| (86 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

==Introduction== | ==Introduction== | ||

Is External Shareware Program which to import F&N Text file to | Is External Shareware Program which to import F&N Text file to | ||

* Sales Invoice | |||

* Sales Credit Note | |||

Export E-Invoice to F&N - Available in Build 18 & Above | |||

* Sales Invoice | * Sales Invoice | ||

* Sales Credit Note | * Sales Credit Note | ||

| Line 8: | Line 12: | ||

==F & N Specification== | ==F & N Specification== | ||

* 17 Jun 2015 | * 17 Jun 2015 - ''ESD soft-drink'' | ||

* | * https://download.sql.com.my/customer/Fairy/FN-Acct_Integration_Reference-20150617.zip | ||

* 15 Aug 2016 - ''ESD Online'' | |||

* https://download.sql.com.my/customer/Fairy/FN-Acct_Integration_Reference-20160815.zip | |||

<div style="float: right;"> [[#top|[top]]]</div> | |||

==Import Program== | ==Import Program== | ||

* Version ( | * Version (3.5.0.20) - 10 Oct 2024 | ||

* | * Evaluation Limit : 50 Records per file | ||

* MD5 : | * https://download.sql.com.my/customer/Fairy/SQLAccFNImp-setup.exe | ||

* MD5 : 0C5BC371CCCD2A67E3AE92F9B7067FCA | |||

===History New/Updates/Changes=== | ===History New/Updates/Changes=== | ||

--Build 20-- | |||

* Fixed Export E-IV for CN apply error. | |||

* Fixed Export E-IV dateTimeValidated formatting not correct. | |||

--Build 19-- | |||

* Enable Import E-Invoice Info from FnN. | |||

* Fixed Export E-IV header delimiter not correct. | |||

--Build 18-- | |||

* Upgrade to Version 3.6. | |||

* Add FnN to Header Field CC as indicator Import from FnN. | |||

* Remove L tax code from import. | |||

* Set Default Open FnN ESD Online Files format. | |||

* Add E-Invoicing Export function. | |||

--Build 17-- | |||

* Fixed Use UOMList not working. | |||

--Build 16-- | |||

* Add Import Remark to DeliveryTerm Field for CSV format. | |||

--Build 15-- | |||

* Add Auto Set to Outlet_ID2 if Debtor_Code2 is empty for CSV format. | |||

* Add Get User Guide Option. | |||

--Build 14-- | |||

* Upgrade to Version 3.5. | |||

* Enable support Running In Windows Limited User. | |||

* Fixed Verify Detail Error not untick the Master when itemcode not found. | |||

* Fixed Verify Not Check Item Code UOM. | |||

* Fixed Scrollbar not visible. | |||

--Build 13-- | |||

* Upgrade to Version 3.4. | |||

* Add Project & Location Lookup for Posting. | |||

--Build 12-- | |||

* Add Outlet_ID2 to shown in Grid. | |||

--Build 11-- | |||

* Upgrade to D25 Compiler. | |||

* Upgrade to Version 3.3. | |||

* Remove Import Debtor_Name2. | |||

--Build 10-- | |||

* Upgrade to XE10 Compiler. | |||

* Upgrade to Version 3.2 | |||

* Add Link to SQL Acc. File | Run. | |||

* Add OutletID=Maintain Customer Code | |||

* Add ESD Online - CSV Format | |||

--Build 9-- | --Build 9-- | ||

* Fix unable to import docamt is 0 even is no DS Code. | * Fix unable to import docamt is 0 even is no DS Code. | ||

| Line 27: | Line 88: | ||

--Build 7-- | --Build 7-- | ||

* Fix CN Get File Error. | * Fix CN Get File Error. | ||

<div style="float: right;"> [[#top|[top]]]</div> | |||

==Todo== | ==Todo== | ||

* | * | ||

==Field Mapping - Header== | ==Field Mapping - Header== | ||

* As at 17 Jun 2015 - ''ESD soft-drink'' - Fixed Length Format | |||

{| class="wikitable" style="margin: 1em auto 1em auto;" | {| class="wikitable" style="margin: 1em auto 1em auto;" | ||

