| (10 intermediate revisions by the same user not shown) | |||

| Line 80: | Line 80: | ||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

! No !! Tax Code || Description || Tax Rate || SST-02 | ! No !! Tax Code || Description || Tax Rate || SST-02 | ||

|- | |- | ||

| 01 || SV || Service Tax 6% charged to the taxable services based on payment basis || 6% || B1_10 <br /> B2_11C | | 01 || SV || Service Tax 6% charged to the taxable services based on payment basis || 6% || B1_10 <br /> B2_11C | ||

|- | |- | ||

| 02 || SVA || Service Tax 6% charged to the taxable service based on accrual/billing basis. It use in IMSV tax code to report in SST-02A || 6% || B1_10 <br /> B2_11C | | 02 || SVA || Service Tax 6% charged to the taxable service based on accrual/billing basis. It use in IMSV tax code to report in SST-02A || 6% || B1_10<br /> B2_11C | ||

|} | |} | ||

<br /> | <br /> | ||

| Line 92: | Line 92: | ||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

! No !! Tax Code || Description || Tax Rate || SST-02 | ! No !! Tax Code || Description || Tax Rate || SST-02 | ||

|- | |- | ||

| 01 || SUV || Service Own | | 01 || SUV || Service Own Used charged at 6% on accrual/billing basis || 6% || B1_9 <br /> B2_11C | ||

|- | |- | ||

|} | |} | ||

<br /> | <br /> | ||

3) ''' | 3) '''Service Exempted''' | ||

:: | :Applicable to same service provider under: | ||

# Group G to Group G (all except Employment and Guards protection service provider). | |||

# Group I to Group I (ie. advertising service provider). | |||

::{| class="wikitable" | |||

|- | |||

! No !! Tax Code || Description || Tax Rate || SST-02 | |||

|- | |||

| 01 || SVE || Service Tax Exempted between same service providers in Group G (excluding item j and k) or in Group I item 8 only. Refer to Service Tax (Person Exempted From Payment of Tax) Order 2018 || || D18C | |||

|- | |||

|} | |||

<br /> | <br /> | ||

4) '''Imported Service''' | |||

:1. For non-Service Tax Registered must declare using '''SST-02A'''. | |||

:2. For Service Tax Registered must declare using '''SS-02'''. | |||

::{| class="wikitable" | ::{| class="wikitable" | ||

|- | |- | ||

! No !! Tax Code || Description || Tax | ! No !! Tax Code || Description || Input Tax || Output Tax || SST-02 || SST-02A <br /> (for imported service) | ||

|- | |- | ||

| 01 || IMSV || Imported Service Tax, any company in Malaysia who acquire the taxable service from company outside Malaysia.Non-SST & Sales Tax reg. must report in SST-02A. Service tax reg. remains report in SST-02 || | | 01 || IMSV || Imported Service Tax, any company in Malaysia who acquire the taxable service from company outside Malaysia.Non-SST & Sales Tax reg. must report in SST-02A. Service tax reg. remains report in SST-02 || PSV <br /> (6%) || SVA <br /> (6%) || B1_10 <br /> B2_11C || B10a | ||

|- | |- | ||

| 02 || IMSVE || Imported Service Tax Exempted between same service providers in Group G (excluding item j and k) or in Group I item 8 only. Refer to Service Tax (Person Exempted From Payment of Tax) Order 2018 || | | 02 || IMSVE || Imported Service Tax Exempted between same service providers in Group G (excluding item j and k) or in Group I item 8 only. Refer to Service Tax (Person Exempted From Payment of Tax) Order 2018 || PSVE || SVE || D18C || | ||

