Delete the transactions

- Cash Sales OR number unable to override (i.e. System Auto set/assign)

Extra Notes

- Both Full Tax & Simplified IV can use same Debtor Code as Not mention required Customer GST ID

- Government 5 cents Rounding Mechanism - NO Tax/GST Code

- Deposit for Non Refundable can use Customer Payment (AR_PM) & set NONREFUNDABLE field to 1

- - Default is SR

- - Will auto reverse once it being Knock-Off

- Doc Disc should proportion by sub total amt for mix tax code (See Cash Sales POS-DocDisc)

- Example

- - Doc Discount = 10% of Document Discount

- - Sub Total for SR = 150.24 => Disc (150.24 * 10%) = 15.02

- - Sub Total for ZR = 988.88 => Disc (988.88 * 10%) = 98.89

0r

- - Doc Discount = 113.91

- - Sub Total for SR = 150.24 => Disc ((150.24/1139.12) * 113.91) = 15.02

- - Sub Total for ZR = 988.88 => Disc ((988.88/1139.12) * 113.91) = 98.89

- Mixed Supplies Tax Code

- - ES

- - TX-ES (Replace TX-N43)

- - TX-RE

- Realise Bad Debts Use CN as Normal

- - System will contra the provision bad debts done at GST-03 by 6 mth bad debts

- - Make sure Knock the actual Bad debts Invoice

- For Purchase Invoice(PI) MUST 1 by 1 post in (i.e. can't Group multi PI in 1 PI)

FAQ

Prompt Invalid class string, ProdID: "SQLAcc.BizApp" error while try to link to SQL Accounting.

- Login SQL Accounting

- Click Tools | Options | General

- Click Register & follow wizard

- Exit SQL Accounting

- Login SQL Accounting

- Try run you application to link again

- If still prompt after above steps

- Uninstall SQL Accounting

- Stop Anti Virus

- Reinstall SQL Accounting

- Run the above steps again

Prompt Access Violation when import.

- This happen due to

- The fieldname is not match with SQL Accounting (eg SQLAcc fieldname UDF_Width yr had call for UDF_Weight)

- Old version of SQL Acc Import program, try update the SQL Acc Import program

- The fieldname had the empty space at the beginning and/or end (norm happen if import from Excel) eg 'DocNo ' or ' DocNo' instead of 'DocNo'

Why after import the DO still had outstanding even the Invoice had imported?

- Yes all import will loss the Transfer status (i.e. if import DO & IV will treat as different) except using SDK import with condition

Which field should I map/insert to for Credit Note & Debit Note for Invoice Number, Invoice Date & Reason?

- In Generally(Recommended) you can use below field (All in Header Field)

| SQL Accounting Field | Mapping Field | Description |

|---|---|---|

| DocNoEx | Invoice Number | Field Size : 20 |

| DocRef1 | Invoice Date | Field Size : 25 |

| Description | Reason | Field Size : 200 |

- If you wanted posted in Detail Field also can

| SQL Accounting Field | Mapping Field | Description |

|---|---|---|

| Remark1 | Invoice Number | Field Size : 200 |

| Remark2 | Invoice Date | Field Size : 200 |

| Description2 | Reason | Field Size : 200 |

Can I post/import to SQL Accounting in Monthly Basis?

- No for GST/SST Era. It advice able to do Daily Basis posting/import as user had more time to verify if posting/import had Error/Problem

- Below is the proper steps to do posting/import

- Backup

- Post/Import to SQL Accounting

- Compare Listing in SQL Accounting with the POS/External Program Listing

In my system had multiple level document discount, how to post to SQL Accounting?

- You can insert 2 or more rows(depend how many level you had) of item as negative unitprice.

- But as mention above Extra Notes proportion by sub total amt for mix tax code.

Can I do like this, DR Bank/Cash In hand/Debtor & CR Sales Account using Journal?

- No. The correct Double Entry is as following

- - Invoice/Cash Sales

- DR Debtor

- CR Sales Account

- - Payment Received

- DR Bank/Cash In Hand

- CR Debtor

- - Invoice/Cash Sales

Can I use just ADMIN ID to Import/Posting?

- No. ADMIN had full Access Right & if had problem user might had problem trace back who doing the importing...

- It adviceable to create Another ID with less Access Right

Can SQL Accounting & External Program(eg POS) Import/Posting doing Stock Control in same time?

- Yes, but we Recommended External Program(eg POS) to do all the Stock Control if the External Program(eg POS)

- able to do all the report Required by the User.

- Reason :

- 01. Faster Import time

- 02. Timing issue as in SQL Acc the Qty is ALWAYS outdated cause real Stock In/Out is from the External Program(eg POS)

- 03. Data redundancy as 2 same data for different system

- 04. Avoid wasting time on Sync correctness stock data between 2 system

Related Ref : Can I control my Stock when I link with other Application?

Can SQL Acc accept negative amount?

- Yes if for Item Row Amount

- No all document amount(DocAmt field) must not below 0

Is there any setting for transaction without Tax?