|- | |- | ||

! FnN Field !! Field Position !! SQL Accounting Field | ! FnN Field !! Field Position !! Field Size !! SQL Accounting Field | ||

|- | |- | ||

| Invoice_Date || style="text-align: center;" | 1 || DocDate | | Invoice_Date || style="text-align: center;" | 1 || style="text-align: center;" | 10 || DocDate | ||

|- | |- | ||

| | | Invoice_ID || style="text-align: center;" | 11 || style="text-align: center;" | 10 || DocNo | ||

|- | |- | ||

| | | Gross Amount || style="text-align: center;" | 41 || style="text-align: center;" | 10 || DocAmt | ||

|- | |- | ||

| | | Outlet_ID || style="text-align: center;" | 71|| style="text-align: center;" | 10 || Maintain Customer Remark or Code | ||

|} | |||

* As at 15 Aug 2016 - ''ESD Online'' - CSV Format | |||

{| class="wikitable" style="margin: 1em auto 1em auto;" | |||

|- | |||

! FnN Field !! Field Position !! Field Size !! SQL Accounting Field | |||

|- | |||

| Invoice_Date || style="text-align: center;" | 0 || style="text-align: center;" | 10 || DocDate | |||

|- | |||

| Invoice_ID || style="text-align: center;" | 1 || style="text-align: center;" | 15 || DocNo | |||

|- | |||

| Total_Gross_Amount || style="text-align: center;" | 4 || style="text-align: center;" | 10 || DocAmt | |||

|- | |||

| Debtor_Code2 || style="text-align: center;" | 9 || style="text-align: center;" | 10 || Customer Code | |||

|- | |||

| <del>Debtor_Name2</del> || style="text-align: center;" | <del>10</del> || style="text-align: center;" | <del>150</del> || | |||

* <del>Customer Name</del> | |||

* Not valid for Build 11 & above | |||

|- | |||

| Outlet_ID2 || style="text-align: center;" | 11|| style="text-align: center;" | 10 || Display Only | |||

|- | |||

| Remark || style="text-align: center;" | 12|| style="text-align: center;" | 200 || | |||

* Delivery Term | |||

* Available in Build 16 & above | |||

|} | |} | ||

==Field Mapping - Detail== | ==Field Mapping - Detail== | ||

* As at 17 Jun 2015 - ''ESD soft-drink'' - Fixed Length Format | |||

{| class="wikitable" style="margin: 1em auto 1em auto;" | |||

! scope="col" style="width: 450px;" | For Sales Invoice | |||

! scope="col" style="width: 450px;" | For Sales Credit Note | |||

|- style="vertical-align: top;" | |||

| | |||

:{| class="wikitable" | |||

|- | |||

! FnN Field !! Field Position !! Field Size !! SQL Accounting Field | |||

|- | |||

| Item_ID || style="text-align: center;" | 14 || style="text-align: center;" | 10 || Itemcode or <br> Maintain Item Code Note | |||

|- | |||

| Unit or <br> SubUnits || style="text-align: center;" | 74 or <br>84 || style="text-align: center;" | 10 || Qty | |||

|- | |||

| Unit_Price || style="text-align: center;" | 94 || style="text-align: center;" | 10 || UnitPrice | |||

|- | |||

| Discount || style="text-align: center;" | 104 || style="text-align: center;" | 10 || Disc | |||

|- | |||

| Tax_Code || style="text-align: center;" | 139 || style="text-align: center;" | 5 || Tax | |||

|- | |||

| SubTotal_Tax_Amount || style="text-align: center;" | 149 || style="text-align: center;" | 10 || TaxAmt | |||

|- | |||

| SubTotal_Net_Amount || style="text-align: center;" | 189 || style="text-align: center;" | 10 || Amount | |||

|} | |||

|| | |||

:{| class="wikitable" | |||

|- | |||

! FnN Field !! Field Position !! Field Size !! SQL Accounting Field | |||

|- | |||

| Item_ID || style="text-align: center;" | 14 || style="text-align: center;" | 10 || Itemcode or <br> Maintain Item Code Note | |||

|- | |||

| Unit or <br> SubUnits || style="text-align: center;" | 74 or <br>84 || style="text-align: center;" | 10 || Qty | |||