|- | |- | ||

|} | |} | ||

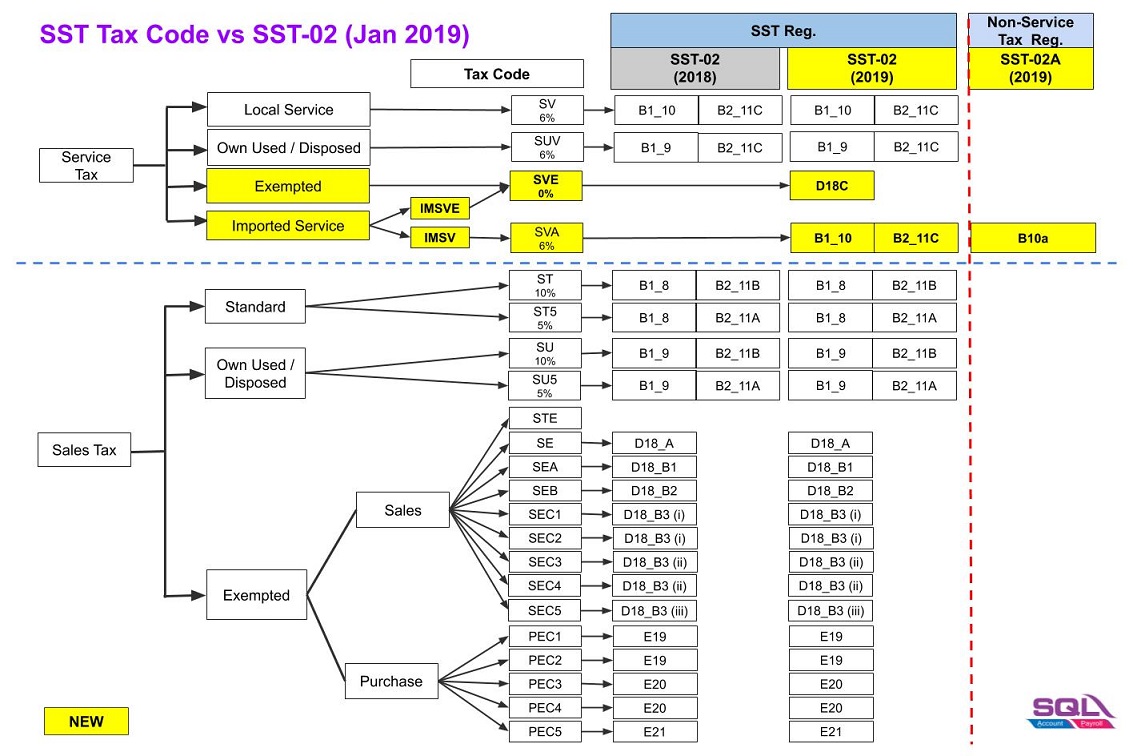

Latest revision as of 04:40, 21 November 2019

Introduction

- Explain the importance and usage of SST Tax Code reflect to SST-02.

SST Tax Code

- SST tax code mapping to SST-02.

Sales

1) Standard

No Tax Code Description Tax Rate SST-02 01 ST Sales Tax 10% charged to the taxable goods based on accrual/billing basis 10% B1_8

B2_11B02 ST5 Sales Tax 5% charged to the taxable goods based on accrual/billing basis 5% B1_8

B2_11A

2) Deemed Supply (Own Used/Disposed)

No Tax Code Description Tax Rate SST-02 01 SU Goods Own Used/Disposed deemed taxable and charged at 10% based on accrual/billing basis 10% B1_9

B2_11B02 SU5 Goods Own Used/Disposed deemed taxable and charged at 5% based on accrual/billing basis 5% B1_9