- No there is no special setting. All you had to do is to set the following field to

| Field | Value |

|---|---|

| Tax | '' |

| TaxInclusive | 0 |

| TaxAmt | 0 |

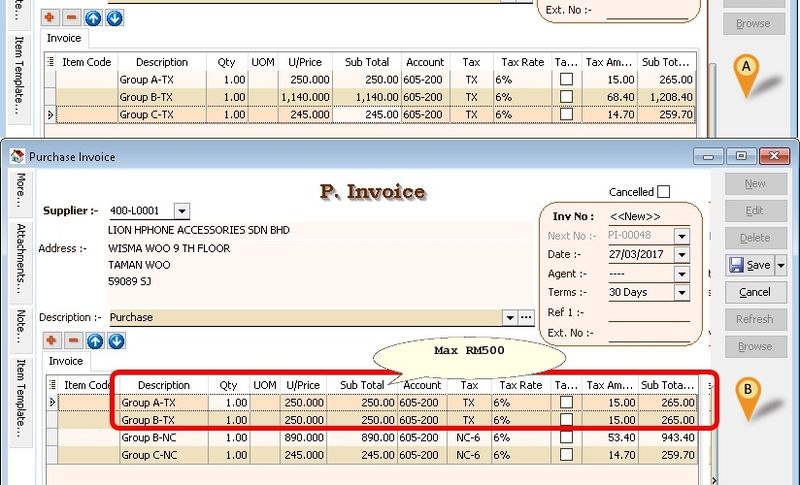

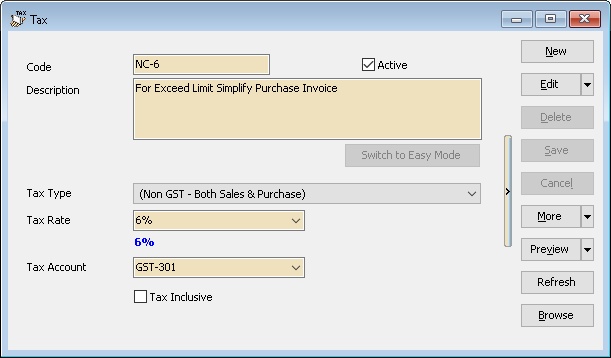

How to post If supplier given is Simplified Invoice but exceed RM500?

- It advisable to ask the user to Request Full Tax Invoice from their supplier as user might pay double Tax due to add back for non claimable amount to the company profit by their Audit/Accountant.

- Below is example(suggest) how we post to Simplified Invoice from supplier

|

Prompt Could not convert variant of type (Null) into type (Integer) error while try to post (eg Invoice)

- Make sure the database you login is had Started the GST.

How to post SR with 6% for issue document after 01 Jun 2018?

- There are 2 solutions

Solution 1

| Add TaxRate Field Script/Code |

|---|

|

... lDtl.FindField('TAX').AsString := 'SR';

lDtl.FindField('TAXRATE').AsString := '6%';

... |

Solution 2

- Create New Tax SR tax code with 6%(eg SR6) in SQL Accounting

Is there any changes in Linking for the SST?

- GST to No SST

- May follow Non GST

- GST to SST

- There is no much changes. Just treat is like normal GST only different is the Tax Code

| Tax Code | Description | Rate | Required Tariff Code |

|---|---|---|---|

| ST5 | Sales Tax | 5% | Y |

| ST | Sales Tax | 10% | Y |

| SV | Service Tax | 6% (8% From 01 Mar 2024) | Y |

| STE | Sales Tax Exempted | N |

- New Field added

| Field Name | Field Type | Field Size | Mandatory | Default Value | Remarks |

|---|---|---|---|---|---|

| TARIFF | String | 20 | C |

|

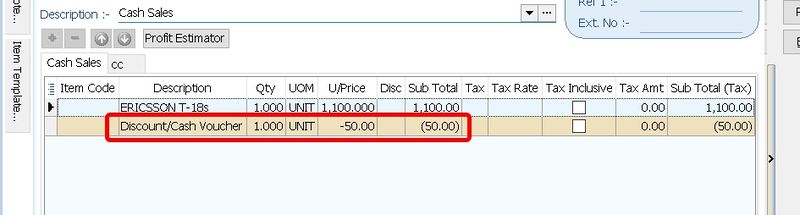

How to SQL Accounting handle if had Discount/Cash Voucher?

- You can treat the Discount/Cash Voucher as Part of item row but is in Negative UnitPrice

Begin 11 Oct 2019 the Company ROC/BRN will increase to 12 digit characters. Any changes in Linking?

- Yes if user is upgrade to Version 875.782 & above.

- Table Affected

- - SY_PROFILE => File | Company Profile

- - AR_CUSTOMER => Customer | Maintain Customer

- - AP_SUPPLIER => Supplier | Maintain Supplier

- Field Changes

- - Original Name REGISTERNO change to BRN

- - New Field BRN2

- - New Field Size for both Fields 30

Is there any changes in Linking for the E-Invoicing?

New Field Added

Available in Version 5.2024.983.848 & above

| Maintain Customer & Maintain Supplier | ||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

| Maintain Stock Item | ||||||||

|---|---|---|---|---|---|---|---|---|

|

Available in Version 5.2024.990.852 & above

| Sales & Purchase Data Entry - Header | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

| Sales & Purchase Data Entry - Detail | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Available in Version 5.2024.990.852 & above

| Maintain Currency | ||||||||

|---|---|---|---|---|---|---|---|---|

|

- Need assistance? May email to support@sql.com.my