|- | |||

| Unit_Price || style="text-align: center;" | 94 || style="text-align: center;" | 10 || UnitPrice | |||

|- | |||

| Discount || style="text-align: center;" | 104 || style="text-align: center;" | 10 || Disc | |||

|- | |||

| Tax_Code || style="text-align: center;" | 139 || style="text-align: center;" | 5 || Tax | |||

|- | |||

| SubTotal_Tax_Amount || style="text-align: center;" | 149 || style="text-align: center;" | 10 || TaxAmt | |||

|- | |||

| SubTotal_Net_Amount || style="text-align: center;" | 259 || style="text-align: center;" | 10 || Amount | |||

|- | |||

| Reference<br>Reference_date<br>Reference_reason || style="text-align: center;" | 179<br>189<br>199 || style="text-align: center;" | 10<br>10<br>50 || Description2 | |||

|} | |||

|} | |||

* As at 15 Aug 2016 - ''ESD Online'' - CSV Format | |||

{| class="wikitable" style="margin: 1em auto 1em auto;" | |||

! scope="col" style="width: 450px;" | For Sales Invoice | |||

! scope="col" style="width: 450px;" | For Sales Credit Note | |||

|- style="vertical-align: top;" | |||

| | |||

:{| class="wikitable" | |||

|- | |||

! FnN Field !! Field Position !! Field Size !! SQL Accounting Field | |||

|- | |||

| Item_ID || style="text-align: center;" | 2 || style="text-align: center;" | 10 || Itemcode or <br> Maintain Item Code Note | |||

|- | |||

| Unit or <br> SubUnits || style="text-align: center;" | 4 or <br>5 || style="text-align: center;" | 10 || Qty | |||

|- | |||

| Unit_Price || style="text-align: center;" | 6 || style="text-align: center;" | 10 || UnitPrice | |||

|- | |||

| Discount || style="text-align: center;" | 7 || style="text-align: center;" | 10 || Disc | |||

|- | |||

| Tax_Code || style="text-align: center;" | 11 || style="text-align: center;" | 5 || Tax | |||

|- | |||

| SubTotal_Tax_Amount || style="text-align: center;" | 13 || style="text-align: center;" | 10 || TaxAmt | |||

|- | |||

| SubTotal_Net_Amount || style="text-align: center;" | 17 || style="text-align: center;" | 10 || Amount | |||

|} | |||

|| | |||

:{| class="wikitable" | |||

|- | |||

! FnN Field !! Field Position !! Field Size !! SQL Accounting Field | |||

|- | |||

| Item_ID || style="text-align: center;" | 2 || style="text-align: center;" | 10 || Itemcode or <br> Maintain Item Code Note | |||

|- | |||

| Unit or <br> SubUnits || style="text-align: center;" | 4 or <br>5 || style="text-align: center;" | 10 || Qty | |||

|- | |||

| Unit_Price || style="text-align: center;" | 6 || style="text-align: center;" | 10 || UnitPrice | |||

|- | |||

| Discount || style="text-align: center;" | 7 || style="text-align: center;" | 10 || Disc | |||

|- | |||

| Tax_Code || style="text-align: center;" | 11 || style="text-align: center;" | 5 || Tax | |||

|- | |||

| SubTotal_Tax_Amount || style="text-align: center;" | 13 || style="text-align: center;" | 10 || TaxAmt | |||

|- | |||

| SubTotal_Net_Amount || style="text-align: center;" | 19 || style="text-align: center;" | 10 || Amount | |||

|- | |||

| Reference<br>Reference_date<br>Reference_reason || style="text-align: center;" | 16<br>20<br>17 || style="text-align: center;" | 15<br>50<br>10 || Description2 | |||

|} | |||

|} | |||

<div style="float: right;"> [[#top|[top]]]</div> | |||

==Setting== | ==Setting== | ||

===In SQL Accounting=== | ===In SQL Accounting=== | ||

Make sure this option is Tick under '''Tools | Options | Customer''' | 01. May refer to Point 2 at [[SQL_Accounting_Linking#Things_To_Consider_Before_Import.2FPost|Things To Consider Before Import/Post]]<br /> | ||