B2_11A

3) Sales - Exempted

No Tax Code Description Tax Rate SST-02 01 STE Sales Tax Exempted on goods as prescribed in the Sales Tax (Goods Exempted From Tax) Order 2018 02 SE Sales Tax Exempted to Export, Special Area (SA), eg. Free Zone, LMW and Designated Area (DA), eg. Langkawi, Tioman, Labuan D18_A 03 SEA Sales Tax Exempted-Schedule A (Class of Person), eg. Government, Local Authority Dept, etc. Detail refer to Schedule A in Sales Tax (Person Exempted From Payment Of Tax) Order 2018 D18_B1 04 SEB Sales Tax Exempted-Schedule B (Manufacturer of specific non taxable goods), eg. control products, medical. Detail refer to Schedule B in Sales Tax (Person Exempted From Payment Of Tax) Order 2018 D18_B2 05 SEC1 Sales Tax Exempted-Sch C (Item 1) on raw materials, components and packaging materials EXCLUDING PETROLEUM imported/purchased from a reg. manufacturer/licensed warehouse by any reg. manufacturer D18_B3 (i) 06 SEC2 Sales Tax Exempted-Sch C (Item 2) on raw materials, components and packaging materials imported/purchased from a reg. manufacturer/licensed warehouse by any reg. manufacturer of PETROLEUM products D18_B3 (i) 07 SEC3 Sales Tax Exempted-Sch C (Item 3) on raw materials, components and packaging materials EXLUDING PETROLEUM imported/purchased from a reg. manufacturer by any agent on behalf of a reg. manufacturer D18_B3 (ii) 08 SEC4 Sales Tax Exempted-Sch C (Item 4) on raw materials, components and packaging materials imported/purchased from a reg. manufacturer by any agent on behalf of a reg. manufacturer of PETOLEUM products D18_B3 (ii) 09 SEC5 Sales Tax Exempted-Sch C (Item 5) on semi-finished taxable goods or finished taxable goods which are subsequently returned by a subcon to a reg. manufacturer after completion of subcontract work D18_B3 (iii)

4) Purchase - Exempted

No Tax Code Description Tax Rate SST-02 01 PEC1 Purchase Tax Exempted-Sch C (Item 1) on raw materials, components and packaging materials EXCLUDING PETROLEUM imported/purchased from a reg. manufacturer/licensed warehouse by any reg. manufacturer E19 02 PEC2 Purchase Tax Exempted-Sch C (Item 2) on raw materials, components and packaging materials imported/purchased from a reg. manufacturer/licensed warehouse by any reg. manufacturer of PETROLEUM products E19 03 PEC3 Purchase Tax Exempted-Sch C (Item 3) on raw materials, components and packaging materials EXLUDING PETROLEUM imported/purchased from a reg. manufacturer by any agent on behalf of a reg. manufacturer E20 04 PEC4 Purchase Tax Exempted-Sch C (Item 4) on raw materials,components and packaging materials imported/purchased from a reg. manufacturer by any agent on behalf of a reg. manufacturer of PETOLEUM products E20 05 PEC5 Purchase Tax Exempted-Sch C (Item 5) on semi-finished taxable goods or finished taxable goods which are subsequently returned by a subcon to a reg. manufacturer after completion of subcontract work E21

Service

1) Standard

No Tax Code Description Tax Rate SST-02 01 SV Service Tax 6% charged to the taxable services based on payment basis 6% B1_10

B2_11C02 SVA Service Tax 6% charged to the taxable service based on accrual/billing basis. It use in IMSV tax code to report in SST-02A 6% B1_10

B2_11C

2) Deemed Supply (Own Used/Disposed)

No Tax Code Description Tax Rate SST-02 01 SUV Service Own Used charged at 6% on accrual/billing basis 6% B1_9

B2_11C

3) Service Exempted

- Applicable to same service provider under:

- Group G to Group G (all except Employment and Guards protection service provider).

- Group I to Group I (ie. advertising service provider).

No Tax Code Description Tax Rate SST-02 01 SVE Service Tax Exempted between same service providers in Group G (excluding item j and k) or in Group I item 8 only. Refer to Service Tax (Person Exempted From Payment of Tax) Order 2018 D18C

4) Imported Service

- 1. For non-Service Tax Registered must declare using SST-02A.

- 2. For Service Tax Registered must declare using SS-02.

No Tax Code Description Input Tax Output Tax SST-02 SST-02A

(for imported service)01 IMSV Imported Service Tax, any company in Malaysia who acquire the taxable service from company outside Malaysia.Non-SST & Sales Tax reg. must report in SST-02A. Service tax reg. remains report in SST-02 PSV

(6%)SVA

(6%)B1_10

B2_11CB10a 02 IMSVE Imported Service Tax Exempted between same service providers in Group G (excluding item j and k) or in Group I item 8 only. Refer to Service Tax (Person Exempted From Payment of Tax) Order 2018 PSVE SVE D18C