* | 02. Make sure this option is Tick under '''Tools | Options | Customer''' | ||

* Perform Tax/Local Amount Rounding | |||

===In F&N Import=== | ===In F&N Import=== | ||

| Line 59: | Line 242: | ||

! Options !! Description | ! Options !! Description | ||

|- | |- | ||

| UOMList || List of UOM available in F&N | | UOMList || List of UOM available in F&N (Normally is CTN & PCS) | ||

|- | |- | ||

| DocNoAsDocNo || | | DocNoAsDocNo || | ||

| Line 72: | Line 255: | ||

* 0 : F&N ItemCode will check against UOMList | * 0 : F&N ItemCode will check against UOMList | ||

* 1 : F&N Itemcode UOM same as SQLAcc Itemcode UOM (Recommended) | * 1 : F&N Itemcode UOM same as SQLAcc Itemcode UOM (Recommended) | ||

|- | |||

| OutletIDAsCompCode || | |||

* For ESD soft-drink - Fixed Length Format Only | |||

* 0 : F&N Outlet ID will check against SQL Accounting | Maintain Customer | Remark Field | |||

* 1 : F&N Outlet ID same as SQLAcc Customer Code (Recommended) | |||

|} | |} | ||

* F&N '''Outlet ID''' should be enter in SQL Accounting | Maintain Customer | Remark Field | * <s>F&N '''Outlet ID''' should be enter in SQL Accounting | Maintain Customer | Remark Field</s> - Not valid for Build 10 & above | ||

<div style="float: right;"> [[#top|[top]]]</div> | |||

==Steps== | ==Steps== | ||

===Import Invoice/Credit Note=== | |||

Below steps is example to import Sales Invoice<br /> | Below steps is example to import Sales Invoice<br /> | ||

01. Click '''Sales | Invoice...'''<br /> | |||

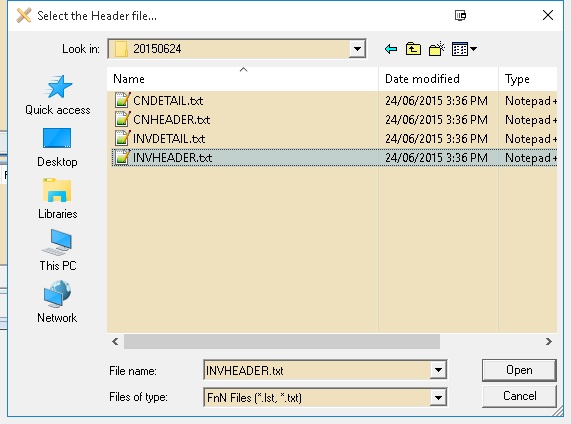

02. Click '''Get File''' button & system will prompt 2 dialog like below<br /> | |||

[[File:FnN-01.jpg|center]] | [[File:FnN-01.jpg|center]] | ||

03. Click '''Files of Type''' & select the FnN File Format type<br /> | |||

04. Select the F&N Invoice Text Header File | |||

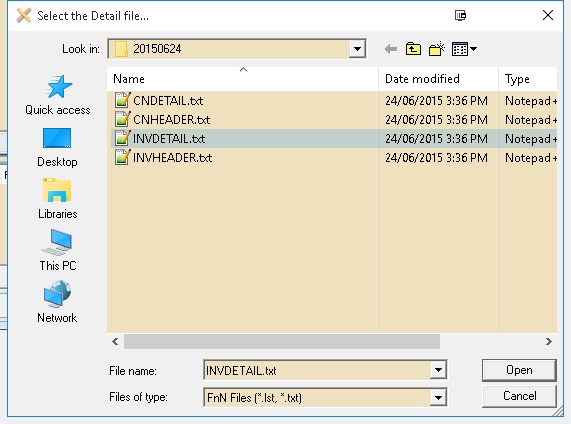

[[File:FnN-02.jpg|center]] | [[File:FnN-02.jpg|center]] | ||

05. Select the F&N Invoice Text Detail File | |||

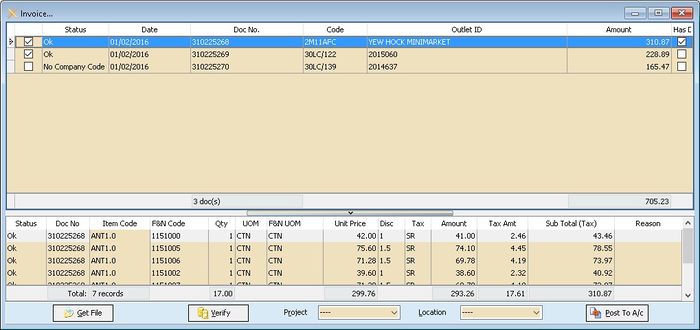

[[File:FnN-03.jpg | 700px|center]] | [[File:FnN-03.jpg | 700px|center]] | ||

06. Click '''Verify''' button to check the data with SQL Accounting Data<br /> | |||

07. Select '''Project''' & '''Location''' (if Required)<br /> | |||

08. Click '''Post To A/c''' button if confirm all is ok to post to SQL Accounting<br /> | |||

:::---------------------------------------------------------------------------------------------------------------------------------------------------- | :::---------------------------------------------------------------------------------------------------------------------------------------------------- | ||

| Line 96: | Line 289: | ||

|} | |} | ||

:::---------------------------------------------------------------------------------------------------------------------------------------------------- | :::---------------------------------------------------------------------------------------------------------------------------------------------------- | ||

<div style="float: right;"> [[#top|[top]]]</div> | |||

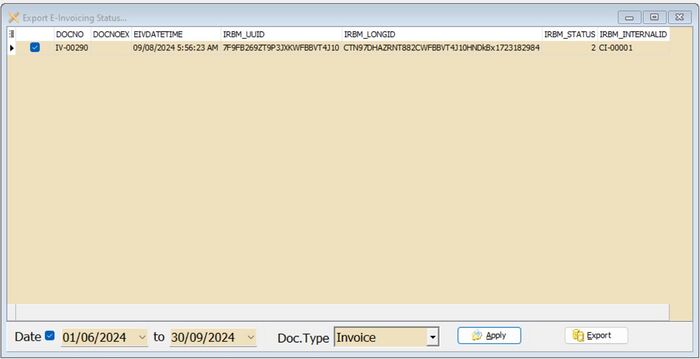

===Export E Invoice/Credit Note=== | |||

[[File:FnN-04.jpg|700px|center]] | |||

:01. Click '''Export E-Invoice Status...''' | |||

:02. Select Range Date (E-Invoice Submission date) | |||

:03. Select DocType (eg Invoice) | |||

:04. Click '''Apply''' | |||

:05. Click '''Export''' | |||

<div style="float: right;"> [[#top|[top]]]</div> | |||

==FAQ== | ==FAQ== | ||

Revision as of 04:55, 10 October 2024

Introduction

Is External Shareware Program which to import F&N Text file to

- Sales Invoice

- Sales Credit Note

Export E-Invoice to F&N - Available in Build 18 & Above

- Sales Invoice

- Sales Credit Note

Limitation

- TaxCode with DS will not import.

F & N Specification

- 17 Jun 2015 - ESD soft-drink

- https://download.sql.com.my/customer/Fairy/FN-Acct_Integration_Reference-20150617.zip

- 15 Aug 2016 - ESD Online

- https://download.sql.com.my/customer/Fairy/FN-Acct_Integration_Reference-20160815.zip

Import Program

- Version (3.5.0.20) - 10 Oct 2024

- Evaluation Limit : 50 Records per file

- https://download.sql.com.my/customer/Fairy/SQLAccFNImp-setup.exe

- MD5 : 0C5BC371CCCD2A67E3AE92F9B7067FCA

History New/Updates/Changes

--Build 20--

- Fixed Export E-IV for CN apply error.

- Fixed Export E-IV dateTimeValidated formatting not correct.

--Build 19--

- Enable Import E-Invoice Info from FnN.

- Fixed Export E-IV header delimiter not correct.

--Build 18--

- Upgrade to Version 3.6.

- Add FnN to Header Field CC as indicator Import from FnN.

- Remove L tax code from import.

- Set Default Open FnN ESD Online Files format.

- Add E-Invoicing Export function.

--Build 17--

- Fixed Use UOMList not working.

--Build 16--

- Add Import Remark to DeliveryTerm Field for CSV format.

--Build 15--

- Add Auto Set to Outlet_ID2 if Debtor_Code2 is empty for CSV format.

- Add Get User Guide Option.

--Build 14--

- Upgrade to Version 3.5.

- Enable support Running In Windows Limited User.

- Fixed Verify Detail Error not untick the Master when itemcode not found.

- Fixed Verify Not Check Item Code UOM.

- Fixed Scrollbar not visible.

--Build 13--

- Upgrade to Version 3.4.

- Add Project & Location Lookup for Posting.

--Build 12--

- Add Outlet_ID2 to shown in Grid.

--Build 11--

- Upgrade to D25 Compiler.

- Upgrade to Version 3.3.

- Remove Import Debtor_Name2.

--Build 10--

- Upgrade to XE10 Compiler.

- Upgrade to Version 3.2

- Add Link to SQL Acc. File | Run.

- Add OutletID=Maintain Customer Code

- Add ESD Online - CSV Format

--Build 9--

- Fix unable to import docamt is 0 even is no DS Code.

- Fix Status no dropdown list.

- Fix Detail not Verify.

--Build 8--

- Fix Get File Error when record is without tax code.

--Build 7--

- Fix CN Get File Error.

Todo

Field Mapping - Header

- As at 17 Jun 2015 - ESD soft-drink - Fixed Length Format

| FnN Field | Field Position | Field Size | SQL Accounting Field |

|---|---|---|---|

| Invoice_Date | 1 | 10 | DocDate |

| Invoice_ID | 11 | 10 | DocNo |

| Gross Amount | 41 | 10 | DocAmt |

| Outlet_ID | 71 | 10 | Maintain Customer Remark or Code |

- As at 15 Aug 2016 - ESD Online - CSV Format

| FnN Field | Field Position | Field Size | SQL Accounting Field |

|---|---|---|---|

| Invoice_Date | 0 | 10 | DocDate |

| Invoice_ID | 1 | 15 | DocNo |

| Total_Gross_Amount | 4 | 10 | DocAmt |

| Debtor_Code2 | 9 | 10 | Customer Code |

| |||

| Outlet_ID2 | 11 | 10 | Display Only |

| Remark | 12 | 200 |

|

Field Mapping - Detail

- As at 17 Jun 2015 - ESD soft-drink - Fixed Length Format

| For Sales Invoice | For Sales Credit Note | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

- As at 15 Aug 2016 - ESD Online - CSV Format

| For Sales Invoice | For Sales Credit Note | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

Setting

In SQL Accounting

01. May refer to Point 2 at Things To Consider Before Import/Post

02. Make sure this option is Tick under Tools | Options | Customer

- Perform Tax/Local Amount Rounding

In F&N Import

This can be see under Tools | Options

| Options | Description |

|---|---|

| UOMList | List of UOM available in F&N (Normally is CTN & PCS) |

| DocNoAsDocNo |

|

| FNCodeAsItemCode |

|

| FNUOMAsUOM |

|

| OutletIDAsCompCode |

|

F&N Outlet ID should be enter in SQL Accounting | Maintain Customer | Remark Field- Not valid for Build 10 & above

Steps

Import Invoice/Credit Note

Below steps is example to import Sales Invoice

01. Click Sales | Invoice...

02. Click Get File button & system will prompt 2 dialog like below

03. Click Files of Type & select the FnN File Format type

04. Select the F&N Invoice Text Header File

05. Select the F&N Invoice Text Detail File

06. Click Verify button to check the data with SQL Accounting Data

07. Select Project & Location (if Required)

08. Click Post To A/c button if confirm all is ok to post to SQL Accounting

- ----------------------------------------------------------------------------------------------------------------------------------------------------

- ----------------------------------------------------------------------------------------------------------------------------------------------------

Export E Invoice/Credit Note

- 01. Click Export E-Invoice Status...

- 02. Select Range Date (E-Invoice Submission date)

- 03. Select DocType (eg Invoice)

- 04. Click Apply

- 05. Click Export

FAQ

May refer to FAQ

See also

- Others Customisation